Oliver's Twist | After the US debt crisis, time to focus on China

All eyes have been on Washington debt. In the coming days, it will be China’s turn. Figures soon to be released by the National Audit Office will help cast light on just how much debt China has racked up since Beijing greenlighted a nationwide program of infrastructure construction to prop up the economy during the global crisis.

Importantly, the figures will provide a snapshot of the fiscal health of local government financing vehicles (LGFVs). That includes at least 10,000 separate legal entities spanning four levels of government administration – right down to individual townships. Many of these LGFVs played a big role in funding highway construction and social housing, projects that were pillars of China’s Keynesian stimulus package launched in late 2008.

Getting an accurate gauge of the debt situation hasn’t been easy. Underscoring the scale of the accounting problem, thousands of central government auditors since July have set out to examine the books of around 10,800 local government entities, of which only about 900 produce regular financial statements as part of their obligations as public bond issuers. What’s more, a portion of the debt held by these LGFVs is in the form of intercompany loans and IOUs.

It’s not hard to image regional entities being reluctant to come clean about all liabilities.

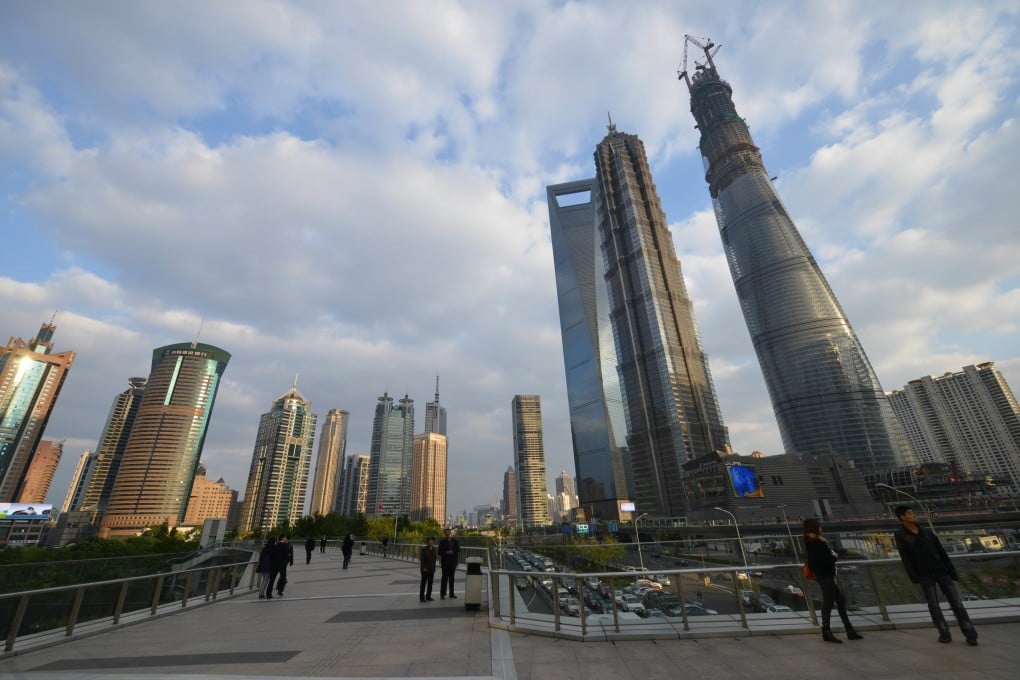

The audit is slated to be released ahead of the annual Communist Party meeting in November. The timing could be more than coincidence according to Standard Chartered, which noted next month’s meeting is the first with Finance Minister Lou Jiwei at the helm. Unveiling the scale of the debt problem to the public could “help the MOF garner higher-level support for a big fiscal reform package, and approval for sterner measures to get LGFVs under control,” according to Standard Chartered analysts in Shanghai.

Early indications of the scale of the problem are a worry. Comments given in September by three central government officials, including Xia Bin, a senior economist formerly with the research arm of the State Council, who cautioned publically of an “astonishing” number, were telling according to Standard Chartered economist Stephen Green. He estimates China’s local government debt could be as high as 24.4 trillion yuan as of June 2013 – or nearly double the current official estimate.