AI-driven unemployment in Hong Kong can be offset by a tax on profits generated by robots

Scott Cheng and David Ketchum say the Hong Kong government must reckon with the impact of artificial intelligence on human employment. One way to do this would be to amend the tax regime, by taxing profits generated from using robots

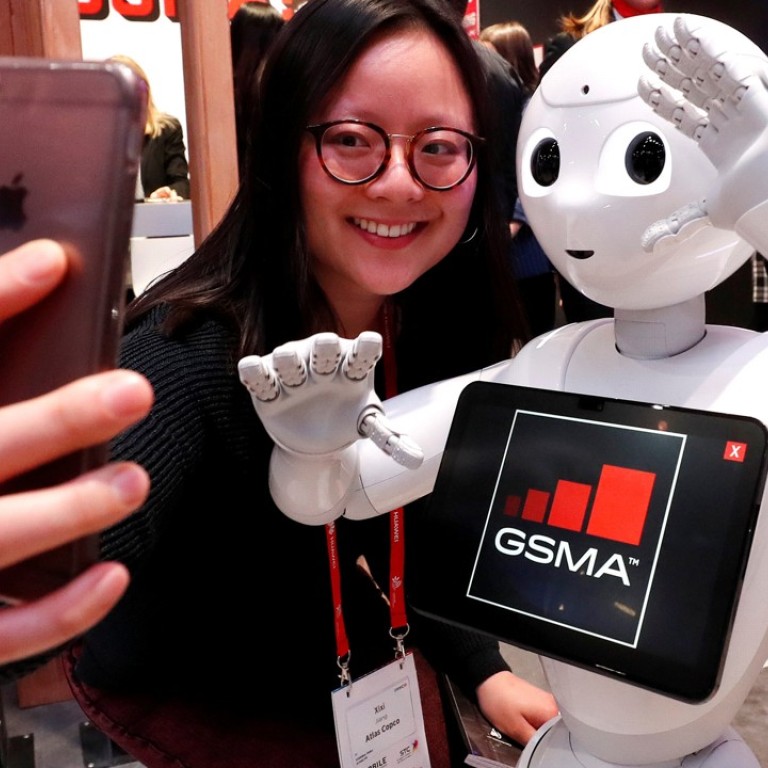

It is therefore an inevitable trend that automated intelligent machines or so-called robotic process systems will take over more human roles.

Worried AI will replace your job? Here’s an explainer to prepare for that day

In this scenario, while gross domestic product may rise and corporations will generate higher profits because of the lower labour costs, the government will collect less from salaries tax (given that more people will be jobless).

Any responsible government must address the gap between the interests of potentially displaced workers and those of shareholders and corporate management.

Governments should be thinking about how to deal with the potential upheaval as a result of massive unemployment

Today, one in three jobs is vulnerable to replacement by AI and robotics, according to research firm Gartner.

Job losses won’t be confined to bus drivers and factory workers; stockbrokers, accountants, lawyers and other rules-based professions, and even doctors and surgeons are at risk.

Artificial intelligence will change the job market and Hong Kong isn’t ready

The benefits to society and the workers displaced are clear, and the tax could slow the displacement of people by robots, giving the economy and society a chance to adapt to the changing realities of the workplace.

Watch: Year of the robot dogs

In the AI revolution, creative children – not wannabe bots – are the future

A universal basic income may have a place in Hong Kong’s future, but traditionally this city has been about opportunity and competition, with plenty of government services but a tenuous social safety net.

With the economy doing well and the machines performing the work, society can afford to pay people to do nothing in this utopian view

Raising taxes on corporations specifically for the use of AI and robots does not fit particularly well with Hong Kong’s free-market economy, even setting aside the challenge of defining and dentifying AI and robots for tax purposes.

In the medium term, robot taxes have the potential to reduce our economy’s ability to innovate. Why add friction to Hong Kong’s innovation economy by adding a financial disincentive to the very actions we wish to encourage?

Let’s try and see whether robots could be put to work with only a light overlay of government intervention. Instead of imposing a tax on the use of AI and robots, let’s consider taxing a portion of the profit increases generated by decreased labour costs and other efficiencies.

In the short term, this kind of tax may deter corporate investment in technology, but as long as innovators and enterprises see that the marginal increase in returns on research and investment are greater than the costs incurred and the tax imposed, they will continue to innovate and use AI and robots.

Chinese regulators move to ensure ‘investment robots’ are not excluded from financial oversight

Given Hong Kong’s huge fiscal reserves, why should we bother with such a tax at all?

This is especially true for those with low education and skills who will bear the brunt of rising unemployment.

Scott Cheng is a public affairs and communications consultant and a former public policy researcher with the One Country Two Systems Research Institute and the Democratic Alliance for the Betterment and Progress of Hong Kong. David Ketchum is founder and CEO of Current Asia and chairman of Digital + Direct Marketing Association Asia