Hong Kong's competitive edge slipping away fast

Philipp Martin Dingeldey and Wan Tin Wai see a bleak future for the city as its financial, trade and business hub advantages wane

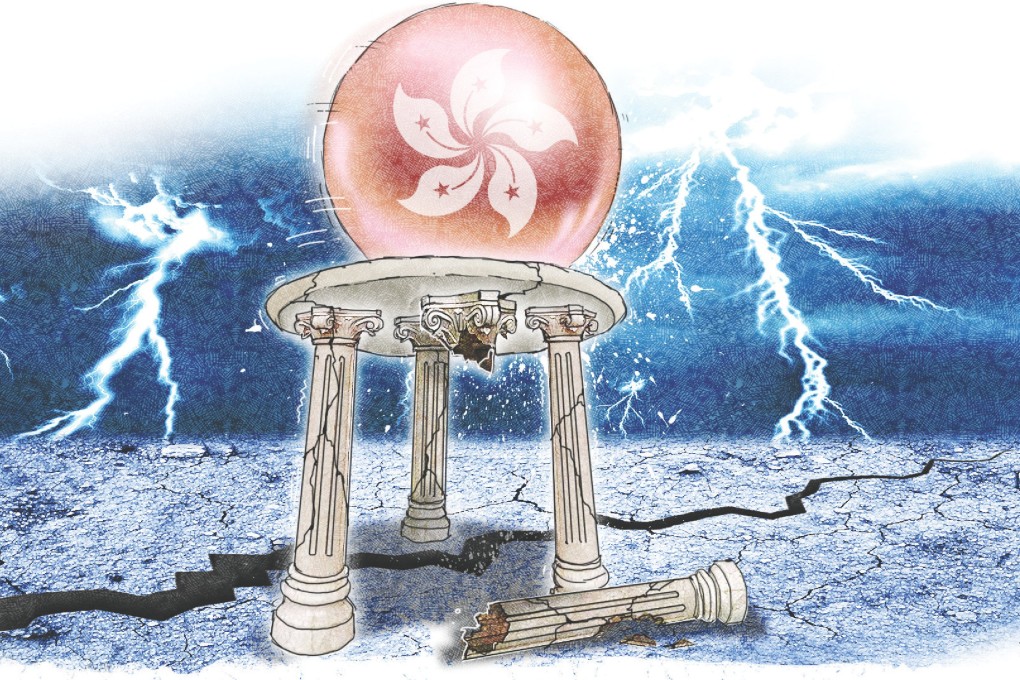

With the rejection by the legislature of the proposed election reform plan, Hong Kong faces a prolonged period of political stalemate and economic uncertainty. Yet even without this political blow-up, last year's Umbrella Revolution was already a clear manifestation of people's long-standing discontent with what they perceive as an unresponsive and unrepresentative government, which they blame for several economic and social "fault lines" that have deeply affected their livelihoods.

Such fault lines stem from chronic income stagnation and growing inequality, the soaring cost of living driven by ever-rising housing prices, and depressing employment prospects for the young, especially those without university educations. According to the Census and Statistics Department, the real wage index for non-professional and non-managerial employees has been on a downward trend for several years. Meanwhile, the city's Gini coefficient has climbed to a record high, from 0.518 in 1996 to 0.537 last year. Likewise, housing prices are severely unaffordable.

In a startling report last August, Trigger Trend, a research firm based in Guangzhou, contended that Hong Kong was "losing its edge as a global financial and commercial centre, and the territory's economic clout will be overshadowed by China's major cities by 2022". This eroding competitiveness is a result of government inaction as well as rapid economic progress on the mainland. The fault lines originate from the government's fiscal dependence on high land prices through alleged collusion with property developers, which have sent prices skyrocketing. The "Crony Capitalism Index", constructed by The Economist, which measures the extent of business tycoons' wealth profiting from a close relationship with government officials, placed Hong Kong at the very top last year.

The city also suffers from an unsustainable economic structure. Until the late 1980s, the economy had four industry pillars - finance, trade and logistics, regional headquarters services for multinationals, and manufacturing. These pillars have been reduced to three in the past two decades, as manufacturing migrated to the mainland. But the remaining pillars are also shrinking, as the city's cost competitiveness continues to erode without a corresponding increase in efficiency and productivity.

Hong Kong faces several risks that may threaten its leading position as an international financial hub in Asia. The financial sector mainly generates its revenue via the stock market by trading shares and launching mainland initial public offerings, as well as through its international banking sector. Nevertheless, last year, a Financial Times article named Hong Kong as the worst place to invest in Chinese IPOs, with transactions recording lower than average returns and a higher chance of losses compared with the Shanghai or New York exchanges. Fundraising is also increasingly being diverted from Hong Kong, with Deloitte reporting that for the first three months of this year, the Shanghai Stock Exchange surpassed the Hong Kong and New York exchanges for the first time in IPO fundraising. The establishment of the Shanghai Free Trade Zone in 2013 poses a significant threat. The renminbi's progressive internationalisation and China's impending capital account liberalisation will facilitate the rise of Shanghai as a financial centre.

More offshore renminbi payments are handled by centres beyond Hong Kong, with their share rising from 17 per cent in 2013 to 25 per cent this year. Clearly, Hong Kong is losing its edge as the premier offshore renminbi centre. In short, facing multiple challenges, Hong Kong's status as a financial hub is less than secure.