Advertisement

Companies from emerging markets like China are now in the big league, and global investors want to play

- The line between emerging and developed markets is blurring. Markets like China and India are becoming simply too big for global investors to ignore

3-MIN READ3-MIN

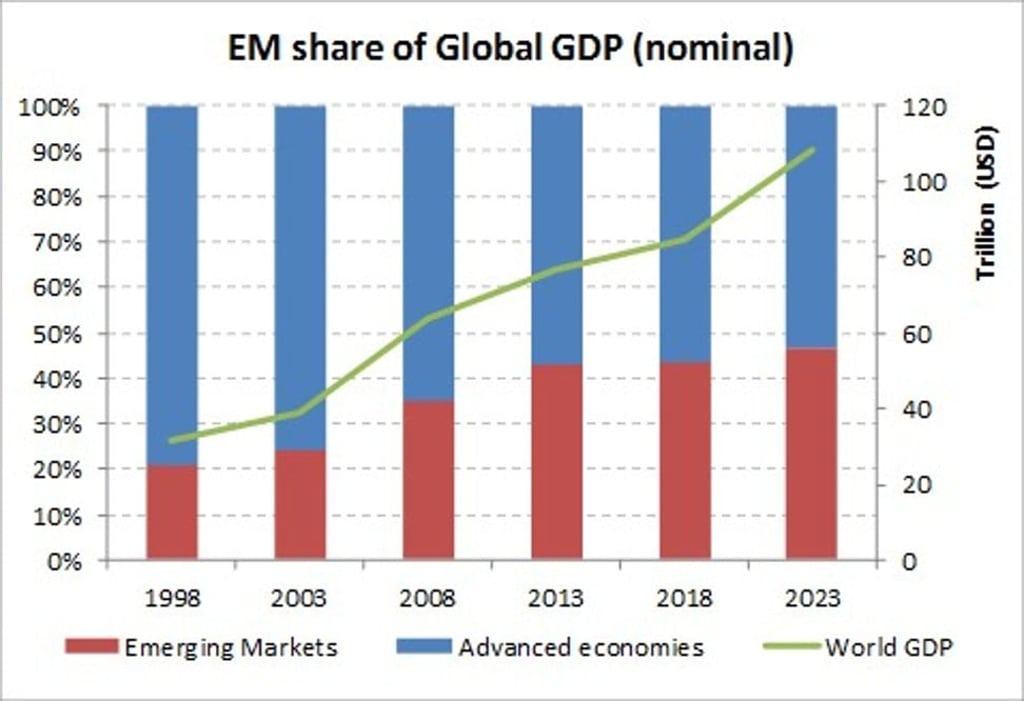

Since China joined the World Trade Organisation in 2001, there has been a significant shift in the contribution of gross domestic product from developed markets to emerging markets.

In nominal US dollar terms, emerging markets’ share of GDP has risen to 45 per cent from 20 per cent, or, expressed in purchasing power parity terms, from 45 per cent to 60 per cent.

Changes in global trade patterns reflect this shift in activity. Whereas two decades ago, the bulk of international trade took place among developed markets, today it is predominantly between developed and emerging economies, with China, India and East Asia accounting for much of this shift.

Advertisement

Emerging markets are no longer a peripheral player in global trade, but an engine of economic activity.

Investors have increasingly sought to access the emerging market growth story through both debt and equity investments. Emerging bond markets have deepened considerably to constitute 25 per cent of global bonds outstanding, from 2 per cent in 2000.

Advertisement

Advertisement

Select Voice

Select Speed

1.00x