Advertisement

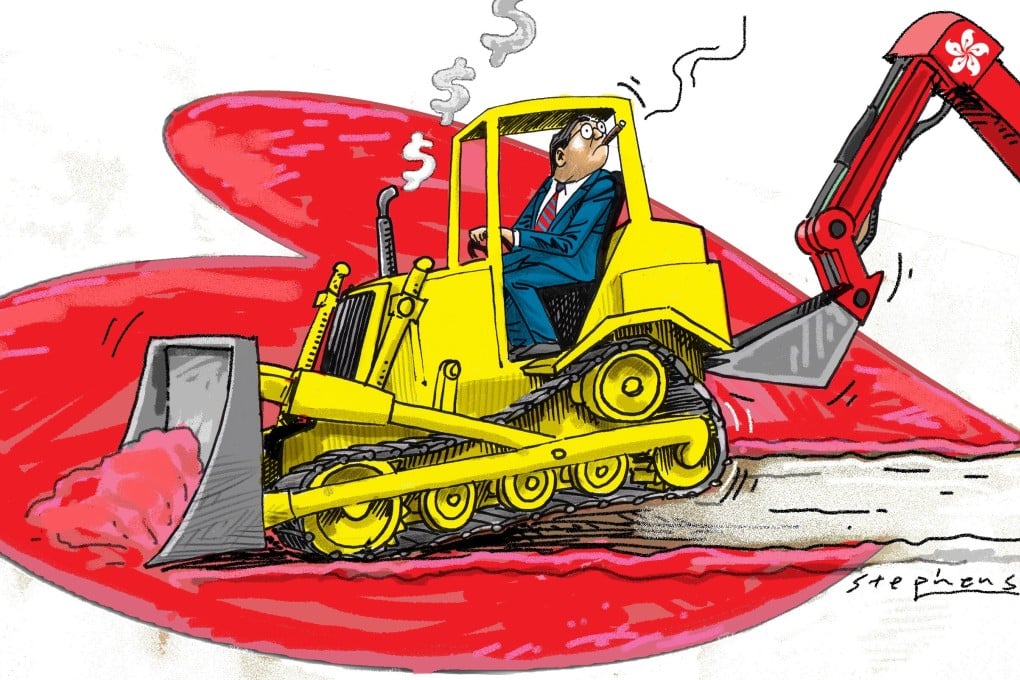

Opinion | Hong Kong’s government must wrest back control of the housing market – or risk the city’s breakdown

- All-too-powerful private developers are at the heart of the housing crisis and drastic measures are called for, such as land expropriation or a Hong Kong sovereign wealth fund to compete in the market

Reading Time:3 minutes

Why you can trust SCMP

Affordable housing is becoming an Achilles’ heel in cities worldwide, but nowhere more so than Hong Kong. The city’s rising housing prices and living costs are juxtaposed against stagnating wages and stark socioeconomic inequality. More than ever, resolving the housing crisis is a matter of national security.

In an article published in the research journal Asian Affairs, former Royal Hong Kong Police officer Martin Purbrick writes that a significant driver of the anti-extradition bill protests last year was dissatisfaction with housing access and costs.

Housing woes have also begun to echo in the upper echelons of government. In her policy address last year, Chief Executive Carrie Lam Cheng Yuet-ngor announced initiatives to increase housing supply, noting that “adequate housing … is also fundamental to social harmony and stability”.

Advertisement

We are running out of time. Hong Kong’s housing situation is rapidly approaching a flashpoint. According to the Global Real Estate Bubble Index released last week by Swiss bank UBS, Hong Kong’s risk of a property bubble is higher than that of Tokyo, Los Angeles and San Francisco – and triple that of New York.

04:11

Tiny 290sq ft temporary housing a welcome upgrade for some low-income Hong Kong families

Tiny 290sq ft temporary housing a welcome upgrade for some low-income Hong Kong families

To solve the housing crisis in Hong Kong, we must first understand its origins: it is not rooted in the issue of land supply but was created by and continues to thrive because of privatisation.

Advertisement

Advertisement

Select Voice

Select Speed

1.00x