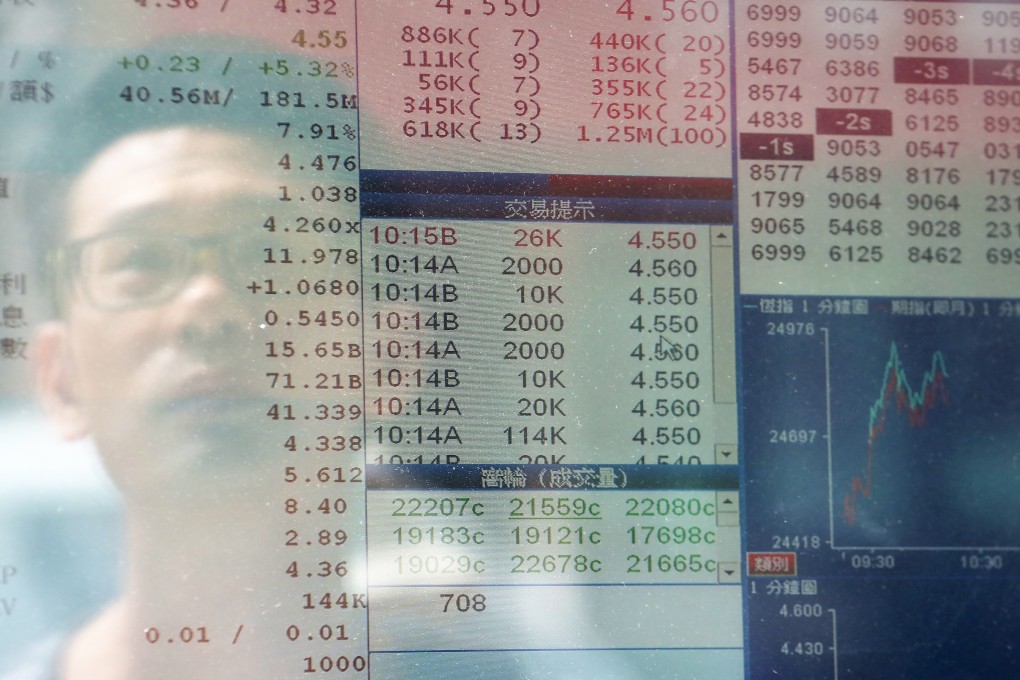

Does stock market turmoil signal the beginning of the next crisis?

Alexander Friedman considers the unintended consequences of six years of coordinated loose monetary policy since the 2008 meltdown

In his Pulitzer-Prize-winning book, Lords of Finance, economist Liaquat Ahamed tells how four central bankers, driven by staunch adherence to the gold standard, "broke the world" and triggered the Great Depression. Today's central bankers largely share a new conventional wisdom - about the benefits of loose monetary policy. Are monetary policymakers poised to break the world again?

The unprecedented period of coordinated loose monetary policy since the beginning of the financial crisis in 2008 could be problematic. Indeed, the discernible effect on financial markets has already been huge.

The first-order impact is clear. Institutional investors have found it difficult to achieve positive real yields in any of the traditional safe-haven investments.

Investors have responded to near-zero interest rates with unprecedented adjustments in the way they allocate assets. In most cases, they have taken on more risk, particularly by increasing allocations in equities.

The resulting second-order impact could ultimately prove devastating. The equity bull market is now six years old. Even after the volatility following the crisis in Greece and the Chinese stock market's plunge, valuations appear to be high.

As long as the tailwinds of global quantitative easing, cheap oil and further institutional inflows keep blowing, equities could continue to rally. But at some point, a real market correction will arrive. And when it does, pension funds and insurance companies will be more exposed than ever before.