Scared of falling home equity and the war on money laundering in Vancouver? Tough luck, and get a grip on reality

- In a city ranked one of the most unaffordable in the world, some people are actually freaking out about price declines

- Meanwhile, others say a crackdown on money laundering and Chinese cash would be ‘catastrophic’

Remember the olden times, Vancouver, when dinosaurs and Pokemon Go ruled the Earth?

Cast your mind back to mid-2016.

That was the last time that pretty much everybody agreed that housing unaffordability was a Very Bad Thing – in principle, at least.

Over the preceding two years, there had been a mix of awe and confusion as the average price of a detached house in Greater Vancouver soared 40 to 50 per cent, thanks to the rocket fuel of Chinese capital outflows. Real estate prices across the board were spiralling through the clouds.

Would-be buyers looked on in horror. Owners tut-tutted in sympathy: I mean, it wasn’t right, was it?

But how many humble-bragged at dinner parties about this terrible phenomenon that was also enriching them beyond all deserving? How many sneaked downstairs to repeatedly check their address on the BC Assessment website, drooling at the improbably pneumatic number spread-eagled before them?

It was ownership as onanism.

Billions in dirty cash ‘helped fuel Vancouver’s housing boom’

How long ago that seems. How quaint the sense of shame.

The big thing now is not to worry about affordability, or pretend to: it’s worrying about equity.

All of a sudden, it’s not plunging affordability that supposedly has Vancouver in uproar, it’s plunging prices.

A real estate market transformed

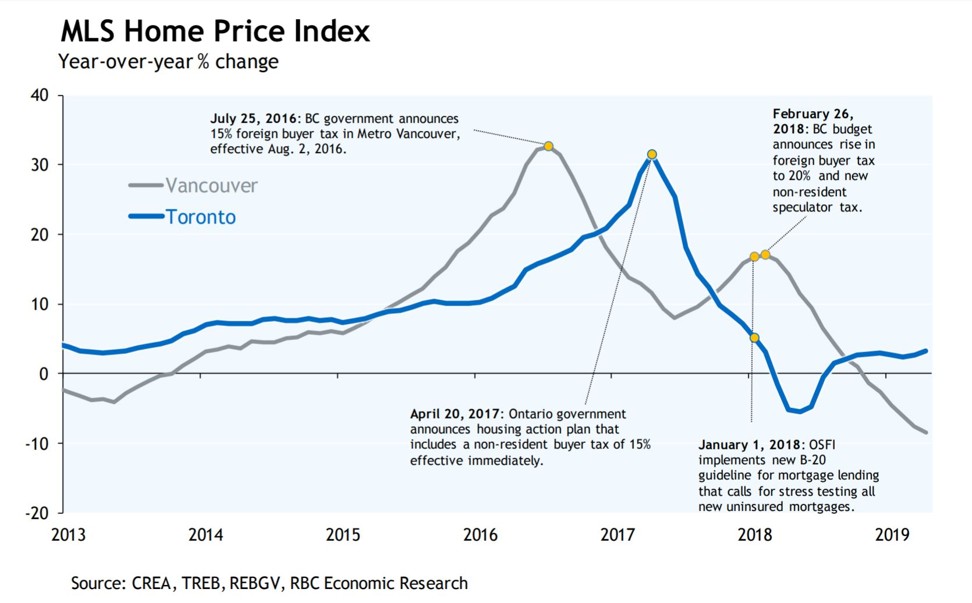

This comes in the face of a left-leaning provincial government that is doubling down on measures that have sucked the life out of the real estate market.

There’s the schools tax, the speculation and vacancy tax, and the foreign buyers’ tax (introduced by the previous BC Liberal government) that has been expanded in geographical reach and increased to 20 per cent.

Foreign homebuyers in Vancouver hit with HK-style 15pc tax

The Real Estate Board of Greater Vancouver’s benchmark price for all residential properties is down 8.9 per cent in the past year, to C$1,006,400. And the overall market is unrecognisable, compared to 2016: May 2019 sales of 2,638 homes for Greater Vancouver were down 45 per cent compared to the same month three years ago.

Listings were up 90 per cent, to 14,685. The sales-to-listings ratio plummeted from a sellers’ paradise of 62 per cent to 18 per cent.

