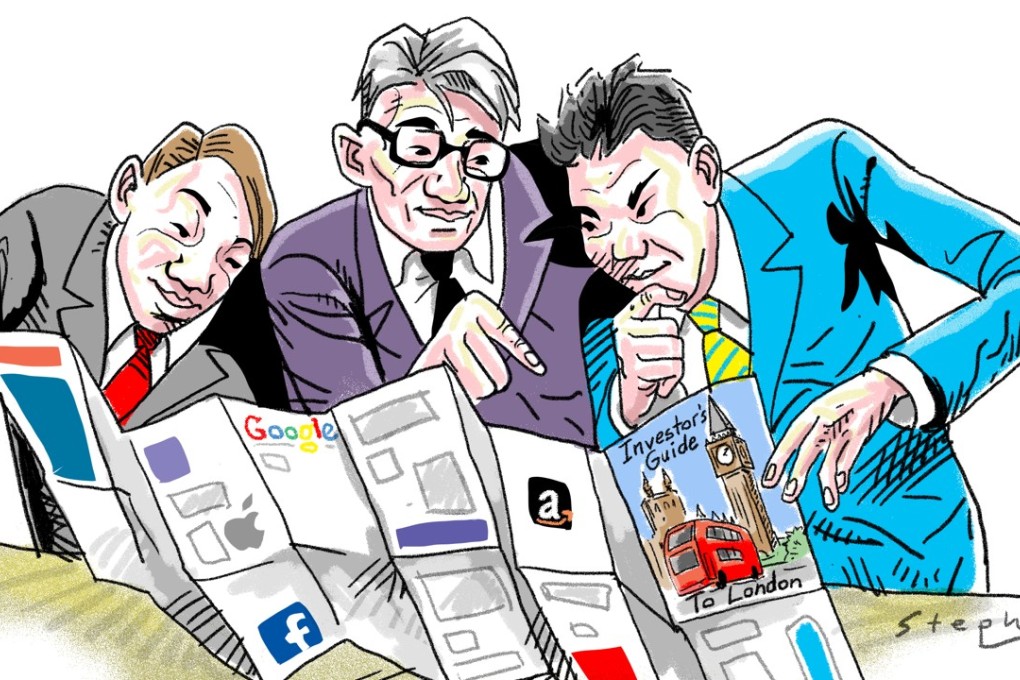

For tech giants and Asian investors, it’s business as usual in post-Brexit London

Hugh Dixon says the city’s strength as a financial and real estate hub runs deep. Despite some initial jitters right after the UK vote last summer to leave the EU, investors have not abandoned London as feared

Watch: A new Apple campus at Battersea Power Station

The Brexit vote hit London’s start-ups and new technology companies hard. In the months afterwards, fundraising dramatically fell due to economic instability and lack of confidence.

Hong Kong investors have also been leading the way when it comes to London commercial real estate

In fact, it was reported that the three months following the vote were the worst ever recorded for fundraising. Nevertheless, if you fast forward 10 to 12 months, there has been a shift in direction and a clear recovery. These start-ups have looked to Asia for investment, allowing the angels to take advantage of the weak British currency.

Hong Kong and Singapore stepped up and have played a vital role in the survival and expansion of UK tech companies. Undoubtedly, there is a cloud over the UK start-up scene, as access to EU talent may become difficult in the future.

Nevertheless, the strong UK education system and government support of start-ups should be able fill the gap, should this benefit disappear.

Hong Kong investors have also been leading the way when it comes to London commercial real estate, being the most active in the first half of this year. Despite the vote to leave the EU, investor demand has remained strong. This has mainly been propped up by the flow of investment from mainland China and Hong Kong.