China’s role in global investment is growing, but the scale remains small

As China’s economy has grown over the past decade, so too has China’s overseas investment.

As China’s economy has grown over the past decade, so too has China’s overseas investment. This has become a highly controversial issue in a number of countries, in part due to the difficulties faced by firms and individuals when attempting to invest in China, as well as the considerable influence of state-owned enterprises in China’s major industries.

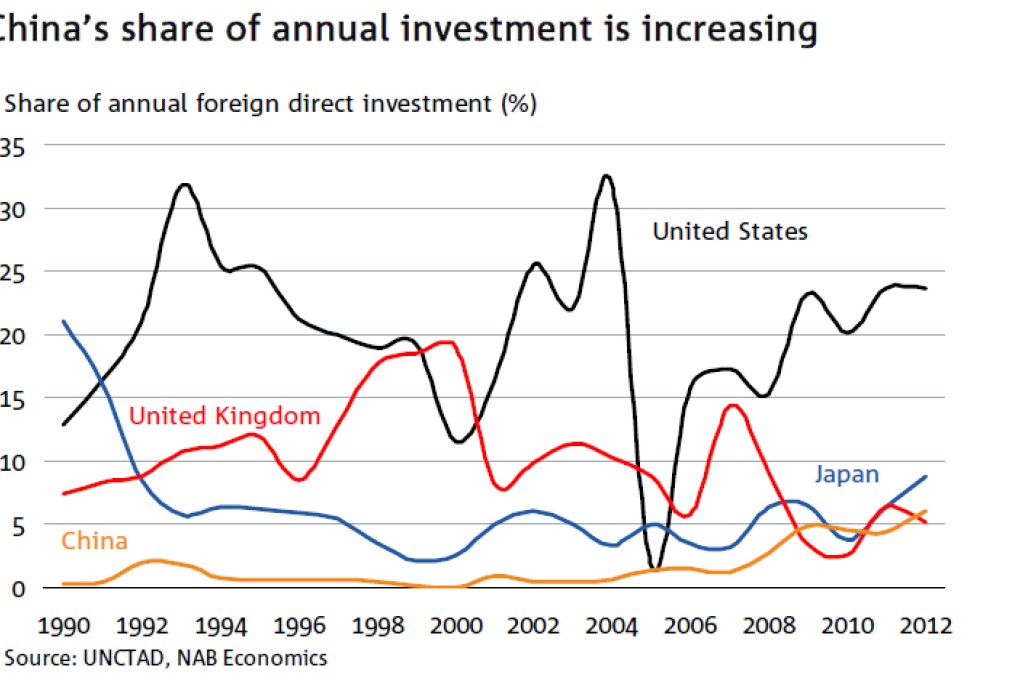

While China’s foreign direct investment has grown significantly in recent years, it still pales in comparison to major global investors such as the United States and Japan.

Data from the United Nations shows that China’s foreign direct investment (which excludes investment in financial assets) has increased strongly over the past decade – rising from around US$2.5 billion in 2002 (around 0.5 per cent of the global total) to US$84 billion in 2012 (a share of 6.1 per cent) (the most up-to-date data available), making China the third largest investor globally. In contrast, the US accounted for almost 24 per cent of global investment in 2012, followed by Japan at 8.8 per cent.

In part, the fact that China, the world’s second largest economy, lags slightly behind in terms of foreign investment reflects domestic regulatory constraints – including constraints on capital flows – as well as restrictions imposed by potential host countries for Chinese investment.

Despite the challenges in investing in China, the country is also a major recipient of foreign direct investment. In 2012, China received around US$121 billion in foreign direct investment – or around 9 per cent of the global total – second only to the US, which received over 12 per cent.

The Heritage Foundation, a US-based think-tank, maintains a database of Chinese foreign investment between 2005 and 2013, which breaks down investment by country and industry category. Over this eight-year period, China’s foreign direct investment totalled US$479 billion (a figure comparable to the UN dataset), compared with investment of almost US$2.8 trillion by private firms and individuals from the US.