The measures enacted by the NDP – elected on a platform of battling unaffordability – appear to be working. And yet, somehow, Vancouver is now supposed to be worrying about owners’ equity

The real estate industry has previously tried to pin all of this on the federal government’s mortgage stress test, “which is causing people at the entry-level side of the market to struggle to secure financing”, according to Ashley Smith, president of the REBGV.

The entry level? It was the multimillion-dollar detached home market that changed direction in Vancouver fastest and first, with its benchmark price falling since at least autumn 2017, almost a year before the rest of the market followed suit.

Vancouver’s ‘spicy’ property-price curbs work. Why haven’t Hong Kong’s?

Since price itself is a lagging measure of a changing housing market, the contemporaneous shifts can instead be located with almost pinpoint precision in the pace of price changes.

The market careens off these measures like a billiard ball.

And yet, somehow, Vancouver is now supposed to be worrying about owners’ equity.

Team Equity’s presto-reverso mindset

Two recent news stories have embodied this presto-reverso mindset.

When anti-tax group Step Up Now released a study last month showing C$89 billion (US$66 billion) in residential home equity had been lost in Metro Vancouver in the past year, it was front-page news.

He’s right. I’m alarmed for the report’s proponents, and their startling lack of short-term memory, self-awareness and perspective.

15 per cent tax targets foreign homebuyers in Toronto

Never mind that Vancouver was now precisely C$89 billion more affordable – this number was supposed to register as the new Very Bad Thing.

Are most Vancouverites really so dense as to imagine that equity and affordability are not two sides of the same coin? I don’t think so.

Yet there is an air of obliviousness to Team Equity, and those opposed to affordability measures in Vancouver in general.

How do we classify the mindset that derides a 0.2 per cent tax on home values beyond C$3 million (US$2.2 million), and 0.4 per cent beyond C$4 million, as an attack on “working class families”?

A second report landed this past week, to address the allied issue of money laundering, which has been in the spotlight in Vancouver for its role in the real estate and luxury car markets.

Chinese cash fuels vast luxury car laundering scheme in Canada

The reaction approached the apoplectic, with Attorney General David Eby twisting the sarcasm-o-meter up to 11.

“How about: ‘Bullet sales decline could impact gun store jobs if government successfully cracks down on gangs’,” he said on Twitter. “‘Cancer doctors fear for careers with crackdown on tobacco’…’Asbestos cleanup firms blame asbestos ban for layoff’.”

You get the idea.

There’s an element of messenger-shooting at play here. I thought the BIV article was plenty illuminating, and it was certainly newsworthy.

It quoted retail analyst Craig Patterson warning that Vancouver’s luxury retailers would take a hit, if Chinese and laundered money were removed from the market (although he didn’t necessarily equate the two).

“Losing Chinese money and laundered money would be catastrophic. Locals in the city don’t buy a lot of luxury goods, or at least not enough to support what’s there. The average Vancouverite struggles financially,” he told BIV’s Glen Korstrom.

China tycoon’s son buys US$3.8m Bugatti with dad’s credit card in Vancouver

Yes, it’s true. Cracking down on money-laundering could diminish the economy. It’s a bit of a no-brainer: if the issue is big enough to worry about its presence, it’s certainly big enough to have an impact by its absence.

And likewise, making Vancouver more affordable will mean that property owners lose equity, at least on paper.

It’s possible to find sympathetic cases among those fretting over efforts to constrain property prices and, maybe, laundered money.

Seniors who were banking on a certain level of equity windfall in their retirement years come to mind: but with prices having doubled in the past 10 years, it’s a tough case to make, like complaining about tax on a winning lottery ticket.

There are any number of ways to put this. You can’t make an omelette without breaking eggs. Every action has an equal and opposite reaction. You can’t have your affordability cake and eat your equity too. And you can’t break systems premised on dodgy money without putting those business models in peril.

So what to do with that awareness?

If we accept that affordability in Vancouver remains a just goal, and that money laundering is wrong, there is only one wise and moral response. And that is to say, tough luck, and stay the course.

The Hongcouver blog is devoted to the hybrid culture of its namesake cities: Hong Kong and Vancouver. All story ideas and comments are welcome. Connect with me by email [email protected] or on Twitter, @ianjamesyoung70.