This week in

trade has felt a bit like the calm in between summer typhoons here in

Hong Kong; nice to have a break from the rain, but we know the next storm is just around the corner. The week has contained a merciful lack of trade headlines, but sandwiched between the unsatisfying conclusion of last week’s round of trade talks in Beijing and next week’s release of the final product list of

US$50 billion of Chinese imports on which the US will apply a 25 per cent tariff, this is likely to be an anomaly compared to the rest of the summer.

Lacking new information, investors’ anxiety has continued as they wonder what’s next. In the short term, trade tensions are unlikely to produce anything besides volatility. Investors have become used to such trade-induced moves, to an extent, but they need to be cautious about making decisions amid this volatility and ensure they are reacting to actions, not talk.

Despite headlines to the contrary, there has been very little action on

US-China trade. The US administration’s focus on the trade deficit means its proposals consist of higher tariffs on imports from China. The US hopes resulting higher prices will change consumer behaviour, by encouraging them to substitute US goods for Chinese ones, thus narrowing the large goods trade deficit.

Markets received an unwelcome reminder of these plans at the end of May, when the US announced that its tariffs on Chinese imports would go into effect as initially planned, dashing hopes that ongoing talks would prevent any action ahead of a larger deal.

Earlier comments from the US that the trade war was “on hold” comforted markets, although the dispute never really paused. After the second round of talks in mid-May, both sides released a moderate-sounding

joint statement highlighting the need for ongoing discussions.

Watch: China and US put trade war on hold

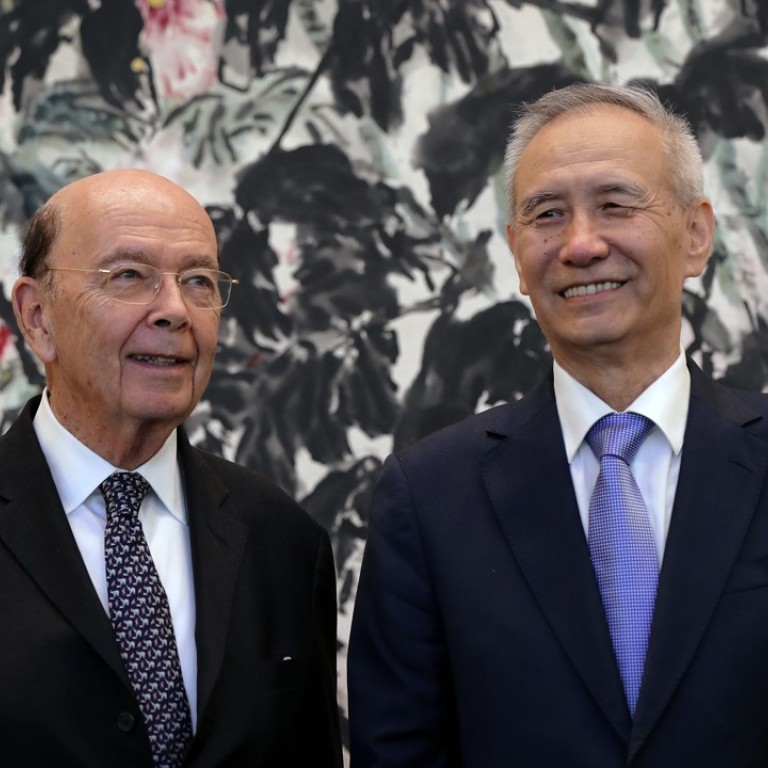

Reading between the lines, it is clear that no real progress was made, and though both parties then agreed not to take immediate action, they left the negotiating table even more frustrated than before. These tensions were on full display in the June round of talks in Beijing, as the parties could not even agree on a joint statement to release after the meeting. Keeping tensions high is an unlikely way to reach a solution to any dispute, and we have seen the fraying of the relatively calm public front in recent days.

In the near term, we cannot dismiss the possibility that the US will begin taxing imports — tariffs are effectively a tax — from one of its

largest trading partners. China’s offer to purchase more US goods, thus narrowing the trade deficit, have not satisfied Washington so far. The modest, and temporary, rise in prices such tariffs could produce are only likely to register at the margins of inflation and not have much impact on the macro outlook. However, over the long term, the potential for restrictions on operations of Chinese companies in the US, and vice versa, remains if a deal is not reached, which could become a drag on earnings going forward.

Unfortunately, investors are going to have to wait and see how this talk will translate into action. To find a resolution to this trade dispute, Chinese and American policymakers will have to get around the same table and hammer out a deal.

In the meantime, we can expect the coming week to deliver another storm of headlines as we come up on the

June 15 deadline for the US to finalise its tariff list and Washington looks for avenues through which to deal with

North Korea ahead of the

June 12 bilateral talks.

Ensuing market volatility may be uncomfortable to sit through, but investors should remember that individual market fundamentals are likely to return to the driver’s seat eventually and determine returns.

Hannah Anderson is a global market strategist at J.P. Morgan Asset Management

This article appeared in the South China Morning Post print edition as: US-China trade tensions leave markets and investors on edge