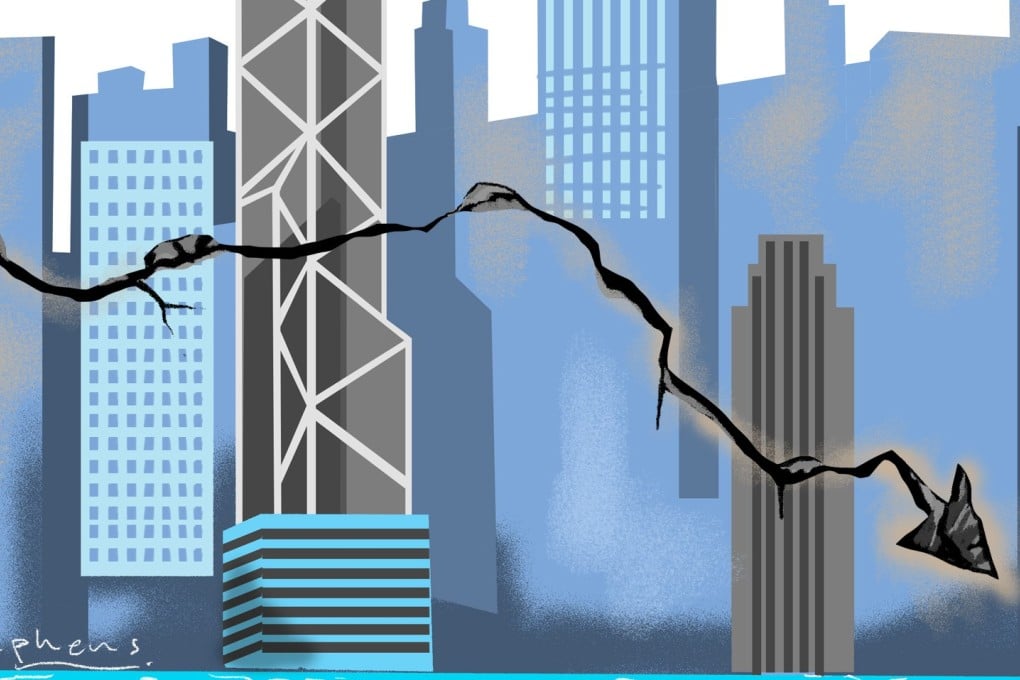

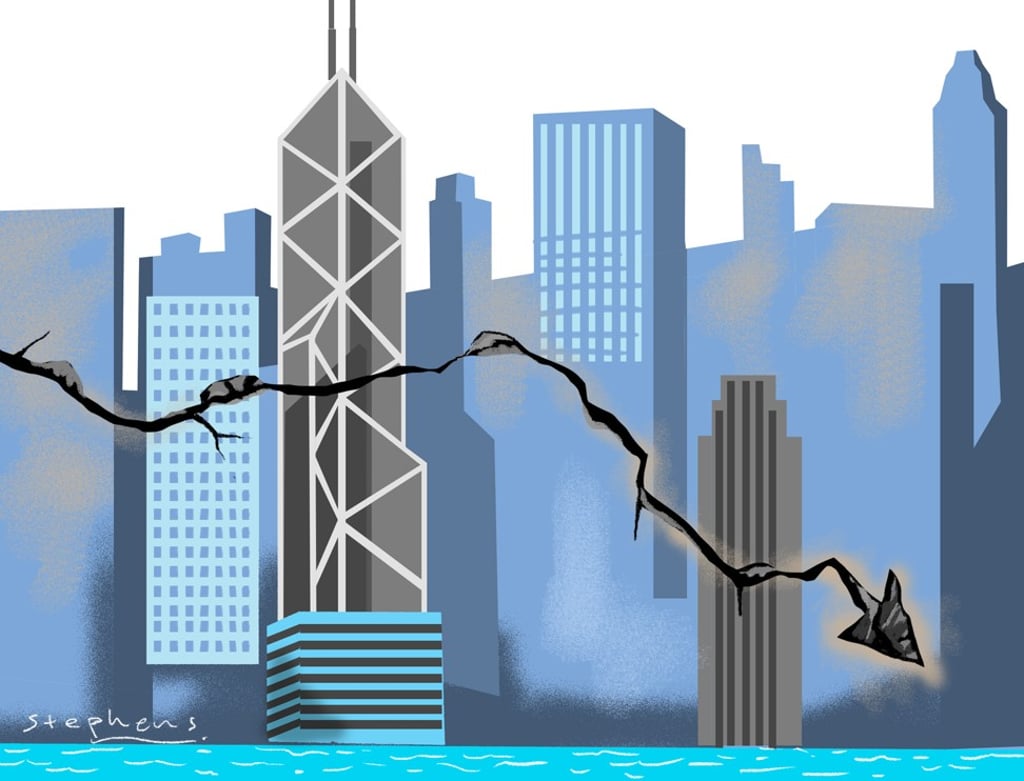

The summer of Hong Kong’s discontent, 20 years after its return to China

Friedrich Wu says the political and socio-economic malaise that has been brewing here for the past decade is coming to a head with recent economic headwinds that are exposing the city’s fading competitiveness in its key industries. The anger that led to the Occupy protests in 2014 is still roiling

For those who have followed Hong Kong’s tumultuous political developments in the past three years, such tight security measures do not come as a surprise. Rather than aiming to deter assassination attempts or terrorist attacks, they are more intended to shield state leaders from the embarrassment of being harassed by unruly local pro-democracy protesters and pro-independence “separatists”. Tellingly, these over-the-top procedures only serve to highlight the political and socio-economic malaise that has been brewing in the SAR for nearly a decade.

Imagining a far better Hong Kong, and rueing 20 years of misrule

Hong Kong’s “fault lines” stem from chronic income stagnation and growing inequality, the soaring cost of living driven by ever-rising housing prices, and depressing employment prospects for the young. According to official statistics, the real wage index for non-professional and non-managerial employees has been on a downward trend for several years. Even graduates are facing increasingly bleak employment prospects due to oversupply by eight government-funded academies plus a myriad of privately-funded post-secondary institutions, as well as a mismatch between salary expectations and skills.