No reason to believe China falsifies its national economic data

Lawrence J. Lau says although the tampering of economic statistics is a problem in regional government, as evidenced by several recent admissions, central government officials understand the harm it brings. The data they put out is not perfect, but it is the most reliable available

The fact that the National Bureau of Statistics does not take the provincial, regional or municipal statistics at their face value is quite well known. Its estimates of the national GDP do not rely solely on the local estimates.

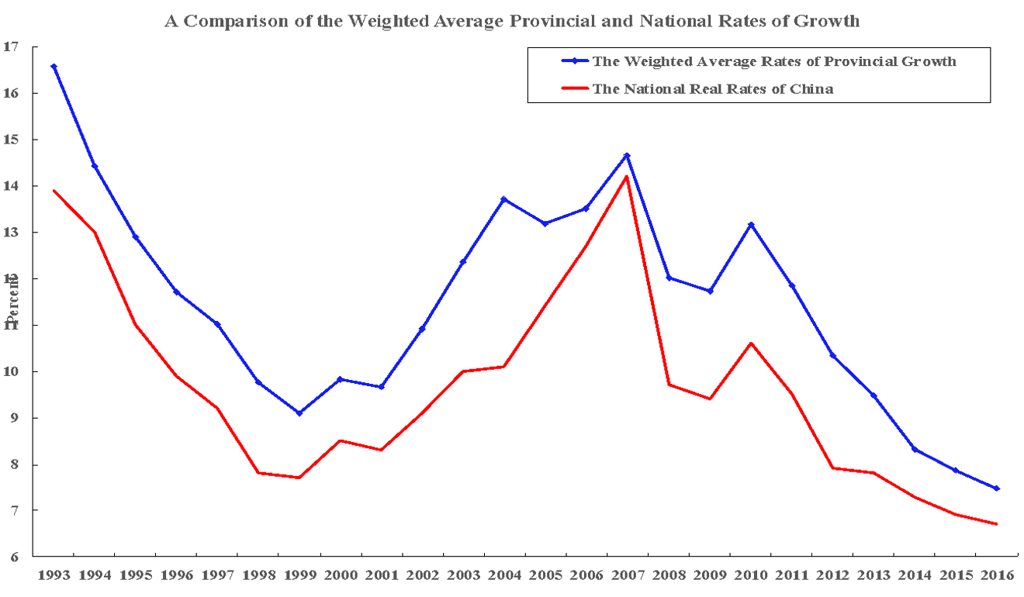

If one compares the GDP-weighted average annual rate of growth of provincial GDPs and the annual rate of growth of the national GDP, all published in the annual China Statistical Yearbook, one finds that, since 1993, the weighted average rate has been consistently higher than the national rate by a couple of percentage points.

If one uses quarterly data, which is available since 2005, a similar picture emerges.