In China’s vast and growing electric vehicle market, local brands have the edge

- Tesla is about the only foreign electric vehicle maker making top sales in China amid intense local competition and price cuts

- But with their focus on the domestic market, Chinese electric carmakers are unlikely to become global names any time soon

The global electric vehicle market has recovered rapidly from the pandemic-related demand shock as sales grew by 43 per cent last year, reaching a record 3.24 million units.

These targets are rippling through global car supply chains, even as new regulatory emission standards and improving consumer acceptance doubled electric vehicles’ share of the global car market to 4.2 per cent in just a year.

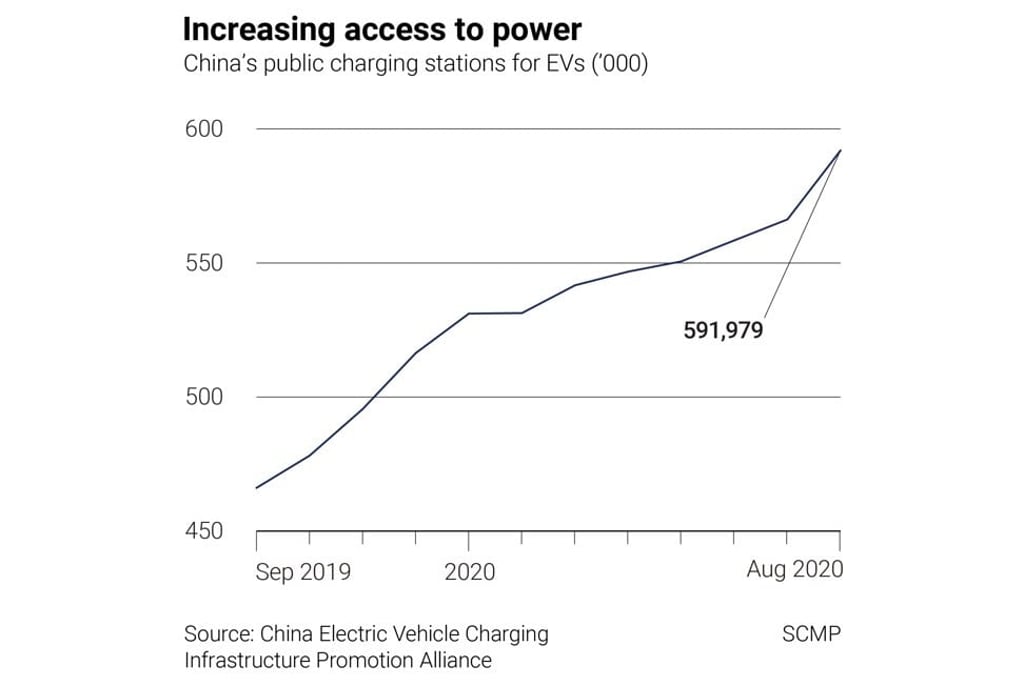

This is only the beginning of a very long electric vehicle adoption cycle. Recent gains by the industry can be sustained and even strengthened over the next few years. Historical constraints to electric vehicle take-up by consumers include access to vehicle charging, but significant investments in charging networks in China should ease the bottleneck soon.