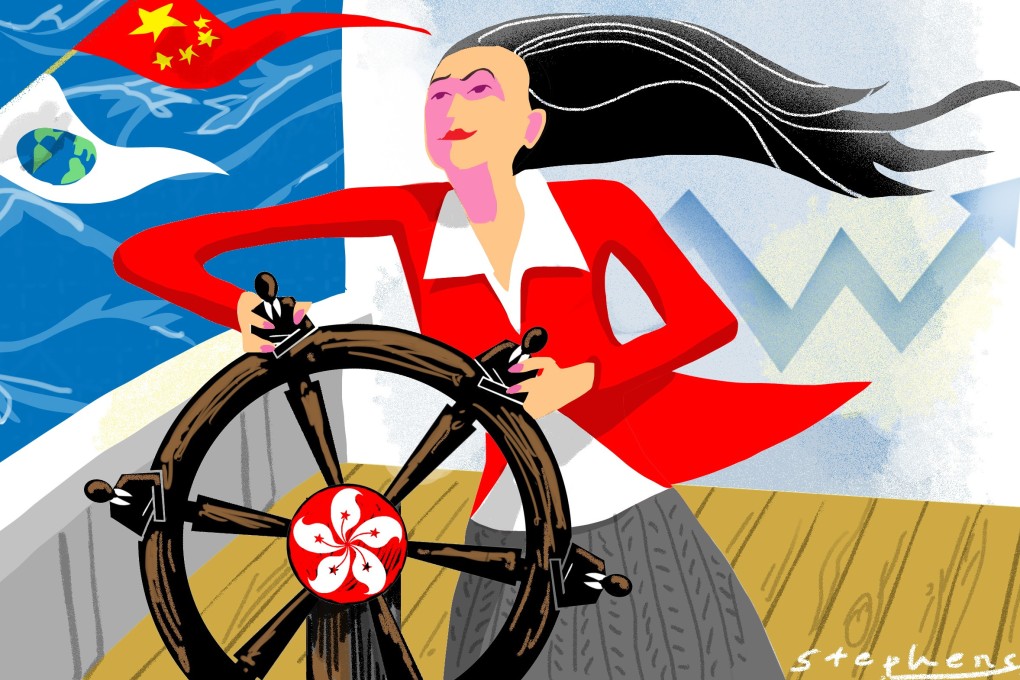

Opinion | In gender equality and corporate governance, Hong Kong can be a champion of change

- Corporate social responsibility in the region lags behind international best practices, which gives Hong Kong a chance to lead by example – by committing to gender equality. HKEX now expects all firms listed here to have a diversity policy

One of Hong Kong’s greatest strengths is its ability to adapt to changing conditions and grasp new opportunities as they emerge. Throughout my career I have watched Hong Kong reinvent itself over and over, reinforcing its competitiveness and exerting an influence that belies its size. Our community has repeatedly acted with the foresight and determination that keep Hong Kong relevant and thriving, even during times when we might have felt the odds were stacked against us.

And I now believe we have another opportunity to be champions of change in a field that is personally important to me, one that I think will be defining for the global corporate community in the decades to follow.

A successful business almost always plays a meaningful role in its wider community and has strong governance, integrity and purpose at its core. We live in a part of the world, however, where corporate social responsibility (CSR) and general corporate governance standards in business lag behind international best practices, and I believe this opens up a real opportunity for Hong Kong to lead by example.

As chairman of one of Hong Kong’s most systemically important organisations, I am unabashedly committed to Hong Kong Exchanges and Clearing leading from the front in this regard. I have recently committed a portion of my own HKEX director’s fee to the pursuit of broad CSR objectives, as I believe leading by example is both a personal and corporate imperative.

Corporate governance isn’t just some vague approach to running a good company – it is a culture and a clear set of rules and procedures that leads to accountability in the boardroom as well as in management. Good governance is responsible governance and ultimately results in a business that is more resilient, a business that is better placed to capitalise on opportunities presented to it, and a business that will perform better.