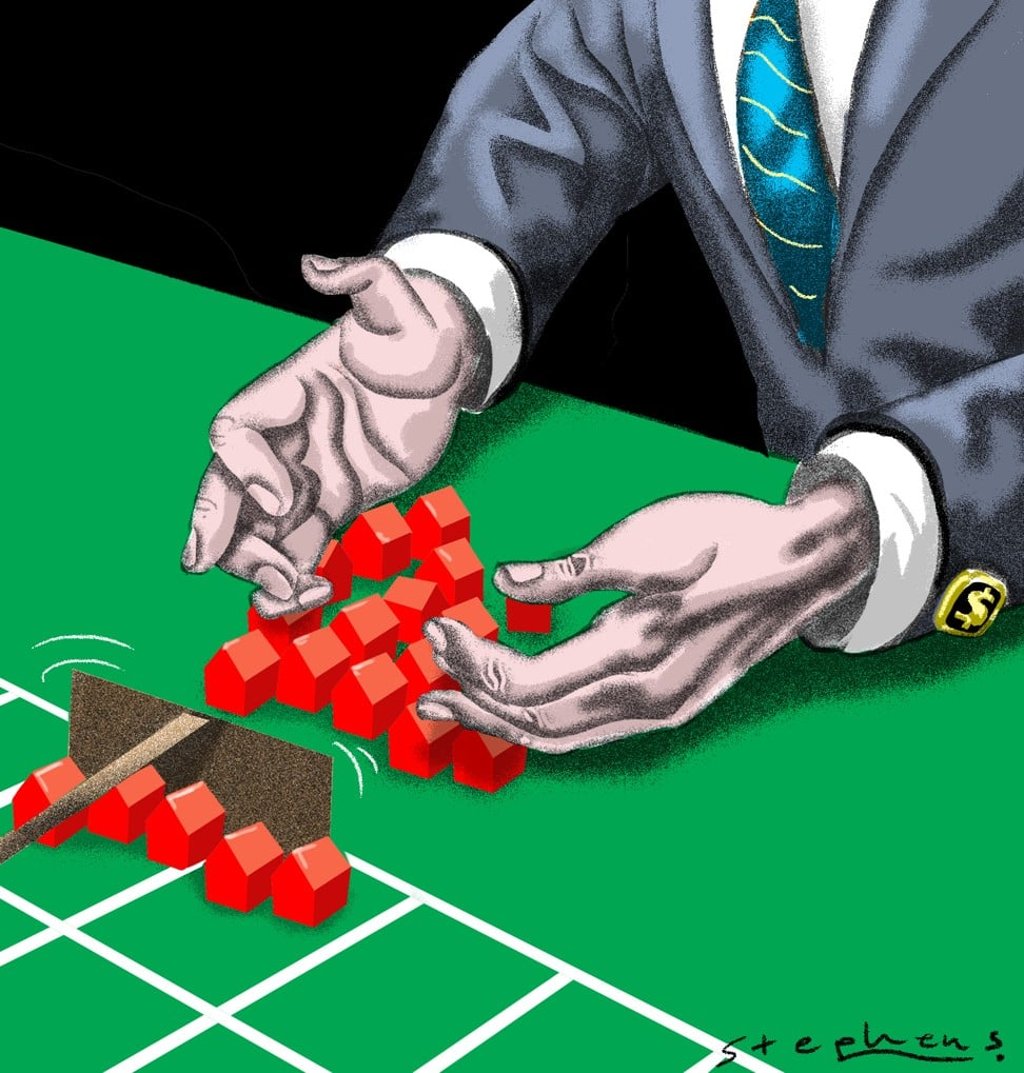

Hong Kong needs radical tax reform, as addiction to real estate is hurting long-term growth

Stefano Mariani says using fiscal policy to reduce the attractiveness of property speculation would encourage investment capital to flow into other sectors, and channel much-needed funds into the knowledge-based economy

The focus of reformists in our Legislative Council, however, should not be on raising taxes, but on broadening the tax base.

One of the underlying fiscal reasons for the property bubble is that, since the abolition of estate duty in 2006, capital assets are generally not taxed. This means investors can hoard real estate and realise very large capital gains, tax-free.

Investors can hoard real estate and realise very large capital gains, tax-free

Hong Kong currently has an unbalanced tax code, which taxes the means through which social mobility may be achieved – that is, income from a successful business or a well-paying job – but leaves capital and accumulated wealth untouched. The effects of this are compounded by the absence of legal restrictions on the acquisition of residential property by non-permanent residents, in stark contrast with jurisdictions operating under similar space constraints, like Singapore and the Channel Islands. Non-permanent resident speculators, therefore, hold an indefensible tax advantage relative to locals.

The government’s strategy of simply hiking stamp duty rates has largely been unsuccessful in cooling the market, an outcome that, to a tax practitioner, is unsurprising.

First, many Hong Kong properties are enveloped, meaning they are owned by offshore companies, not directly by individuals. When the owner of the company wishes to sell the property, he simply sells the shares in the company and that transfer does not bear stamp duty.

Second, high rates of stamp duty increase transaction costs, driving owners to wait for still greater capital appreciation, and accordingly does nothing to reverse the hoarding of property by wealthy non-permanent residents.