Opinion | Financial markets are a key source of America’s prosperity, so leave them out of the US-China trade war

- The clamour to place greater restrictions on Chinese investment is growing on Capitol Hill. However, such a move would be deeply irresponsible, not least because it would threaten both the US economy and its global influence

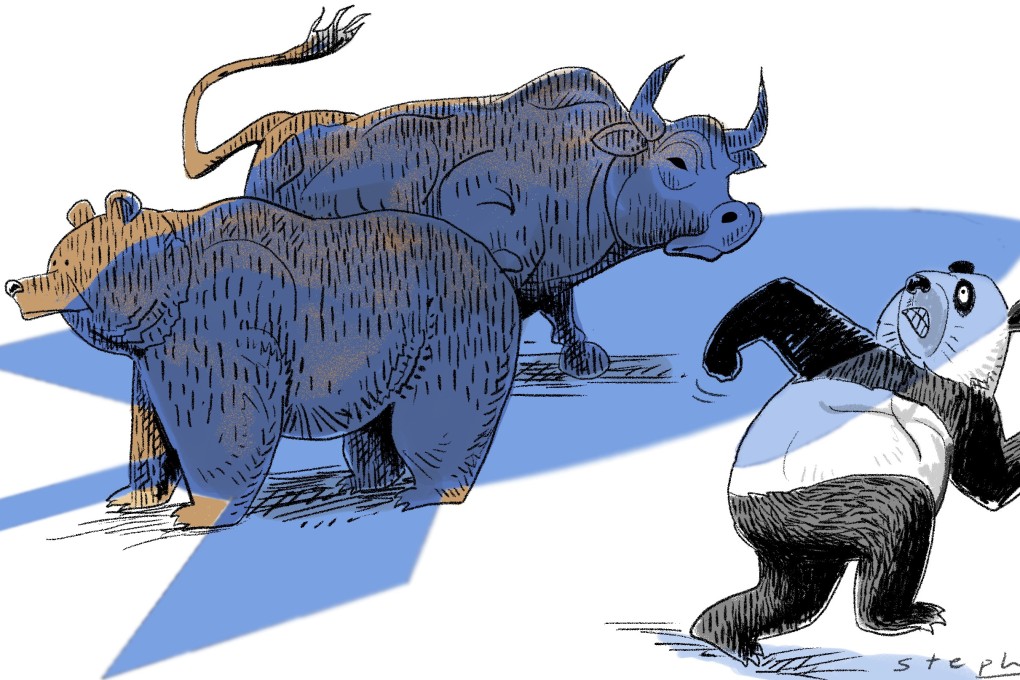

US-China relations have further deteriorated in recent months, and escalating friction is affecting most channels of economic interaction between the two countries, including trade, direct investment and the flow of people. Financial markets are the latest aspect of the relationship to come into the cross hairs.

Politicians and pundits with a hawkish bent are proposing to curtail bilateral investments in stocks, bonds and other financial assets. Such “financial market decoupling” rhetoric is short-sighted and will adversely affect long-term US economic and national security interests.

These developments echo the irresponsible rhetoric in other areas and must stop. We must avoid making financial market access a tool for short-term geopolitical objectives.