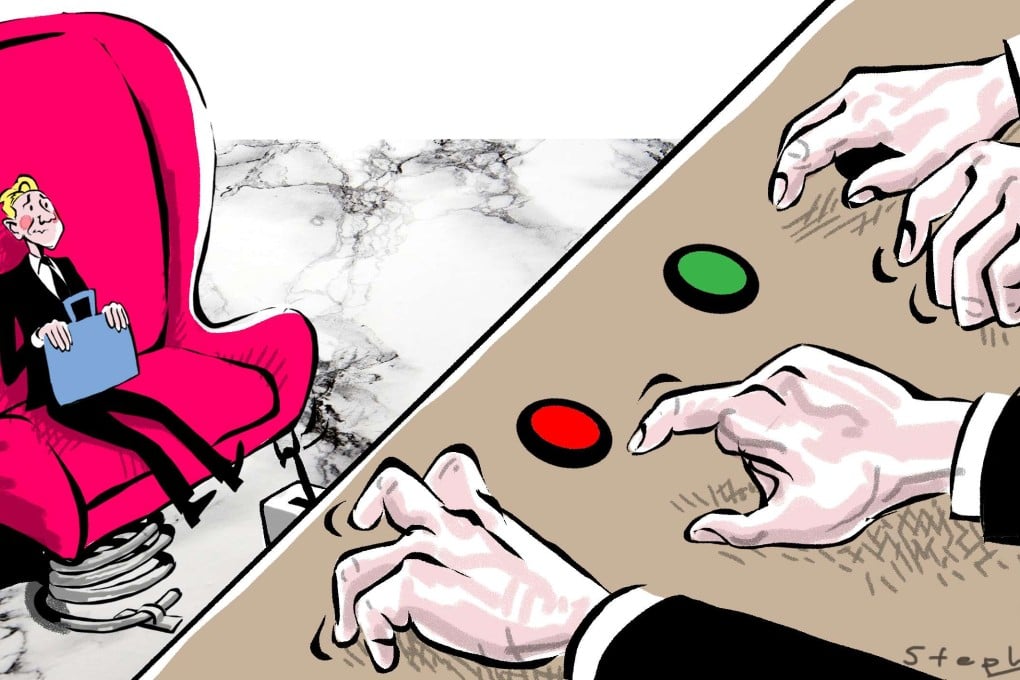

Why is it so difficult for small businesses to open an account at some banks in Hong Kong?

Arthur Yuen says banks’ due diligence checks on customers need to be stringent but not prohibitive, so that SMEs – particularly start-ups and foreign companies – can access the services they need

I am naturally very concerned, given that bank accounts are essential for operating businesses and financial inclusion. I am surprised that this should happen in Hong Kong, which has a well-developed and highly efficient banking system.

Don’t count on Hong Kong when it comes to one simple thing: opening a business bank account

Let me start with the context. One may recall that, 10 years ago, it was possible to open a bank account rather swiftly.

It’s sobering now to reflect how challenging the process can be for some parts of the community. In recent years, international efforts in anti-money laundering and counterterrorist financing have been stepped up significantly.

At the same time, global sanction regimes and other regulatory requirements have added to the complexity of the landscape in which banks now operate. As a result, banks are subject to much tighter international standards in establishing and maintaining relationships with potential and existing customers.