Advertisement

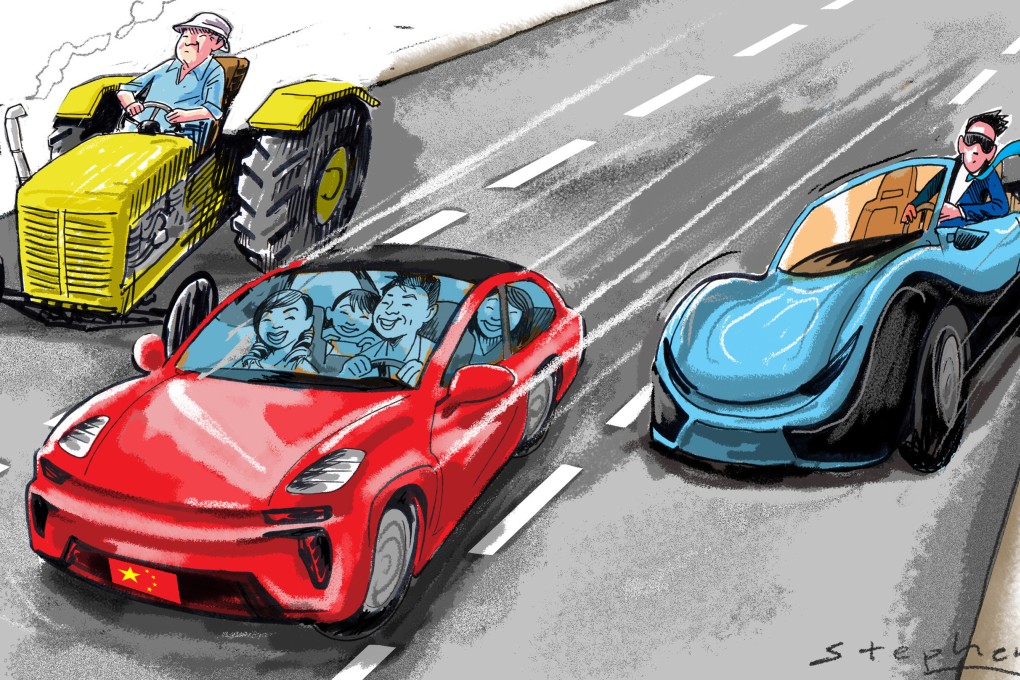

Opinion | Middle-class nation: how China is rising to the challenge of common prosperity

- Far from turning back the clock on capitalism, Beijing is using it to help socialism amid challenges including geopolitical tensions, an ageing population and an overheated property market

Reading Time:4 minutes

Why you can trust SCMP

6

Founded 100 years ago, China’s Communist Party has always branded itself as a party for workers and peasants. But it is also known for being flexible and pragmatic.

With rising wealth and improving social mobility, China is moving poorer people into the middle class, a process that the party has branded its “common prosperity” programme. The party is thus moving with its constituency and staking its brand on a successful outcome, transforming itself into a party of the middle class.

China, with a population of 1.4 billion, already has a middle class of at least 340 million, larger than the entire US population. (Some estimates put the Chinese middle class at more than 400 million, using a looser definition of the term.)

Advertisement

Beijing’s plans could increase the middle-class population to an estimated 500 million by 2025 and about 750 million by 2035. Put another way, it is looking for roughly half the mainland population to be middle class by 2035, from less than 30 per cent today, using a conservative definition.

To realise this, the Chinese economy will need to double by 2035, having just doubled over the past decade. Most Chinese people are still classified in the lower-income bracket although, in recent years, pockets of extreme poverty have been eliminated from the mainland.

Some investors seem to worry that common prosperity is a kind of Robin Hood campaign. This is simply wrong. One only has to look at the Zhejiang pilot programme announced last July to get a detailed picture.

Advertisement

Select Voice

Choose your listening speed

Get through articles 2x faster

1.25x

250 WPM

Slow

Average

Fast

1.25x