It’s clear that a US-China trade deal will not be quick, or easy

- Hammering out one big trade treaty between two different systems is virtually impossible. The US and China are more likely to produce a series of treaties focusing on different aspects of trade — and this could take decades

The biggest surprise is not that Trump launched a tweet from the left field, nor that the US authorities enacted such a measure without any form of legislative check on his decision.

It may be that nobody believed Trump – which is a reasonable guess. It may be that the markets did not believe the tariffs would make much difference. The total amount of world merchandise exports at the end of 2018 was US$19.48 trillion, according to the World Trade Organisation.

Exports rose by 10 per cent in that year. To put this into perspective, this increase in trade alone is hundreds of billions of dollars more than the threat of tariffs so far. On a global basis, tariffs do not make that much difference. World trade is affected but not threatened.

But from a narrower perspective, it is a big deal. China will continue to be hurt as it is still an exporter and depends hugely on the West. And you can be sure that Europe and other trading partners will not give China an easy ride.

Until Trump was elected, most countries were too diplomatic, too understanding and too slow to appreciate that China had moved into the role of an assertive trading partner

Trump articulated a nagging unease in the US that they have carried the rest of the world for a long time. For 70 years, the US has taken a magnanimous view on trade, allowing largely unfettered access to its markets.

Free trade has been hugely beneficial to the world economy and, even though tariffs are a great way for governments to raise money, years of low tariffs have been a great boost to the global economy.

Low tariffs and largely free trade have been critical to China’s development. The US and the rest of the world viewed China’s economic rise with benevolence, taking advantage of cheap labour that coincided happily with the need to massively scale up production into the digital revolution.

Until Trump was elected, most countries were too diplomatic, too understanding and too slow to appreciate that China had moved into the role of an assertive trading partner, imposing a host of non-tariff barriers to support its own industry.

The rise in tariffs means that companies will begin trading tactically, adjusting their supply chains, substituting, using third parties and adjusting their processes to minimise the impact of the tariffs.

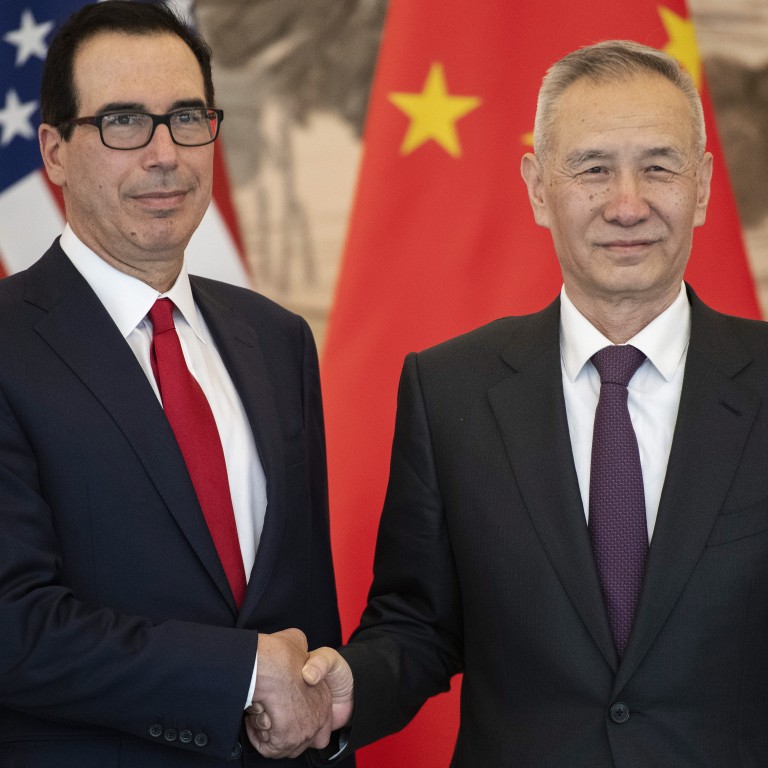

It is therefore almost certain that we will not see one big trade treaty. The ideal of a shake of the hands, a signing ceremony and going back to what we had before is not going to happen. We are more likely to see a series of treaties, with the early ones being broad brush strokes and general.

The most likely model is that of the arms limitation talks between the US and Russia in the 1970s. Negotiators will deal step by step on different trade issues, concluding a series of treaties, each dealing with different part of the trade spectrum.

Chinese Vice-Premier Liu He and his negotiating team had better get used to a long shift – this one could take decades.

Richard Harris is chief executive of Port Shelter Investment, and a veteran investment manager, banker, writer and broadcaster, and financial expert witness