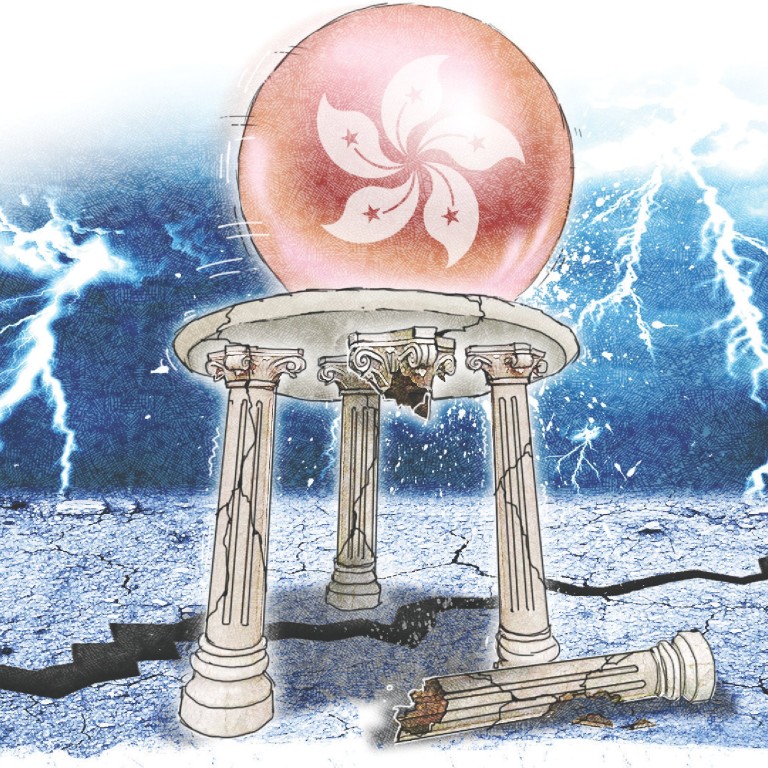

Hong Kong's competitive edge slipping away fast

Philipp Martin Dingeldey and Wan Tin Wai see a bleak future for the city as its financial, trade and business hub advantages wane

With the rejection by the legislature of the proposed election reform plan, Hong Kong faces a prolonged period of political stalemate and economic uncertainty. Yet even without this political blow-up, last year's Umbrella Revolution was already a clear manifestation of people's long-standing discontent with what they perceive as an unresponsive and unrepresentative government, which they blame for several economic and social "fault lines" that have deeply affected their livelihoods.

Such fault lines stem from chronic income stagnation and growing inequality, the soaring cost of living driven by ever-rising housing prices, and depressing employment prospects for the young, especially those without university educations. According to the Census and Statistics Department, the real wage index for non-professional and non-managerial employees has been on a downward trend for several years. Meanwhile, the city's Gini coefficient has climbed to a record high, from 0.518 in 1996 to 0.537 last year. Likewise, housing prices are severely unaffordable.

In a startling report last August, Trigger Trend, a research firm based in Guangzhou, contended that Hong Kong was "losing its edge as a global financial and commercial centre, and the territory's economic clout will be overshadowed by China's major cities by 2022". This eroding competitiveness is a result of government inaction as well as rapid economic progress on the mainland. The fault lines originate from the government's fiscal dependence on high land prices through alleged collusion with property developers, which have sent prices skyrocketing. The "Crony Capitalism Index", constructed by , which measures the extent of business tycoons' wealth profiting from a close relationship with government officials, placed Hong Kong at the very top last year.

The city also suffers from an unsustainable economic structure. Until the late 1980s, the economy had four industry pillars - finance, trade and logistics, regional headquarters services for multinationals, and manufacturing. These pillars have been reduced to three in the past two decades, as manufacturing migrated to the mainland. But the remaining pillars are also shrinking, as the city's cost competitiveness continues to erode without a corresponding increase in efficiency and productivity.

Hong Kong faces several risks that may threaten its leading position as an international financial hub in Asia. The financial sector mainly generates its revenue via the stock market by trading shares and launching mainland initial public offerings, as well as through its international banking sector. Nevertheless, last year, a article named Hong Kong as the worst place to invest in Chinese IPOs, with transactions recording lower than average returns and a higher chance of losses compared with the Shanghai or New York exchanges. Fundraising is also increasingly being diverted from Hong Kong, with Deloitte reporting that for the first three months of this year, the Shanghai Stock Exchange surpassed the Hong Kong and New York exchanges for the first time in IPO fundraising. The establishment of the Shanghai Free Trade Zone in 2013 poses a significant threat. The renminbi's progressive internationalisation and China's impending capital account liberalisation will facilitate the rise of Shanghai as a financial centre.

More offshore renminbi payments are handled by centres beyond Hong Kong, with their share rising from 17 per cent in 2013 to 25 per cent this year. Clearly, Hong Kong is losing its edge as the premier offshore renminbi centre. In short, facing multiple challenges, Hong Kong's status as a financial hub is less than secure.

The city's position as an international trade hub is at stake, with its logistics sector facing increasing competition from southern China. Since 2000, Hong Kong's port business has shifted from handling direct cargo to transshipment cargo, and since 2008, overall container throughput has been in relative decline. Over the years, mainland ports have caught up fast. As a result, the Hong Kong port's importance for handling direct cargo intended for southern China fell from 76 per cent in 2001 to 39 per cent in 2011, translating into the growing dependency on transshipment cargo. Unfortunately, transshipment cargo is less profitable since such operations require logistical adjustments (for example, on-site storage facilities). Such adjustments have not been implemented in Hong Kong, resulting in more time taken in cargo handling and dwelling, decreasing overall efficiency. This, coupled with higher handling charges compared with Shanghai, makes Hong Kong not only less efficient but also more expensive. BMT Asia-Pacific has forecast that international transshipment will constitute the lion's share of overall throughput growth for Hong Kong until 2030, thus further increasing its vulnerability to international trade shocks.

Last, but not least, Hong Kong also faces mounting challenges to its attractiveness as a hub for multinationals' regional headquarters. Among these, the costs of doing business have increased vastly, the city's pollution is nearly on a par with that of mainland cities, and fiscal incentive packages vis-à-vis other mainland cities are lacking. Of the 1,389 so-called multinational regional headquarters reported by Invest Hong Kong, more than half employ fewer than 20 workers, thus inflating the overall number and their ostensibly regional functions. The city's high living and employment costs, soaring rents and a shortage of locals with appropriate skills translate into high operating costs for multinationals. A recent survey by CBRE Research ranks Hong Kong's prime office market the most expensive in Asia, more than double Shanghai's. Moreover, once granted the status of newly established regional headquarters by the Shanghai municipal government, multinationals enjoy many benefits, including financial bonuses, subsidies and eased immigration procedures. Short of government action, Hong Kong will gradually lose its attractiveness as a hub for regional headquarters.

With the steady erosion of competitive advantages, a fractured government that espouses an archaic "positive non-interventionism" policy, and an economy dominated by self-serving crony capitalists, Hong Kong's decline seems as inevitable as it is inexorable. The Umbrella Revolution may thus be seen as a manifestation of the people's desire to directly elect a more responsive government that can help reverse the city's sinking economic fortune. However, with the veto vote and no second option, the legislature will become even more divisive, creating gridlock. With the government in limbo, the city's fault lines will deepen and widen. Hong Kong, the once vaunted "Pearl of the Orient", now faces a cloudy destiny.