Enough of the concrete pouring, there are better things to spend our money on

Hong Kong’s public savings amount to HK$767,000 for every household. There’s no reason why we can’t have world class social services with that money

Hong Kong’s leader has publicly backed an assertion by the city’s former central banker that the “miserly” fiscal philosophy of the past decade should be abandoned even if increased spending leads to budget deficits.

SCMP, August 4

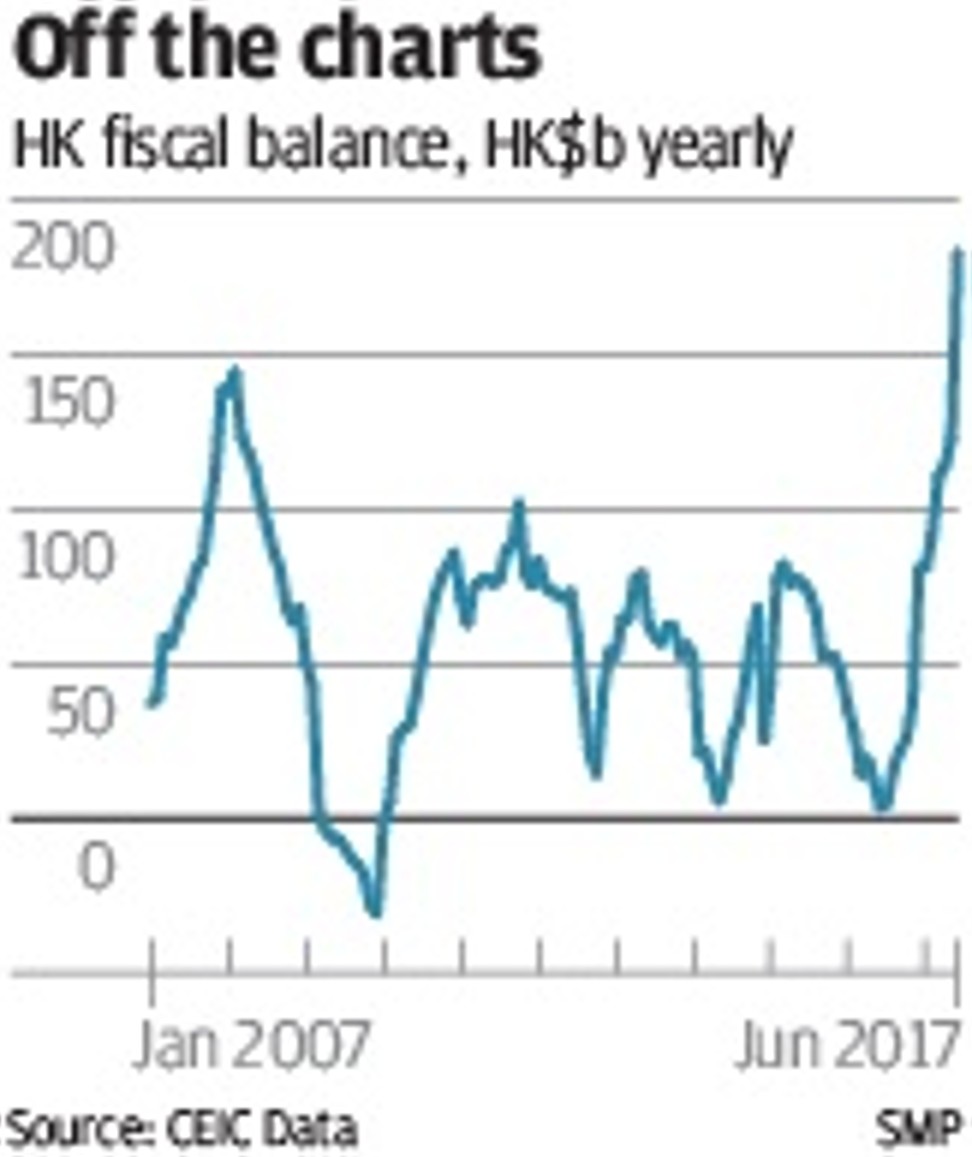

Let’s put some immediate perspective on this one, starting with the off-the-charts performance that the chart shows.

As of the end of June our government’s fiscal balance registered a running surplus of HK$184 billion a year on cash accounts. Put this in the context of the mere HK$16.3 billion surplus that Financial Secretary Paul Chan Mo-po forecast in his budget only a few months ago. This is BIG.

And when he told us that he expects reserves to rise to HK$952 billion by the end of March next year (they already stand at just over HK$1 trillion) he was being a little shy about telling you the whole story.

He did not mention another HK$317 billion in placements by statutory bodies with the government’s Exchange Fund. Those also count as our public savings.

Of more significance, he did not mention that the fund holds investment profits of HK$638 billion. Yes, these may still go down. They may also still go up.

On the whole, however, HK$638 billion is a pretty good figure for what they are worth right now and, again, it is our money.

Put it all together and we have net fiscal reserves at the moment of just a shade under HK$2 trillion, which is equivalent to 76 per cent of annual gross domestic product. Our public savings now amount to HK$767,000 for each and every household in Hong Kong.

It is largely the doing of Chan’s predecessor, John Tsang Chun-wah, whom I have regularly referred to in this column as Johnny Doomcloud or Tsang Chicken Little. He was possibly the most miserly pessimist we have ever had as Financial Secretary.

And I entirely agree with our past monetary chief, Joseph Yam Chi-kwong, that building up such a miser’s hoard against the chance of the sky falling in was not a wise thing to do. We can put the money to better uses than encouraging fiscal irresponsibility and warmongering in the United States.

It was first of all a bad idea because it also encourages waste at home. I am thinking, among other things, of that pointless bridge to Macau and that just as pointless second railway to Guangzhou.

There are more examples. The engineering fraternity smacks its lips when it sees big fiscal surpluses and it has dined well, very well indeed, at the expense of the rest of us.

But spending the money on high profile concrete pouring projects has also stopped us from setting up some world firsts in social services with a level of savings only to be seen elsewhere in a few oil sheikdoms. We could, for instance, long ago have funded a complete, full service, self-sustaining public health system rather than hunting for the money every year again from operating revenues. It could make the world sit up and take notice. This is how to do it.

Although recent events in matters of legal jurisdiction have made a dead letter of the Basic Law, its provisions against deficit financing would never have been effective anyway and are no reason to keep running giant surpluses.

But, please, Carrie, we have poured enough concrete.

Do something better with the money, will you?