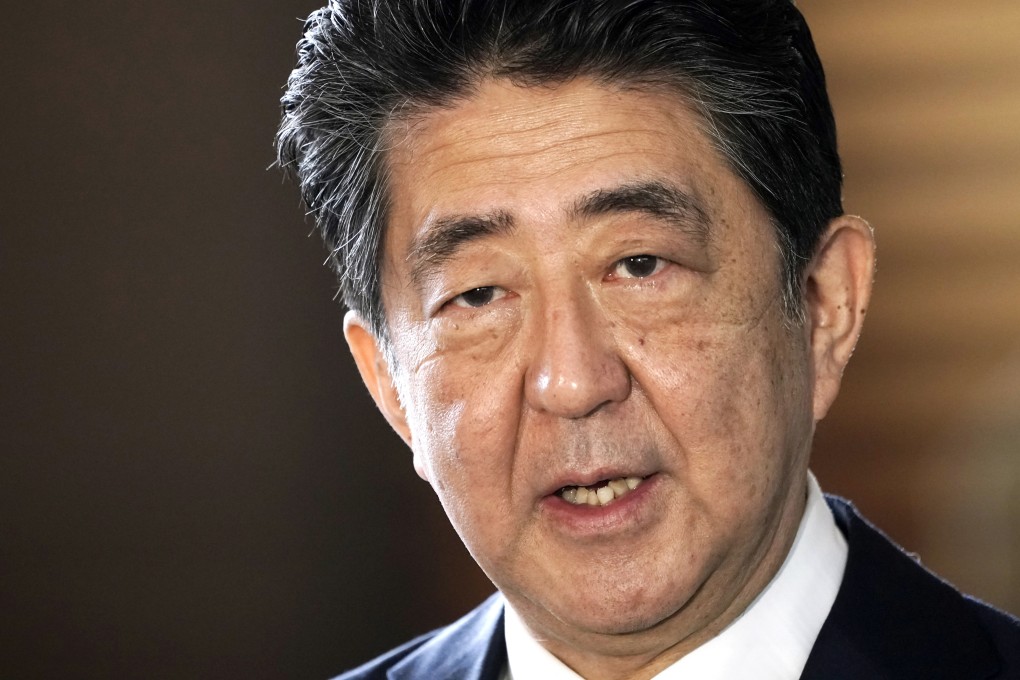

My Take | The legacies of Abenomics will outlive Shinzo Abe

- The slain Japanese leader was a giant among the likes of Donald Trump, Scott Morrison, Boris Johnson and Justin Trudeau

Nationalistic Chinese greeted news of Shinzo Abe’s death with indifference or, in some cases, even with jeers. Understandably, the Japanese leader was perceived as a right-wing politician intent on reviving his country’s militarism by rewriting its constitution.

But that was only one side of him. Whatever his own personal beliefs, Abe was practical enough to put a lid on right-wing extremism and to have balanced Japan between the United States and China. And he did that much more skilfully than most of his contemporaries in the Asia-Pacific. Whatever happens to the Japanese constitution in the coming years, the country’s military is already one of the world’s most powerful in all but name.

But to me, Abe’s teaching moment was really his domestic economic programme, launched with much fanfare at the start of his second time as prime minister and only to peter out thereafter. Japan’s decades-long Great Recession should be a warning to any big economy that you cannot defy gravity forever and that sooner or later, we all come crashing down.

I am, of course, thinking of China. What else? Managing the nation’s rise to power is only half the job. It’s when the economy starts to slow or crash that the real test of leadership will come as it must work to keep the country intact and preserve the stability of society.

Abenomics and his ‘three arrows’

When Abe returned to office a second time, he tried to shock the domestic economy out of its deflationary spiral with his so-called three arrows: renewed monetary easing with negative interest rates, and the massive and regular purchases of corporate debt and even stocks (otherwise known as quantitative easing, or QE); heavy fiscal spending – which raised government debt to 240 per cent of gross domestic product, one of the world’s highest; and structural reforms such as tax cuts, shareholder activism and gender equality. The jury is still out on their effectiveness, but there is no doubt that it made a big impact on the thinking of economists and policymakers, and helped legitimise QE around the world.

What is QE? For those of us who lived and suffered through the Asian financial crisis of the late 1990s, it’s basically the very opposite of the policies the International Monetary Fund imposed on East Asian economies that sought its bailout, and the resultant social unrest and suffering IMF conditionalities caused. And we had to put up with “holier than thou” criticisms from the West – you people deserved it for being profligate and loading up on debt you couldn’t afford. Yeah, sure, like that would never happen to a super-sophisticated advanced economy like the United States now, would it? When the shoe was on the other foot, it was QE, not IMF conditionalities.