With US interest rates

on the rise, the dollar’s recovery losing steam and global fiscal austerity spreading, China needs a viable policy plan to hit a

growth target of around 6.5 per cent amid signs the economy is drifting off course.

Beijing must take corrective steps very soon so that the country has much more cohesive monetary, currency and budgetary policies to avoid being blown off course by headwinds which are dampening global recovery. Complacency is not an option when China’s economy is in desperate need of extra help.

Beijing only needs to study the global landscape to recognise the risks to growth. The most immediate danger is the threat of outright

trade war with the US. With China’s manufacturing sector so dependent on smooth-running world trade flows, any serious rupture to global commerce could make a sizeable dent in the country’s growth prospects for years to come.

Storm clouds are already gathering according to recent business surveys showing China’s manufacturing sector under serious pressure from growing trade frictions. September’s Caixin/Markit purchasing managers index (PMI) fell to a

15-month low of 50, the threshold marking the boom-or-bust line for factory activity. China’s official PMI index also fell to a seven-month low of 50.8 in September. China’s manufacturing sector is heading into potential crisis with some factories earmarked for possible shutdown, with significant job losses on the cards.

Watch: Beijing residents hope for swift end to trade war

With the end of global monetary accommodation in sight, China faces an uphill battle. Monetary conditions are being progressively tightened around the world thanks to the US Federal Reserve’s steady drive towards higher interest rates. Over the past three years, the key Fed funds rate has risen from zero to over 2 per cent following last week’s Federal Open Market Committee rate decision and might easily reach 4 to 5 per cent in the medium term if the Fed returns rates to the levels prevailing before the

2008 financial crisis.

US bond yields have risen in tandem, forcing global borrowing costs even higher as the world grapples with the prospect of more super-stimulus being withdrawn. The US is not alone on the monetary taper as the European Central Bank is also getting ready to wind down on zero interest rates and overgenerous monetary accommodation later this year. Super-stimulus has reached the end of the line and world interest rates and bonds yields are set to press higher.

Beijing has two choices: it can either choose to follow the Fed or else

decouple policy to go it alone. Recent hints suggest the People’s Bank of China will keep its powder dry while it weighs its options over the slowing economy and its impact on the currency. Divergent monetary policy may be no bad thing if Beijing believes benign neglect of the yuan exchange rate can give a much-needed competitive boost to China’s hard-pressed export manufacturers. Roughly speaking, a 4 per cent drop in the yuan’s value should be the monetary equivalent of a 1 per cent cut in domestic rates.

In reality, China’s monetary policy must be firing on all cylinders to promote faster growth. There is no reason why interest rates cannot be cut again, especially if Beijing can be persuaded to “let go” on the currency. A rate cut would help stimulate domestic demand, while a weaker yuan would give a helping hand to China’s hard-pressed export sector.

Micro-monetary measures should also include easier conditions for borrowers with further cuts in the

reserve requirement ratio for banks. Beijing must ensure China’s financial system is kept flush with more than adequate liquidity.

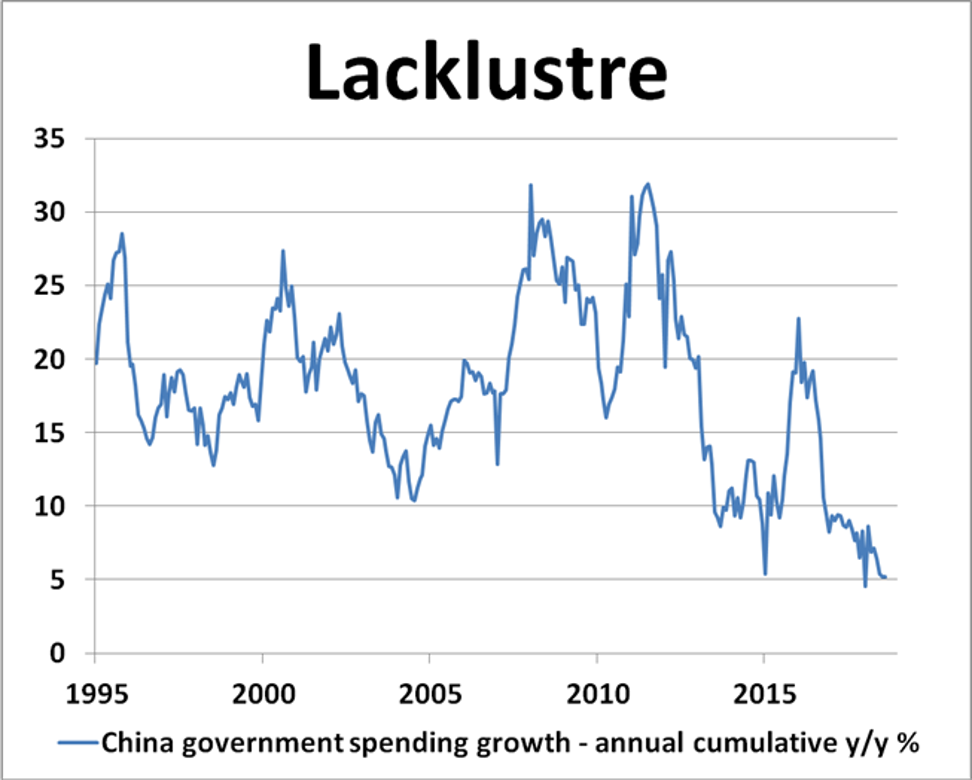

On the fiscal side, government efforts are still left wanting. Government spending growth has slowed to a crawl, close to 5 per cent year-on-year, hardly sufficient for an economy which is supposed to be expanding at a 6.5 per cent rate. Beijing should prioritise a snap programme of tax cuts and spending initiatives to promote growth, not hinder it.

Beijing cannot afford to leave the economy drifting rudderless much longer.

David Brown is chief executive of New View Economics

This article appeared in the South China Morning Post print edition as: China needs policy rethink to keep economy on course