Why walking away from a successful career in finance is not so hard

Tan Chin Hwee says set against the boom-and-bust cycle of the industry, material success is, in the end, only one part of a life well lived – which teaches loss and the importance of intellectual honesty

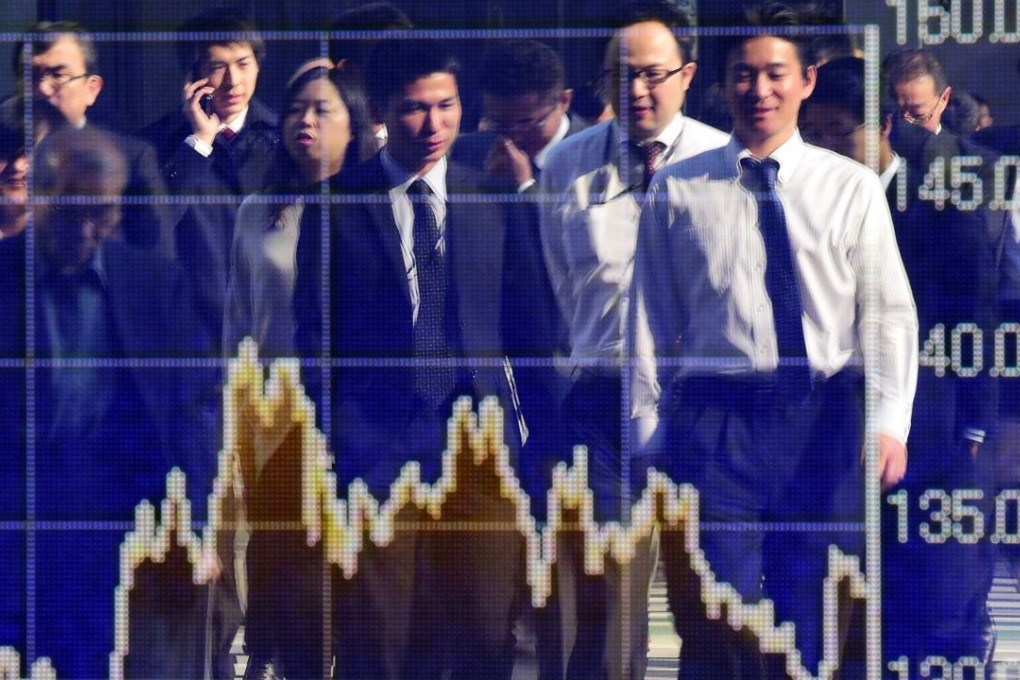

I always wanted to be in finance; I am drawn to the energy and intensity, but most of all the intellectual challenge. Managing money professionally is probably the best thing next to professional sports. The market is objective: it doesn’t care whether you have a PhD or a CFA, only three letters count – PnL, profit and loss.

As a college student, my rude introduction to finance almost ended up in bankruptcy as I speculated on options with no understanding of the Black-Scholes-Merton pricing model. Ironically, that episode was also how I managed to “sweet-talk” my way into my first job on the buy side in 1995 as the interviewers were impressed with my risk-taking abilities and intellectual curiosity.

The winner-takes-all mentality prevalent in the industry is a constant challenge to my upbringing. To be a successful financial executive, every part of you has to be devoted to success, but at what cost?

Even so, I was still not adequately prepared for the 1997 Asian crisis as a young finance professional; my first credit default happened on my mother’s birthday in 1997. I will never forget that defining humbling experience.

From then on, I was determined to be the best in the industry in Asia. I began to devote my life to being a better investor. That included uprooting my young family and moving to be near New York, for four years, starting again from the bottom of the trading floor at a major global hedge fund.

Fast forward to 2015, one could argue that I have had a successful investment career, yet, I have always felt like I am a square peg in a round hole in the industry.

I have watched four economic crises ravage and cut short many careers in the financial industry over the past 21 years. The winner-takes-all mentality prevalent in the industry is a constant challenge to my upbringing. To be a successful financial executive, every part of you has to be devoted to success, but at what cost?