Update | China’s capital outflows may increase after MSCI decision

Beijing didn’t just lose face but it also faces more capital outflows after global share index compiler MSCI declined to include mainland A shares in its emerging market indices.

The rejection, the third time in three years, had the effect of calling off multibillion dollars worth of stock buying orders in A shares listed in Shanghai and Shenzhen.

The MSCI emerging market indices are tracked by US$1.7 trillion in assets managed by the world’s largest pension funds, insurers and institutional investors. The inclusion of A-shares in the index would mean these big stock buyers would all need to add Shanghai or Shenzhen A shares to their portfolios.

HSBC estimated that at least US$30 billion would have flowed into China in the event of a favourable MSCI decision, while some analysts put the amount as high as US$400 billion in the long run. Now these potential inflows have dried up.

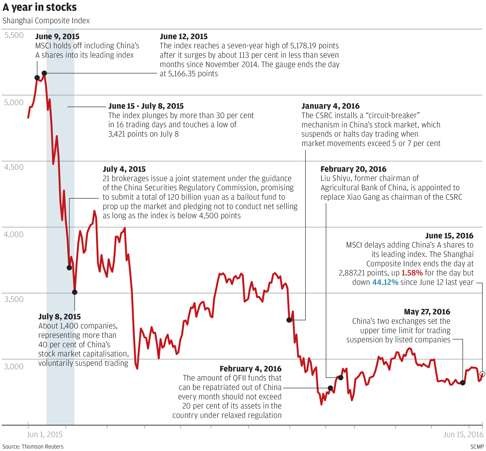

Big capital inflows are very much what China needs at a time when the Shanghai Composite Index is down 45 per cent from a year ago. The country’s capital outflow last year was estimated to reach US$1 trillion amid slower economic growth, slumping stocks and a weaker yuan.

Capital outflows and the share market may get worse after the MSCI decision, according to analysts.

“We expect A-share market sentiment to be hurt in the short term. The [Hong Kong-Shanghai] stock connect programme and offshore A-share ETFs have registered net buying in the past few weeks,” said Louisa Fok, equity analyst with UBS CIO Wealth Management. “We believe the unwinding of these trades could add pressure to China’s A-share markets in the short term.”

As if to brush off the bad news, Shanghai and Shenzhen stock markets rose on Wednesday after the MSCI decision was announced. But Christy Tan, head of markets strategy and Asia research at NAB, believes the rally may be short-lived. “Some negative repercussions could be expected ahead,” she said.

The continued exclusion of A shares in the indices was also a blow for Beijing’s hopes to internationalise the yuan as it wants more fund houses and institutional investors to use the currency for investment.

“The direct impact on onshore yuan and offshore yuan is quite limited, though understandably the non-inclusion could have removed some support for the [renminbi] in the form of potential portfolio inflows,” Tan said.

Some fund houses that have bought in advance of the MSCI decision may now need to sell down their stock portfolios

Joseph Tong, chairman of Morton Securities, believes there could be some outflows from the mainland Chinese stock markets as a result of the non-inclusion decision.

“Some fund houses that have bought in advance of the MSCI decision may now need to sell down their stock portfolios. The decision will also mean there are a few more opportunities to seehuge capital outflows in China’s stock markets in the coming year as the next annual MSCI review will be in June 2017,” Tong said.

Veteran fund manager Mark Mobius, executive chairman of Templeton Emerging Markets Group, supported the MSCI decision. “This was a brave stance by the MSCI executives. This confirmed their guidelines regarding the availability of liquidity and shows that they have kept their high standards on the inclusion of stocks in their indices,” Mobius said.

However, Mobius does not think the decision would led to significant capital outflows. “Investors are already able to get a significant amount of access to the Chinese markets. The only disadvantage we now have is a lack of access to the full list of shares listed on the Shanghai and Shenzhen stock exchanges,” he said.

For China to stand a better chance for inclusion next time, Mobius said Beijing should relax its foreign exchange controls to the extent that it allows investors to enter and leave the market without undue restrictions.

Christopher Cheung Wah-fung, legislator for the financial services sector in Hong Kong, said the MSCI setback may help encourage Beijing to launch the Shenzhen and Hong Kong stock connect scheme sooner.

The stock connect scheme between Hong Kong and Shanghai has been operating since November 2014 but the proposed Shenzhen and Hong Kong stock connect scheme, which was originally planned for last year, was postponed and no launch timetable has been announced.

“The MSCI decision showed that institutional investors would like to see China open up its market further,” Cheung said. If Beijing launches the Hong Kong-Shenzhen stock connect sooner, “it would help bring in more capital inflows to the mainland stock markets and would boost the mainland stock markets”, he added.

Aidan Yao, senior emerging Asia economist at AXA Investment Managers, said Shenzhen-Hong Kong stock connect would improve market accessibility for global investors.

“MSCI did not rule out the possibility of an off-cycle decision that brings A shares to the index before the next annual review, should further significant improvements be achieved before June 2017. We expect the government authorities to continue to push for reforms and deregulation, trying to meet the outstanding criteria in order to win for an inclusion,” Yao said.