Debt-laden Italy eyes China’s belt and road, risking more than just the wrath of Donald Trump and the EU

- It’s clear why Italy, in need of an economic jump-start, would warm to China, but just as clear why engaging China bilaterally is not a good idea

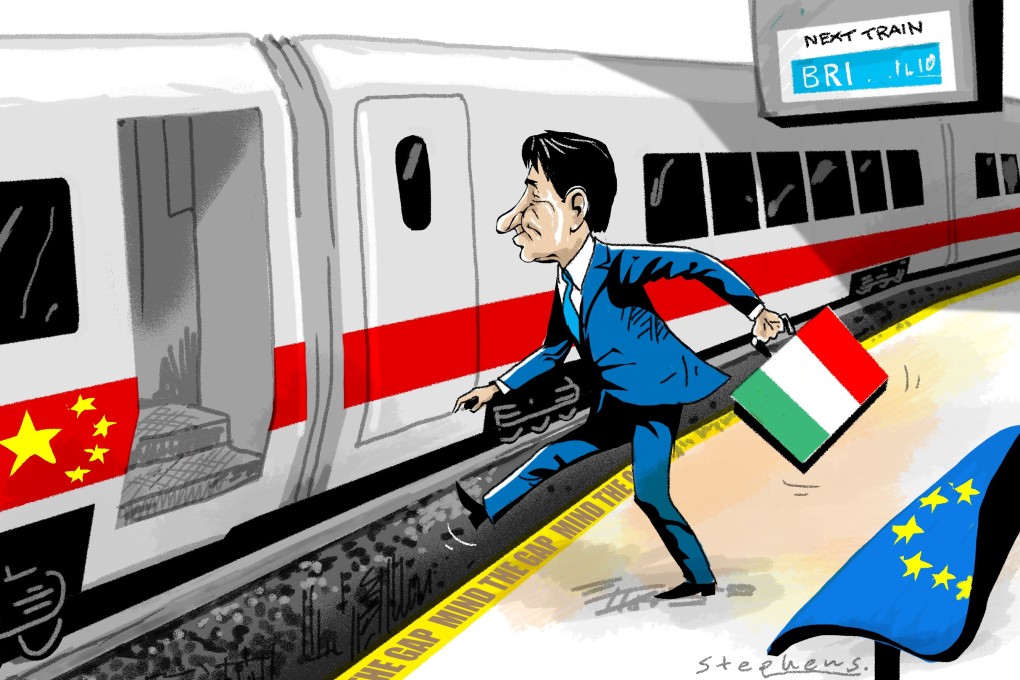

Is China’s “Belt and Road Initiative”, as Italian Finance Minister Giovanni Tria says, “a train that Italy cannot afford to miss”? Prime Minister Giuseppe Conte also thinks Italy should jump on board, saying the multibillion-dollar Chinese infrastructure plan is “an opportunity for our country”.

True, deeper commercial engagement with China is a no-brainer for Italy, where GDP growth has been low or stagnant since the late 1990s, and is expected to decelerate from 1 per cent in 2018 to 0.2 per cent this year. China, on the other hand, boasts the world’s second-largest economy after the US. It is the biggest exporter, an increasingly significant overseas investor and is gradually rebalancing its growth model towards domestic demand.

Moreover, a partnership with China could attract the additional capital inflows that Italy sorely needs, given constrained lending by its banks. Whereas Italy has received about €14 billion in Chinese investment since 2000, Chinese firms invested €10.5 billion in 55 belt and road countries in the first 10 months of 2018 alone, and have signed contracts for belt and road projects worth more than US$80 billion.