Wealth Blog | Dr Doom and Gloom makes his investment predictions for 2013

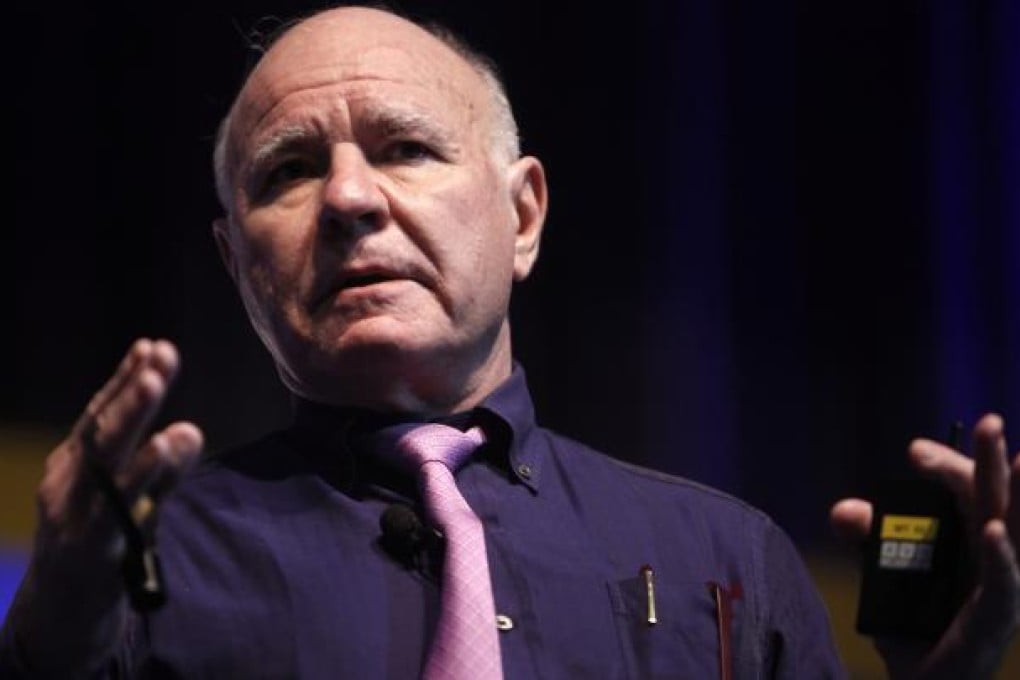

It’s always good value listening to the thoughts of Marc Faber, otherwise known as Dr Doom. The eternally bearish investment guru can always be relied on to pour cold water on market exuberance, no matter how buoyant things might look.

He notes the S & P 500 is getting very close to the all-time high of 1565, but he’s not big on equities full stop. “If you look back at equity performance over the last 15 years, it has not been good. The Dow hit 1100 in March of 1999 and we’re only getting close to 1,4000 now,” he reminded RTHK listeners. In fact, equities have done miserably in the last 15 years, he concluded. So isn’t it about time that they are the place to be? Not really, he said, pointing out that the Dow Jones and S & P Stock performance, dividends included, averages out at a pretty unexciting 6 per cent per annum.

When you print money, he sighs, it tends to go to the people closest to it, so the rich guys get this money at the expense of people at the lower end. But he doesn’t think we’re anywhere near the 16th or 3rd centuries where massive social upheaval erupted. But when food prices go up, you get more social problems. Not so much for the partner at Goldman Sachs because as a percentage of his total income food expenditure is maybe 3 per cent, “unless he is a heavy cocaine user.” But in India people spend 50 to 60 per cent of their income on food, so when food prices rise, it hurts the lower income recipients most.

“I’m saying this not because I have a grudge, I’m in the financial sector, and a prime beneficiary of money printing, but I don’t like it from a society point of view because it creates an increase in the wealth inequality and it leads to social problems, such as we now have in the Middle East, as an example.” Faber thinks printing money is a bid thing, because if you print money, something will go up. But now he’s rubbing his hands in glee. “Now I think we are getting into bubble stage and I love it, because it means there will be a crash.”

Predications for 2013

Faber says he really doesn’t know how the year will finish. We have to be realistic, he advises. It’s tough when there is heavy intervention by governments in the free market, “and to term what governments are doing as intervention is very polite, I could say manipulation, because if you artificially suppress interest rates, then somebody could accuse you of being a manipulator of markets.” The difficulty is the zero interest rates, especially when real household inflation is 5 - 10 per cent, if you include insurance premiums, professional fees, taxes, energy, rents and property prices.