Opinion | Why Hong Kong’s era as a global financial centre is far from over

- While sceptics argue that Hong Kong’s stock market is overwhelmingly Chinese in character, the various stock and bond connect schemes between Hong Kong and the mainland ensure the global orientation of the city’s financial sector

- The Greater Bay Area will consolidate Hong Kong’s role as the region’s financial hub

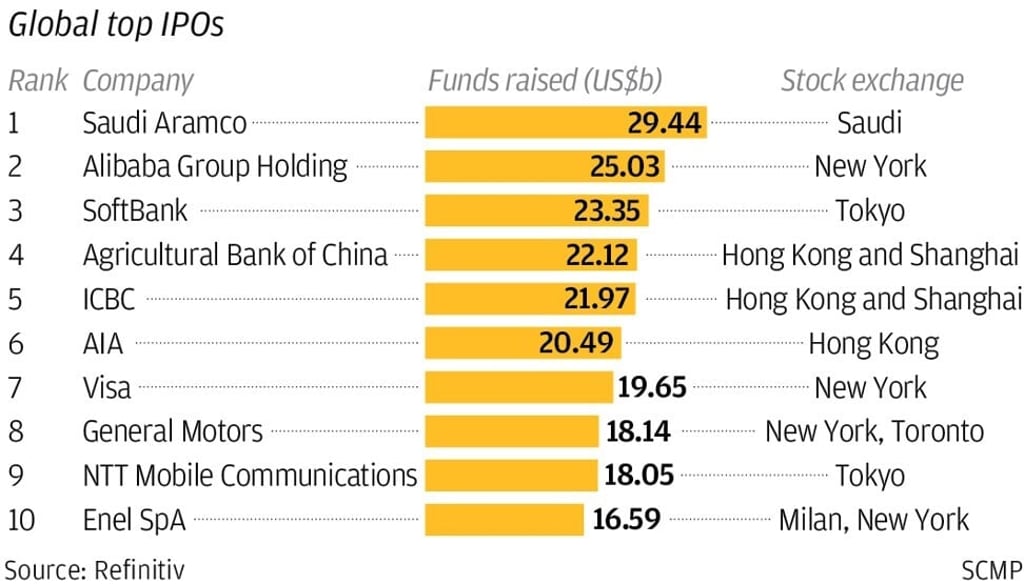

First, since the late 1990s, Hong Kong’s stock exchange has been a destination for mainland IPOs. It is true that currently there are only a few overseas companies listed on the Hong Kong exchange, apart from world-renowned brands such as Samsonite, Prada, L’Occitane and Budweiser. But as of August, more than half of the companies listed on the exchange were from the mainland, with nearly 80 per cent of the bourse’s total market capitalisation accounted for by nearly 1,300 China-oriented enterprises.

In addition, the fundamentals that makes our city an appealing financial hub will remain strong despite the Covid-19 pandemic – an open capital market, pro-business environment with an effective regulatory framework, a reliable legal system based on common law, preferential access and proximity to the Chinese market, excellent infrastructure and more.