Hong Kong will gain from a more diversified energy portfolio

William Yu says the public consultation on Hong Kong's energy options should explore expanding the sources and types of our imports, and consider ways to open up the power market

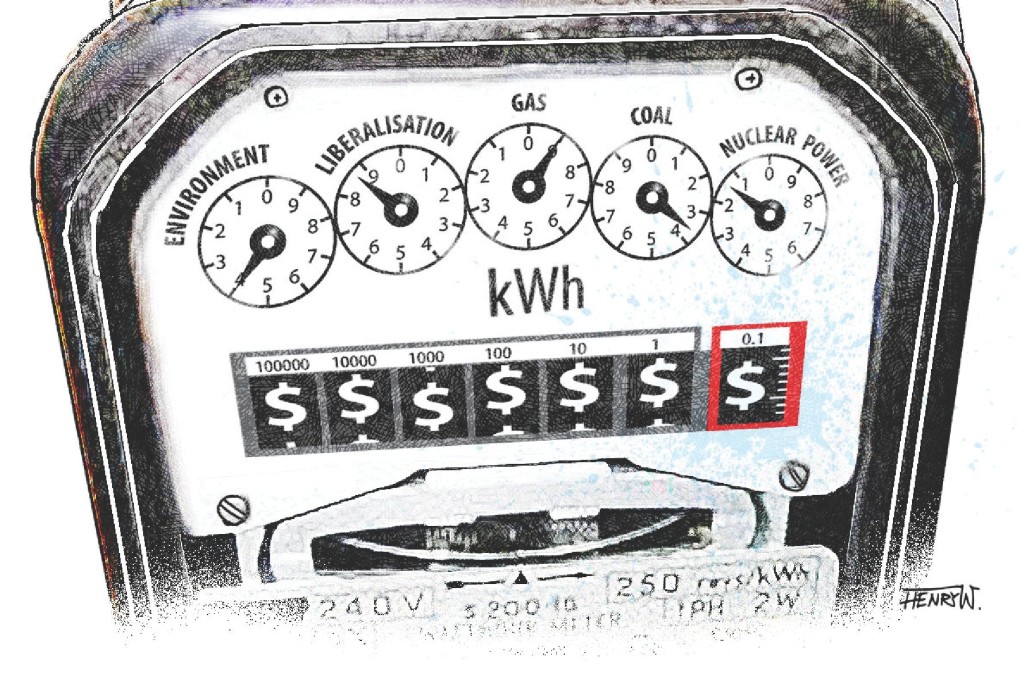

The heated debate over Hong Kong's energy future was rekindled at the beginning of the year when electricity tariffs were increased again. The price rises over the past few years have mainly been due to the greater use of natural gas in the energy mix. To combat air pollution, utility companies try to reduce the use of coal, substituting it with more natural gas or nuclear power.

In 2012, Hong Kong relied on coal (54 per cent), nuclear power (23 per cent), natural gas (23 per cent) and a negligible amount of renewable energy for its electricity. Among these, gas has emerged as the fuel of choice for the future.

Global gas demand is expected to grow steadily over the next decade and its price is geographically sensitive. In general, the US has the lowest price per million British thermal units (Btu), Europe is in the middle and Asia has the highest price. Studies suggest that the price of natural gas will not fall before the techniques of horizontal drilling and fracking become widely available or transport infrastructure is in place to deliver liquefied natural gas to areas further away.

A regional approach ... and importing alternative sources of clean energy might be worth considering

Thus, Hong Kong can expect natural gas prices to remain high in the mid term, especially when it is bound by the current contracts of between 20 and 30 years signed by the utility companies. We can expect the electricity tariff to continue to rise in line with the increasing portion of natural gas in the fuel mix.

In the short term, nuclear energy appears to offer a better deal in terms of price. But, after the 2011 Fukushima accident, the Hong Kong public might be sceptical about increasing our share of nuclear power. Besides, even if it wanted to, Hong Kong might not be able to get much more supply from the mainland.

CLP recently said it would buy 10 per cent more nuclear power from Daya Bay, raising its share to 80 per cent of the plant's total capacity. With electricity demand rising in southern China, it will be very difficult for Hong Kong to get 100 per cent of Daya Bay's supply.

If the Hong Kong government plans to increase the share of nuclear power in our energy mix from the existing 23 per cent to 40 per cent, or even 50 per cent, the additional supply must come from other newly built nuclear power plants. This implies that future nuclear power prices will no longer be as competitive as those offered by the Daya Bay plant, which was built more than 20 years ago.

Coal prices will also play a part in stabilising electricity tariffs. Prices fell last year, and Indonesia, which supplies the majority of Hong Kong's coal, has capped its output in order to stem the decline in prices.