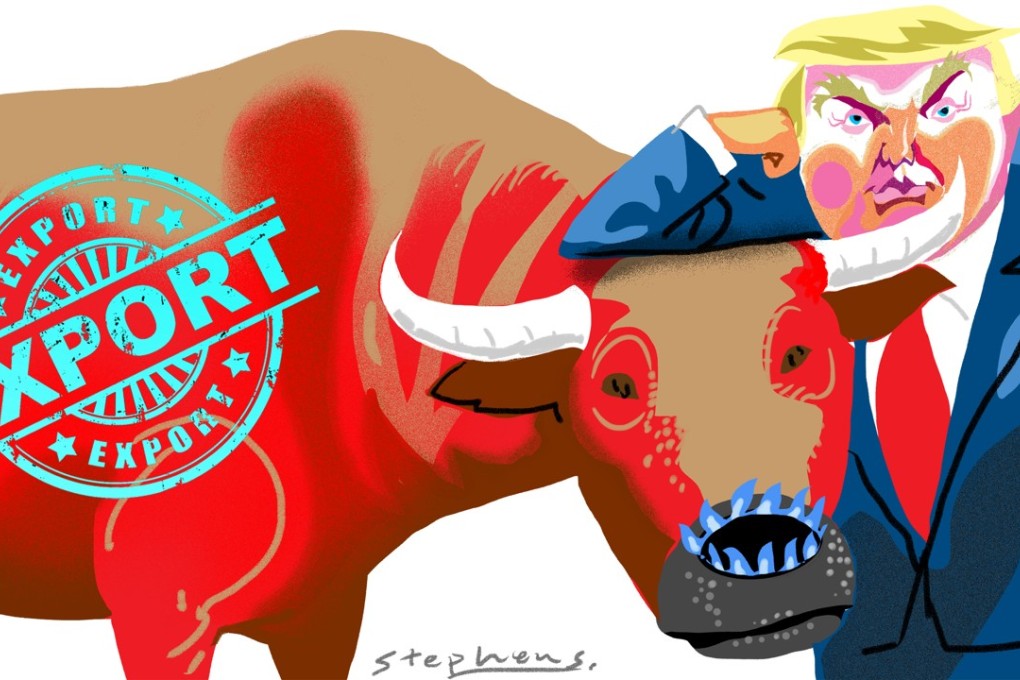

Trump should increase US exports to China, not launch a trade war

Lawrence J. Lau says Trump’s new tariffs may lead to a reduction in Chinese exports to the US, but the overall US trade deficit is unlikely to fall, and there’ll be no positive impact on its GDP or employment

After adjustments for the difference in the valuation of exports and imports and in the treatment of re-exports through Hong Kong, the discrepancy can be reduced to between US$325 billion (Chinese data) and US$362 billion (US data). If trade in services, in which the US has a surplus, is included, the 2017 deficit is estimated to be between US$287 billion and US$323 billion.

Trump wishes to reduce the trade deficit by US$100 billion. He proposes to accomplish this by imposing tariffs on Chinese exports to the US. Whether this can be done in a manner consistent with the World Trade Organisation rules is not so clear, but it is unlikely to deter Trump.