How Hong Kong’s professional services sector can provide the glue for Belt and Road projects

Joseph Ferrigno says China’s ‘One Belt, One Road’ will have major economic, social and political benefits, as long as the schemes are well managed, and that offers many opportunities for Hong Kong’s private sector

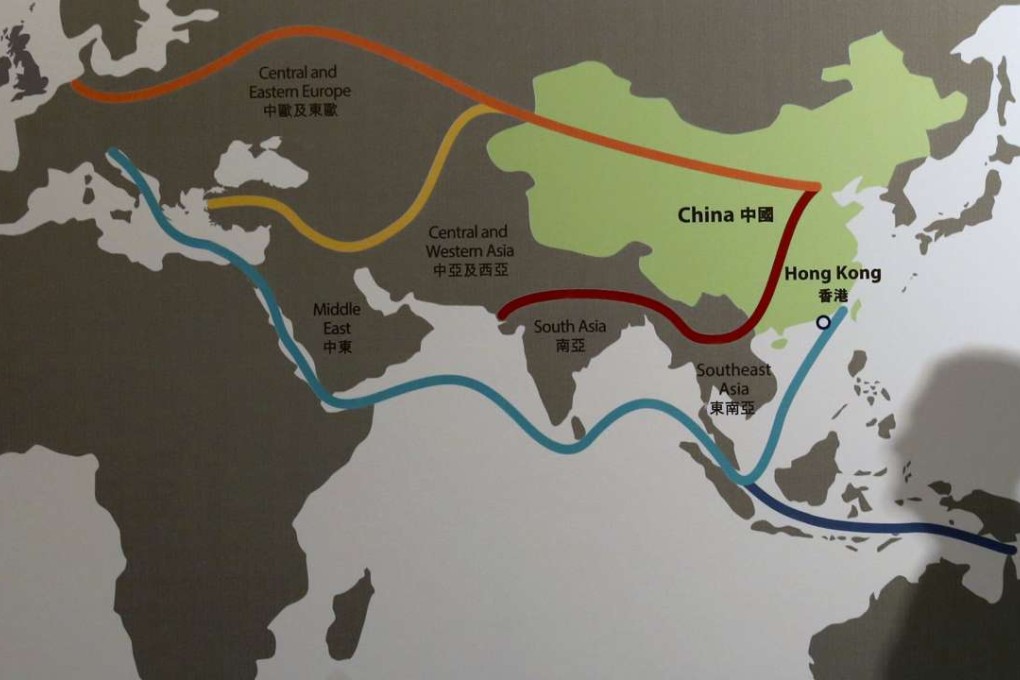

China’s Belt and Road initiative that we hear so much about these days is an inspiring vision for greater cooperation, inclusiveness and higher growth among several countries. It was proposed in October 2013 and includes strategies for the development of connecting infrastructure on land and sea. It is estimated to require expenditure of US$1 trillion this decade.

“One Belt, One Road” has become highly attractive to governments and the private sector because of its significant potential economic, social and political benefits, if the projects are successfully implemented. And that is a “big if”.

It is not just capital that is needed. Other, much more scarce resources are also required. Advanced project development, management and risk absorption capabilities that are necessary to successfully implement Belt-and-Road-inspired projects far exceed what governments can provide. That is why public/private partnerships (“PPPs”), which are relatively new to Asia, are essential. They contribute innovative ideas, project management and risk control as well as capital. The private sector, working closely with the public sector, can play leading roles in Belt and Road projects. Public/private partnerships can result in projects which have the most appropriate and innovative designs, the most cost-efficient and timely construction and the most efficient operation.

China’s one belt, one road initiative set to transform economy by connecting with trading partners along ancient Silk Road

Public-sector partners, national and local governments, as well as national and international infrastructure development banks, are key participants. Development banks must play major roles in the larger, more complex public/private partnerships. They can take higher risks than the private-sector lenders and investors, and are staffed with experts who have many years of experience in project procurement and financing in developing countries and can assess which projects are feasible and which are not. They also know how to get the best from the private-sector participants.