The View | Why the metaverse matters for investors, in the longer term

- Ten years ago, the internet evolved from something you viewed on a desktop to an always-on mobile connection in your pocket

- With the metaverse, the internet will jump out of your pocket. Hardware and software firms will benefit as VR headsets, then the metaverse, enter the mainstream

We’ve been here before. Back in 2003, an app called “Second Life” promised a new way of living virtually, by using avatars to shop and socialise. While big brands rushed to open virtual stores, “Second Life” never attracted more than a million regular inhabitants.

The current excitement, combined with a pandemic-induced surge in virtual socialising, suggests they might. Mentions of the metaverse in company meetings have accelerated at a far faster pace than that of previous technological trends.

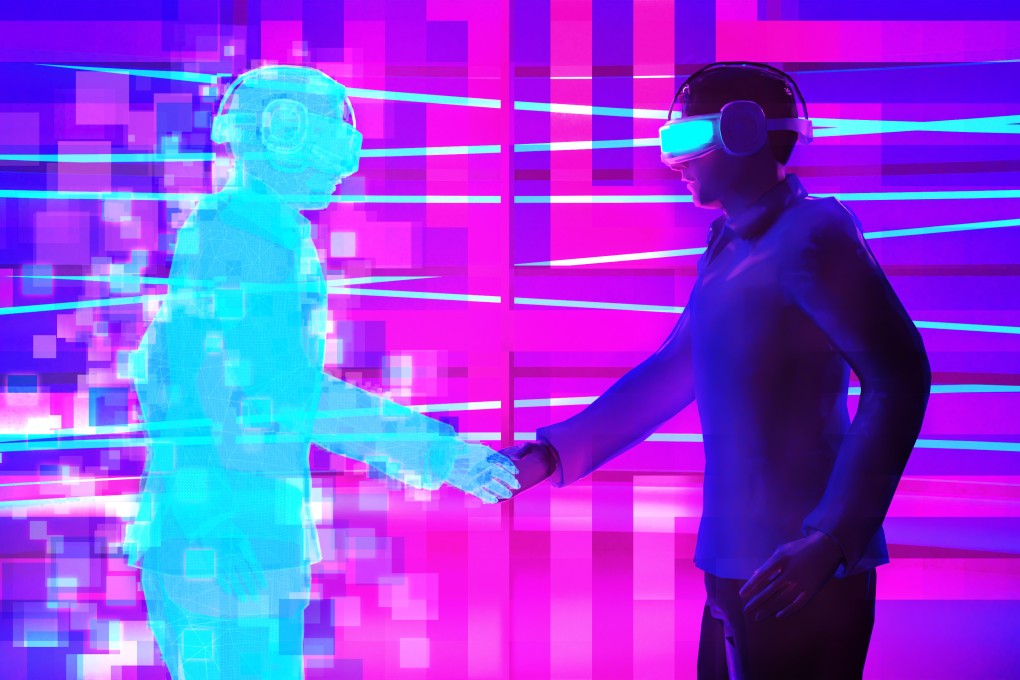

The pull of its metaverse, Facebook hopes, will be the merging of the digital and physical worlds. This metaverse will be accessed not through panes of glass, but via virtual reality or augmented reality headsets that project interactive images onto your physical surroundings.

This world is “persistent” which means that it continues to exist and develop even when there are no people interacting with it. VR headsets already allow people to immerse themselves in the digital environment of games, but now AR is taking this one step further by superimposing objects onto the real world.