Why Abe’s Tokyo election debacle may create ripples beyond Japan

William Pesek says a weaker yen as the Japanese prime minister tries to shore up support may spark a currency tussle with China, and invite the ire of Donald Trump. Abe would be wise to tap the momentum of his EU trade deal

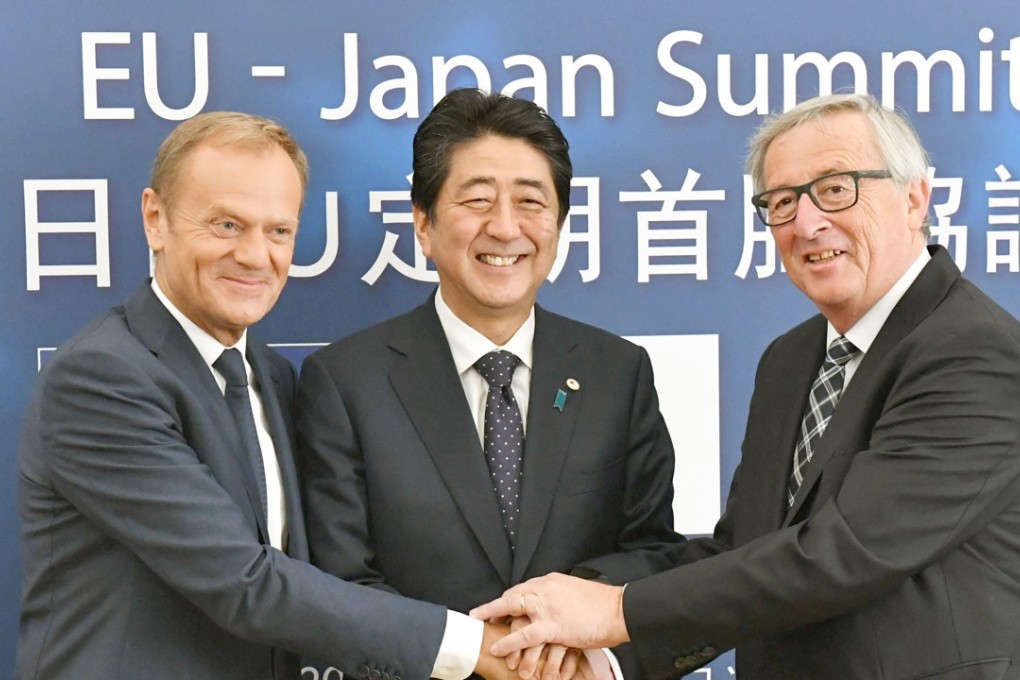

Is Japan finally about to add more to Asian growth than its deflation subtracts? Prime Minister Shinzo Abe’s sealing a giant trade deal with the European Union is one reason to bet on increased GDP. But the real boost may come from his comeuppance in recent Tokyo elections. Abe wasn’t on the ballet, but his Liberal Democratic Party took a pounding. It was the first opportunity for voters to punish Abe for a spate of scandals and unpopular policy moves, and they did.

Japan PM Abe stung by scandal and poor polls

Abe seemed to get the message. His team is buzzing about accelerated structural upgrades, closer trade ties with China and South Korea, and even a change in the Bank of Japan leadership. Abe also chatted with US President Donald Trump at the G20 in Hamburg last week about more open and active trade. To Ed Rogers, head of Tokyo-based Rogers Investment Advisors, Abe’s sliding support rates are a “wake-up call” to get serious about reform and a buy signal for yen assets.

For a G7 economy, Japan has a decidedly developing-world mindset on exchange rates

What might all this mean for Asia? Obviously, Asia’s No 2 economy generating demand and outward energy for the first time in decades would be highly welcome. There’s a good chance, though, that Tokyo’s tactics will shake up the neighbourhood in ways that irk China and pull Trump into the fray.

The problem: the yen may be about to fall significantly. For a Group of Seven economy, Japan has a decidedly developing-world mindset on exchange rates. Abe’s LDP has spent the 25 years since the bubble economy burst battling speculators.

Japan ploughs its own furrow as end of cheap money fast approaches

The dump-Kuroda narrative is code for: the BOJ had better regain that awe among currency traders. We saw a hint of that last week, when the central bank intervened to cap bond yields. Next, Tokyo may turn its beggar-thy-neighbour predilections up to 11. That would get Xi Jinping’s (習近平) attention, perhaps leaving the Chinese president tempted to weaken the yuan. China is getting less traction from pumping fresh credit and debt into the financial system. The search for economic tailwinds is sure to lead Xi back to exchange rates. A weakening yen may get Xi back there even quicker – and Trump on Twitter soon after.