US-China dispute goes beyond trade: it’s about technology and fair competition

Haibin Zhu says resolving imbalances between the US and China is easy; the real obstacles to preventing a costly trade conflict concern China’s goals for technology, its industrial policy and hesitance to embrace open markets at home

There are two possible scenarios. The first is a last-minute deal where both sides step back and put tariffs on hold while negotiations continue.

The first scenario is still possible. If either side makes concessions before July 6, the tariffs could be cancelled or postponed. But the large gap between the two sides and lack of trust imply reaching a grand deal is unlikely in the near term. Even with agreements, implementation issues could easily bring conflict back.

The direct impact on the macro economy could still be manageable. Even after accounting for the second-round effect on employment, investment and consumption, a 25 per cent tariff on all China’s exports to the US would cause GDP growth to slow by around 0.5 percentage points.

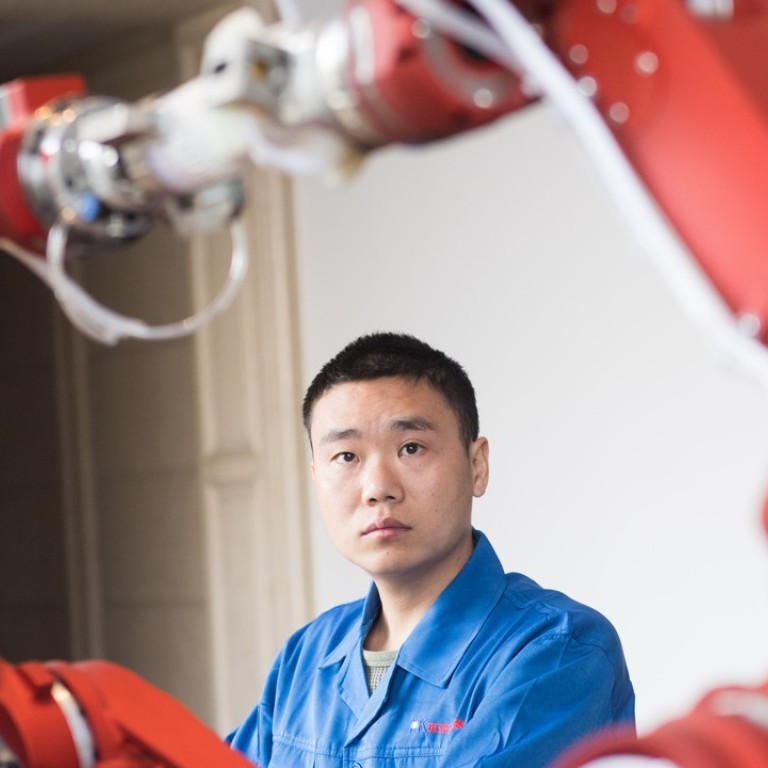

Watch: What’s the beef with the ‘Made in China 2025

The US seems to have underestimated the negative impact of China’s retaliatory actions on American companies in China. The Chinese side seems to have underestimated the bipartisan support for US policy changes towards China, potentially leading to misjudgments that China can withstand the negative consequences longer than the US.

More importantly, unlike trade negotiations, negotiations on technology fronts not only involve the Chinese government’s commitment to promote openness and structural reforms, but depend more on policy implementation. There is generally a lack of trust regarding China’s implementation from the US side, making negotiations even more difficult.

From an economic perspective, a trade war would be a “lose-lose scenario” and negotiation is the preferred approach. We cannot rule out that the US hard-line announcement could be a bargaining strategy. There is still room for negotiation.

Haibin Zhu is chief China economist and head of China equity strategy at J.P. Morgan