Why should China change its successful trade policies just to please the US, given America’s own history of violations?

Dani Rodrik says when crafting a global trading environment, it’s important to realise that all nations have different political and social settings, and so will not play by the same ‘rules’

There are good reasons for China – and other economies – to resist the pressure to conform to a mould imposed on them by US export lobbies. After all, China’s phenomenal globalisation success is due as much to the regime’s unorthodox and creative industrial policies as it is to economic liberalisation.

That many of China’s policies violate WTO rules is plain enough. But those who derisively call China a “trade cheat” should ponder whether China would have been able to diversify its economy and grow as rapidly if it had become a member of the WTO before 2001, or if it had slavishly applied WTO rules since then.

The irony is that many of these same commentators do not hesitate to point to China as the poster boy of globalisation’s upside – conveniently forgetting on those occasions the degree to which China has flouted the global economy’s contemporary rules.

China’s bond market is the unlikely winner of US-China trade spat. Here’s how

China plays the globalisation game by what we might call Bretton Woods rules, after the much more permissive regime that governed the world economy in the early post-war period. As a Chinese official once explained to me, the strategy is to open the window but place a screen on it. They get the fresh air (foreign investment and technology) while keeping out the harmful elements (volatile capital flows and disruptive imports).

Why the US has a weak case against China’s ‘unfair’ trade practices

Any sensible international trade regime must start from the recognition that it is neither feasible nor desirable to restrict the policy space countries have to design their own economic and social models. Levels of development, values and historical trajectories differ too much for countries to be shoehorned into a specific model of capitalism.

International trade rules, which are the result of painstaking negotiations among diverse interests – including, most notably, corporations and their lobbies, cannot be expected to discriminate reliably between these two sets of circumstances. Countries pursuing harmful policies that blunt their development prospects are doing the greatest damage to themselves.

When domestic strategies go wrong, other countries may be hurt, but it is the home economy that pays the steepest price – which is incentive enough for governments not to pursue the wrong kind of policies. Governments that worry about the transfer of critical technological know-how to foreigners are, in turn, free to enact rules prohibiting their firms from investing abroad or restricting foreign takeovers at home.

In quest to cut trade balance with China, Trump misses opportunity to pressure Beijing over opening up of economy

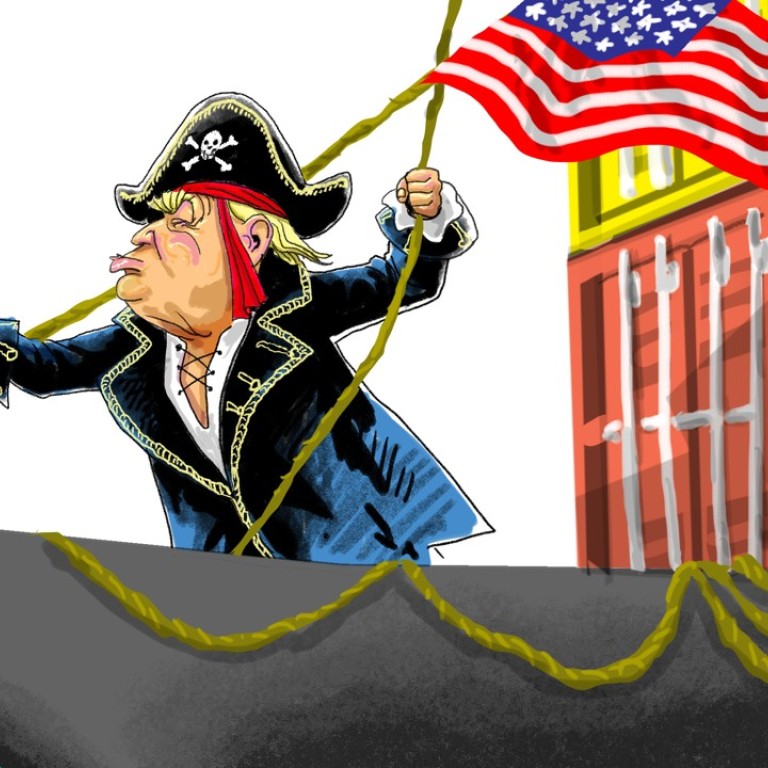

Many liberal commentators in the US think Trump is right to go after China. Their objection is to his aggressive, unilateralist methods. Yet, the fact is that Trump’s trade agenda is driven by a narrow mercantilism that privileges the interests of US corporations over other stakeholders.

It shows little interest in policies that would improve global trade for all. Such policies should start from the trade regime’s golden rule: do not impose on other countries constraints that you would not accept if faced with their circumstances.

Dani Rodrik, a professor of international political economy at Harvard University’s John F. Kennedy School of Government, is the author of Straight Talk on Trade: Ideas for a Sane World Economy. Copyright: Project Syndicate