CNOOC will face serious challenges managing Nexen

G. Bin Zhao says decisions must further the oil giant's globalisation

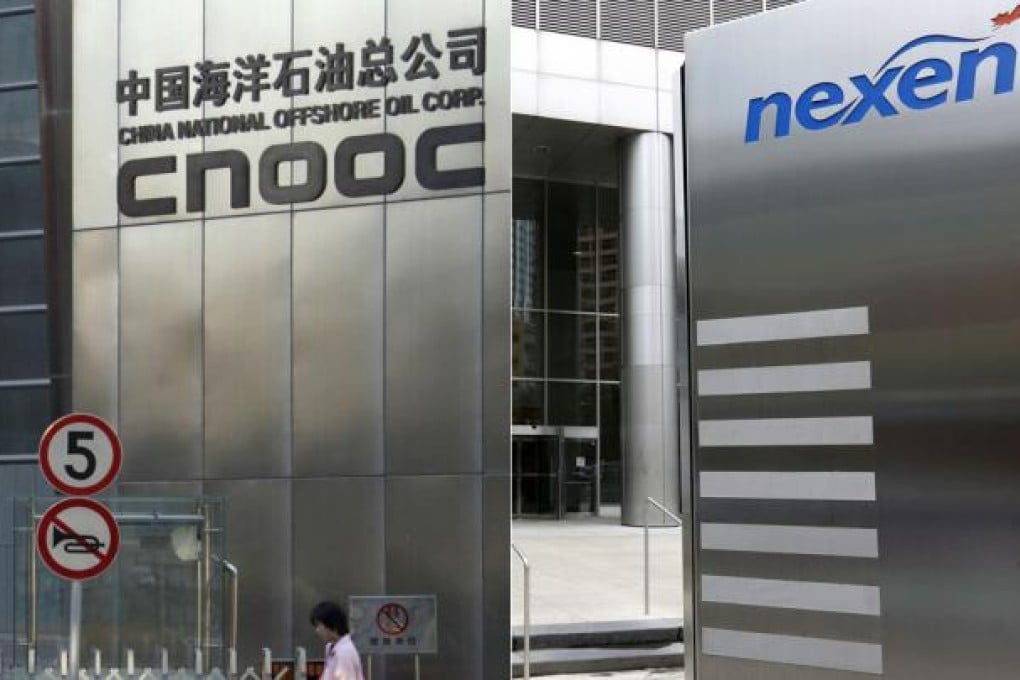

CNOOC's acquisition of Nexen is being watched closely, given that it is China's largest overseas investment acquisition to date. How the China National Offshore Oil Corporation integrates and manages Nexen will provide a noteworthy example for major state-owned enterprises to follow in the future. It will also challenge the wisdom, talent and courage of CNOOC's executives.

There are many differences between CNOOC and Nexen in corporate hierarchy, employee incentives, and national and corporate cultures, but perhaps the core difference is in the ownership system.

First, Nexen's organisational structure is similar to the one at CNOOC, so integration in the early stages should be relatively easy. But CNOOC needs to optimise its hierarchical structure to adapt to its new global position.

The first step is to incorporate all of Nexen directly into CNOOC as a subsidiary with independent management. Next, Nexen's projects in the North Sea, the waters of Nigeria and other places will be gradually taken over by either existing or newly established independent subsidiaries.

Nexen, as the headquarters for North and Central America, will manage projects that fall under its administration, and assist CNOOC in upgrading and establishing its oil sands and shale gas divisions in Beijing to enhance the core competitiveness of the entire company. In addition, Nexen will greatly strengthen the international management and operations of CNOOC.

Second, CNOOC needs to create a more flexible employee incentive system, neither going beyond the nature of a state-owned enterprise nor losing the enthusiasm of its international management team. For example, although Nexen is much smaller, its core management team was paid much more than the team at CNOOC; therefore, it will be difficult to determine what payment standard will prevail after the merger.