Xiaomi case reflects need for China to reform markets

With its Hong Kong IPO nearing, the smartphone maker has postponed plans to issue China depositary receipts that aim to lure Chinese tech giants back home

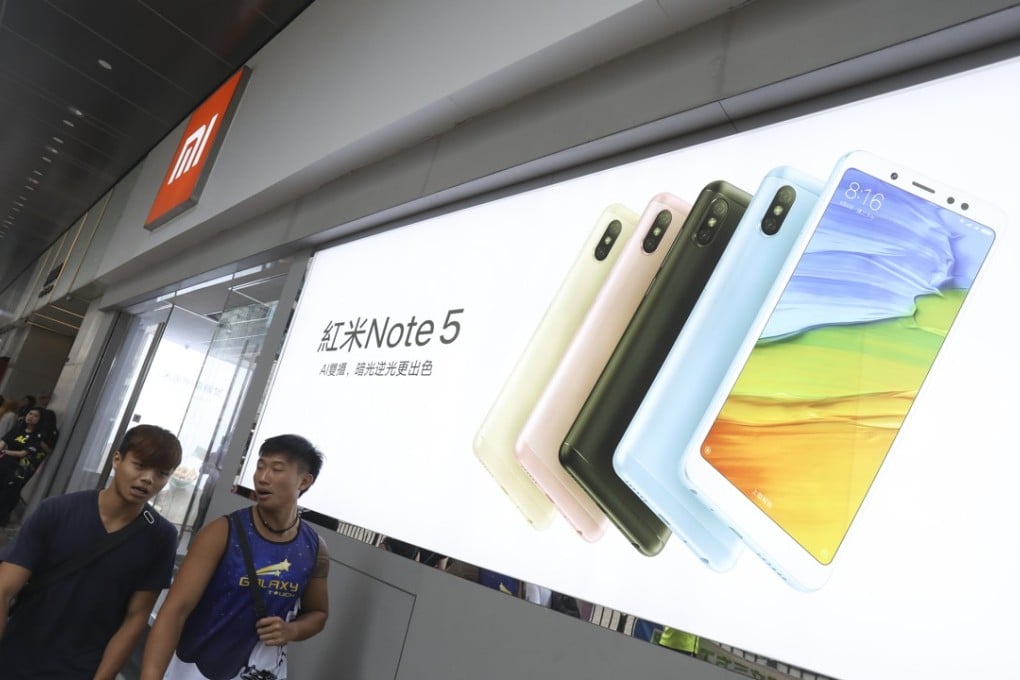

Hong Kong investors are waiting with bated breath for the mega initial public offering of Chinese smartphone maker Xiaomi. Their mainland counterparts, however, have been disappointed.

This is because the Beijing-based tech giant has postponed its application for an offering of China depositary receipts (CDRs), a type of equity proxy that allows investors to trade stocks listed on foreign stock exchanges and are modelled on the US versions.

Xiaomi said it would refile an application after its IPO.

Besides disappointing mainland investors, it will also have implications for regulators in China.

One reason for the delay is that Xiaomi and the China Securities Regulatory Commission couldn’t agree on the valuation of its CDRs. The thinking is that a successful IPO in Hong Kong will offer a clearer picture of how much the company is worth.