How interest rate controls created a shadow banking system in China

Gregory C. Chow says by easing its control on bank deposit rates, China would not only boost market efficiency but also rid the economy of the created problem of a shadow system

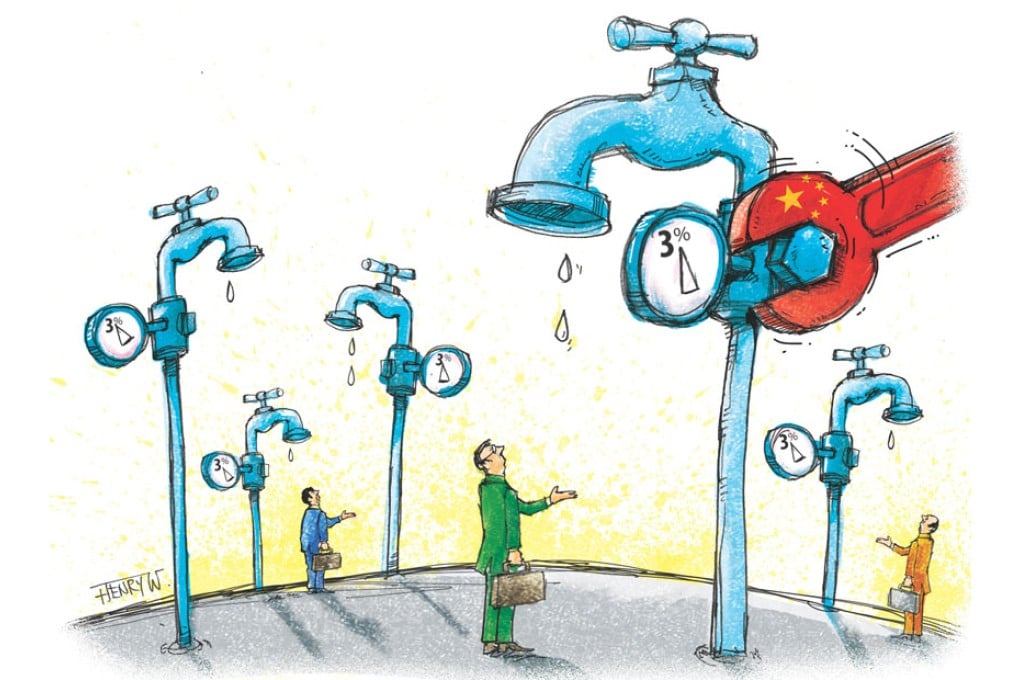

It is well known that the interest rate commercial banks can pay to depositors is controlled by the government. As of February this year, the rate was only 3 per cent per year, while the consumer price index increased by 3.2 per cent , providing depositors with a negative real return for their deposits.

As a result, some depositors would like to receive a higher rate. At the same time, some borrowers and banks are willing to pay higher rates, because they can still make a profit on the higher rates. Thus the policy has created a shadow banking system paying a higher rate of interest than the official rate.

An article in The New York Times reported on how such a market works. Financial products are offered - through text messages on mobile phones - by some of China's biggest banks to raise cash for lending outside the scrutiny of bank regulators.

The policy has created a shadow banking system paying a higher rate of interest

This is causing concern that these wealth management products are being used to "repackage old loans and prop up risky companies and projects", and that "shadow banking is helping drive the rapid growth of credit in a weakening economy, which could lead to - in the worst situation - a series of bank failures", the report said.

Let us apply the tools of supply and demand to understand this phenomenon. The supply and demand of deposits depends on the rate of interest. The higher the rate of interest, the more money people will deposit in the banks; the lower the rate of interest, the more the banks will accept deposits. The equilibrium interest rate is that rate which makes the quantity supplied equal to the quantity demanded.

In a free market, the interest rate will reach this equilibrium rate. If the rate of interest is arbitrarily set below the equilibrium rate, the amount that the depositors are willing to supply is less than the amount that the banks wish to obtain. This results in a shortage of deposits in the market.

When there is such a shortage, some banks are willing to pay a higher interest rate to attract more deposits, for them to lend to borrowers who are willing to pay an even higher rate. This institution, known as the shadow banking system, helps to eliminate the shortage of loans. It benefits the economy because both the depositors and the lenders get what they want.

In conclusion, it is the government's control of the interest rate that causes the shortage of money available for projects that require the loans. The shadow banking system solves the shortage problem. In a market economy, demand and supply determine price in equilibrium and leads to an efficient allocation of resources, bank loans in this case. Any interference inevitably decreases economic efficiency.