Macroscope | Even with US ban on Xinjiang silicon, the future looks bright for China’s renewables

- Washington’s ban may cause some near-term supply chain disruption for solar panels. But, with Beijing’s carbon neutrality goal, solar and wind energy manufacturing and installation can only accelerate in China

With the move, US solar panel producers will have to search for alternative sources of polysilicon. This may cause some near-term supply chain disruptions but, longer term, the supply-demand balance may well tilt further towards China’s burgeoning domestic market.

China’s renewable energy industry has achieved remarkable growth over the past decade, with aggregate capacity growing by a compound rate of 14 per cent annually since 2012, with the share of renewables rising from 9.1 per cent to 15.9 per cent of total energy consumed over the same period.

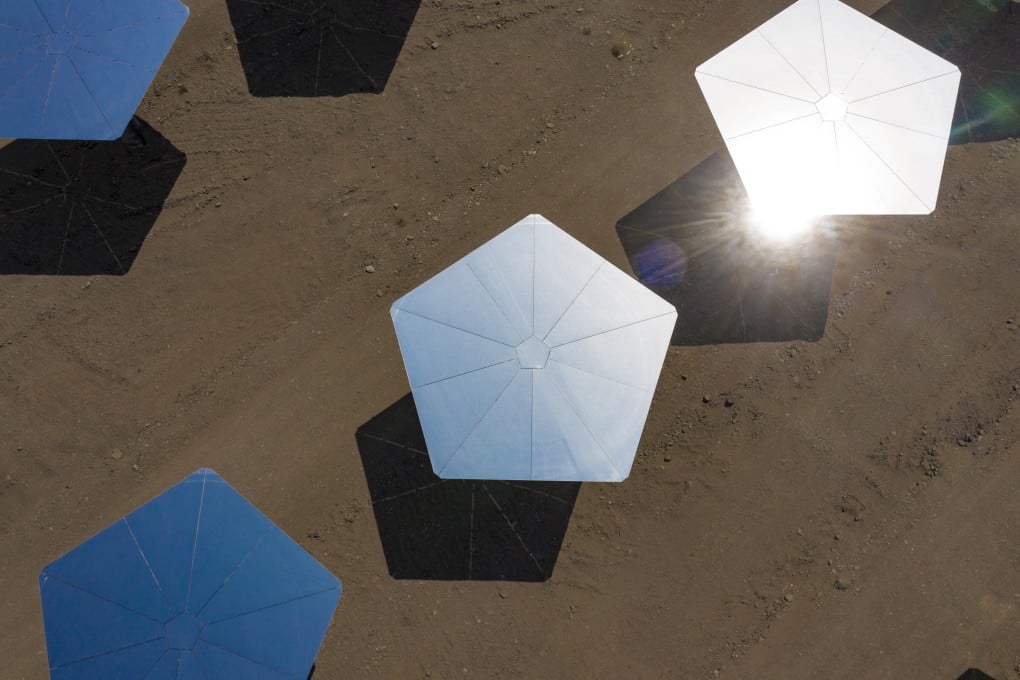

To achieve that goal, solar and wind energy will be the main drivers, due to their undeniable advantages in terms of scalability, cost and safety. They are also the clear favourites of the central government.

The government’s explicit target includes raising the combined installation of wind and solar power to at least 1,200 gigawatts by 2030, an increase of over 200 per cent from 2020. Beijing has also vowed to increase wind and solar energy’s share from the current 9.7 per cent to 16.5 per cent of energy consumption in 2025.