Ignore George Soros’ prophecy of doom; China has its economic situation well under control

Lau Nai-keung says the slowdown is just part of the restructuring process and while a few mistakes are inevitable along the way, it doesn’t mean China is heading for a hard landing

In an interview with Bloomberg TV in Davos at the World Economic Forum, George Soros declared that a hard landing of the Chinese economy was “almost unavoidable”, and that he has shorted US stocks and Asian currencies. This statement amounted to a formal declaration of war with China. The sharp fall in offshore renminbi and the Hong Kong dollar recently should be regarded as skirmishes.

Soros was aware that the deciding factor of his final battle lay in a general evaluation of China’s economic situation

The Chinese economy is now in a “new normal” status, with the growth rate slowing to below 7 per cent. This would be a relatively high rate in any other country, but it is a record low for China since its reform and opening up in 1978. Hence, it has created speculation overseas. Moreover, the yuan has devalued against the US dollar and there have been large fluctuations in China’s stock market, causing swings in stock and currency markets around the world.

Soros was aware that the deciding factor of his final battle lay in a general evaluation of China’s economic situation. To aid his financial attack, he has repeatedly let it be known that he is very pessimistic about the Chinese economy, to create a state of panic among the global investment community.

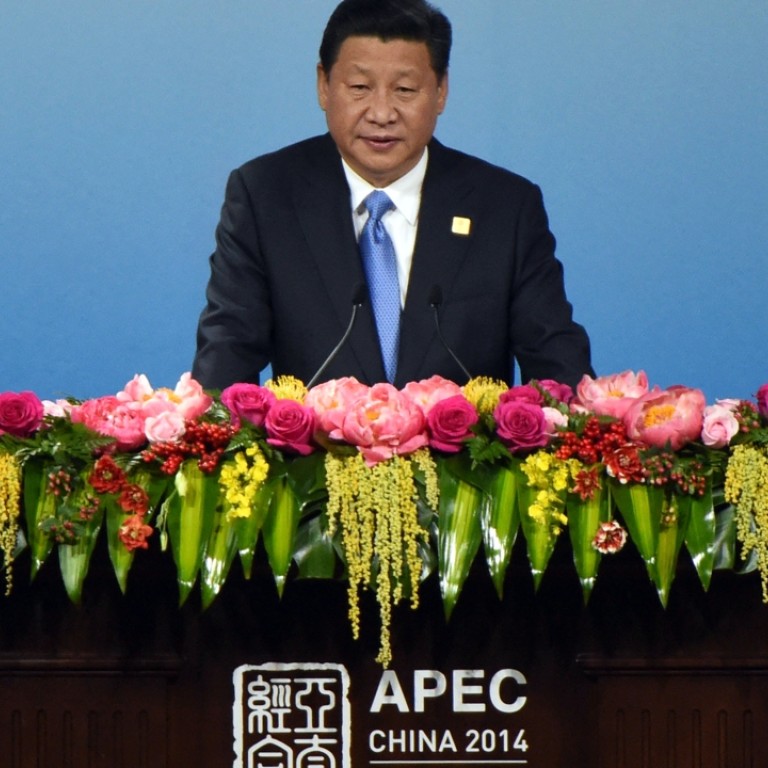

In his speech at the Asia-Pacific Economic Cooperation forum in November 2014, Xi went on to elaborate on the main characteristics of a new normal. In terms of speed: “from high-speed growth to medium-high speed”; structure: “continuous optimisation and upgrading of economic structure”; and, propulsion: “from factor driven and investment driven to innovation driven”.

It is clear that, 2½ years ago, the top decision-makers in China had already envisioned the economic slowdown that took place in the second half of last year, as an inevitable phenomenon of the new normal of economic transformation and upgrading. Just as a car travelling at high speed has to slow down for a sharp turn, so it is for the economy. If the driver isn’t careful, the car could be damaged.

READ MORE: Why sustained, healthy development will be the new normal for China’s economy

Of course, in that scenario, the problem lies with the driver, not the car. By the same token, there is no problem with the Chinese economy, but in the process of economic transformation, there are some problems with financial management, especially the management of general expectations about the economic growth rate, and the response when things slow down.

If Soros were to short the yuan and Hong Kong dollar, he would be making a big mistake in his judgment of the situation

There are many people in the world who make the mistake of seeing the economy and stock market as one and the same, but this is not the case. The US economy, for example, has been in bad shape since 2008, but its stock market has been continuously rising; China, on the other hand, has long boasted a strong economy but suffers from a weak stock market.

Let us use another analogy. It is like a person who has flu but, due to a lack of experience and mismanagement of the minor ailment, it turns into pneumonia. If the patient was originally in great health, he should recover. Recently, there have been mishaps in China’s virtual economy, with obvious mismanagement and subsequent financial losses, but the real economy is as robust as ever.

Speculators manipulate the market every day, and pundits have to find excuses on a daily basis to explain away its erratic ups and downs and convince the general public that they are somehow related to the economy. Soros et al persistently bad-mouthing the Chinese economy has already had an effect, with increasing capital flight, and the accompanying downward pressure on the renminbi.

READ MORE: As China transitions to a ‘new normal’, some financial, economic and political pain is inevitable

So, if Soros were to short the yuan and Hong Kong dollar, he would be making a big mistake in his judgment of the situation and in the power and determination of the Chinese government. Given veteran Soros’ astuteness, his current attacks are obviously not directed at China – his real targets are other Asian currencies. Judging from the extraordinary calm displayed by the Hong Kong government and its citizens, who are very experienced in dealing with international financial heavyweights, we should know that if we take Soros too seriously, we will end up falling into his trap, spending too much effort refuting his claims, defending his false attacks, changing our rules too frequently and suffering more losses.

The Chinese leadership is facing a new situation and, given its inexperience, it is inevitable that it will make some mistakes. But, each time, it admits to them and quickly finds remedies. Since Beijing has begun to grasp the situation and taken charge, the probability of an economic hard landing can only diminish. It now only has to concentrate on doing its own thing, and let others gradually form rational views and expectations, and the financial crisis will disappear by itself. Soros will meet his Waterloo very soon.

Lau Nai-keung is a member of the Basic Law Committee of the NPC Standing Committee, and a member of the Commission on Strategic Development