Opinion | China’s education crackdown is a welcome move away from a profit-obsessed growth model

- Despite the temptation to see the edtech squeeze as a harbinger of stronger regulatory headwinds, it is in fact more of an epiphany

- The merits of entrepreneurship and equity financing will increasingly be judged by how they benefit or undermine China’s development

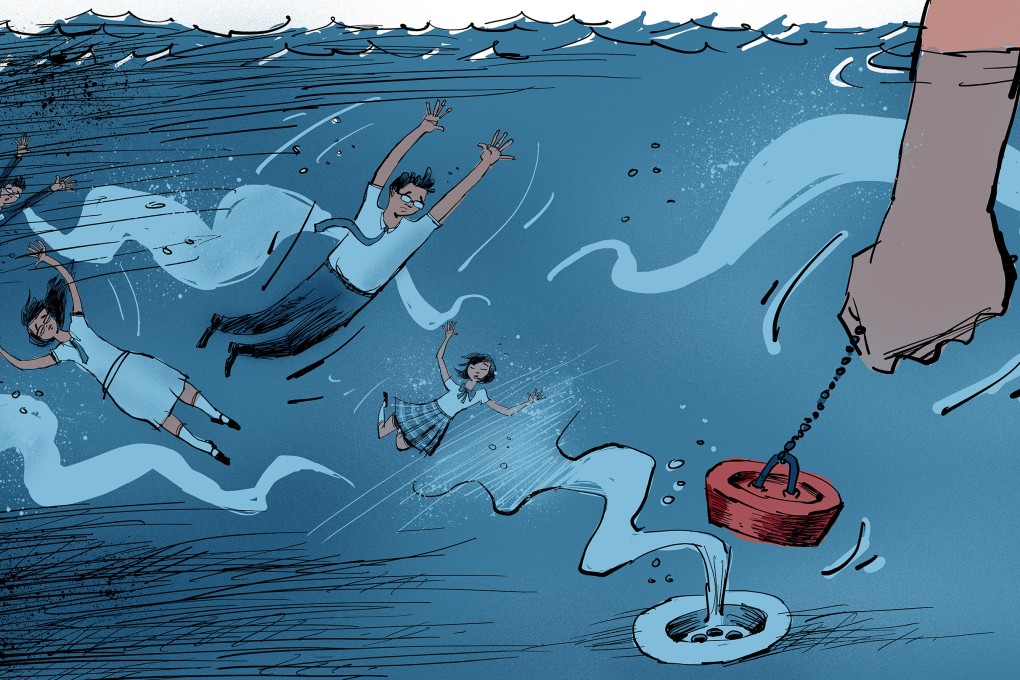

No industry’s fortunes have perhaps declined more precipitously than China’s education technology, or edtech, sector in the past year. Its leading players were jubilant around this time last year, buoyed by fresh rounds of funding as though the tap would never run dry.

But market-watchers who look more closely will see that the move was not so sudden or rash. A major industry shake-up had been in the making long before the clampdown. The writing was on the wall, but only a very small number took note.

A message that went viral in WeChat groups recently hinted at what might really have prompted the edtech debacle. At a conference on education in September 2018, President Xi Jinping issued a sternly worded reprimand to after-school tutoring operators, criticising them for breaching rules governing education and student development.