Xiaomi case reflects need for China to reform markets

With its Hong Kong IPO nearing, the smartphone maker has postponed plans to issue China depositary receipts that aim to lure Chinese tech giants back home

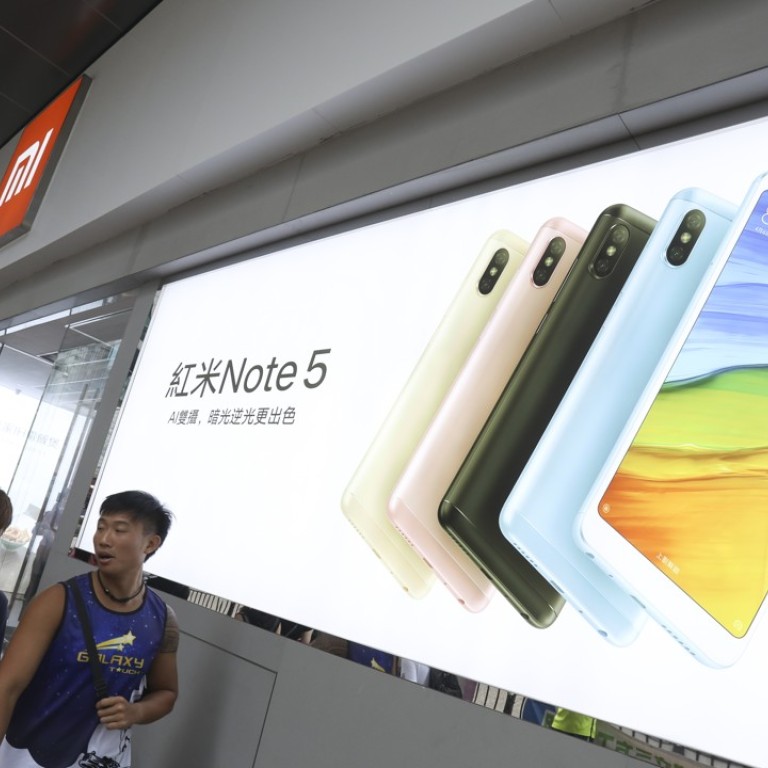

Hong Kong investors are waiting with bated breath for the mega initial public offering of Chinese smartphone maker Xiaomi. Their mainland counterparts, however, have been disappointed.

This is because the Beijing-based tech giant has postponed its application for an offering of China depositary receipts (CDRs), a type of equity proxy that allows investors to trade stocks listed on foreign stock exchanges and are modelled on the US versions.

Xiaomi said it would refile an application after its IPO.

Besides disappointing mainland investors, it will also have implications for regulators in China.

One reason for the delay is that Xiaomi and the China Securities Regulatory Commission couldn’t agree on the valuation of its CDRs. The thinking is that a successful IPO in Hong Kong will offer a clearer picture of how much the company is worth.

Regulators have also reportedly asked Xiaomi about its business model, financial conditions, user figures in its internet business, and future profitability.

Thanks mostly to a looming trade war between China and the United States, the domestic A-share market has suffered a downturn. Xiaomi probably doesn’t want to enter a volatile market at this time and see its CDRs dragged down, and vice versa.

Ironically, Xiaomi’s latest valuation of its Hong Kong IPO is being affected by its CDR postponement. Previously, it was aiming to raise as much as US$10 billion, splitting the shares between Hong Kong and Shanghai.

Now, sources say that plan is to issue about 2.18 billion shares in Hong Kong, scheduled for July 9, at a range of HK$17 to HK$22 per share. This adds up to US$6.1 billion or HK$48 billion.

Xiaomi filed an application for listing in Hong Kong last month. Its mega flotation is the largest in the city since Postal Savings Bank of China raised US$7.4 billion in 2016.

E-commerce giant Alibaba, which listed in New York, raised US$25 billion in the world’s biggest IPO in 2014. Alibaba owns the South China Morning Post.

For the mainland, CDRs are a new tool of reform that may help further open its capital markets, offer more choices for investors and attract more innovative companies back to list there.

Chinese regulators are used to limiting risks, but they will also need to be open-minded with CDRs as part of Beijing’s efforts to lure those foreign-listed Chinese tech giants home.

To an extent, Xiaomi’s case reflects the current struggle between reform and the old way of regulation.

But Beijing knows reform is needed. Instead of focusing on capital restrictions within the existing regulatory framework, there needs to be a new mindset to open up markets, attract tech companies and look after the interests of retail investors.