Advertisement

Macroscope | US seeks to bolster tech prowess with return to state-led industrial policy

- Washington is taking a leaf out of Beijing’s book by pouring state funds into technology development, with a focus on semiconductors

- Yet, while both the US and mainland China are striving for greater self-reliance, catching up with Taiwan in advanced chip-making remains a challenge

Reading Time:3 minutes

Why you can trust SCMP

13

The US Senate recently passed a US$280 billion industrial policy bill to bolster American technological prowess in the tech race with China. Long critical of Chinese government subsidies to key industries, US policymakers, in an about-face, are now embracing government intervention in industry to “win the 21st century”.

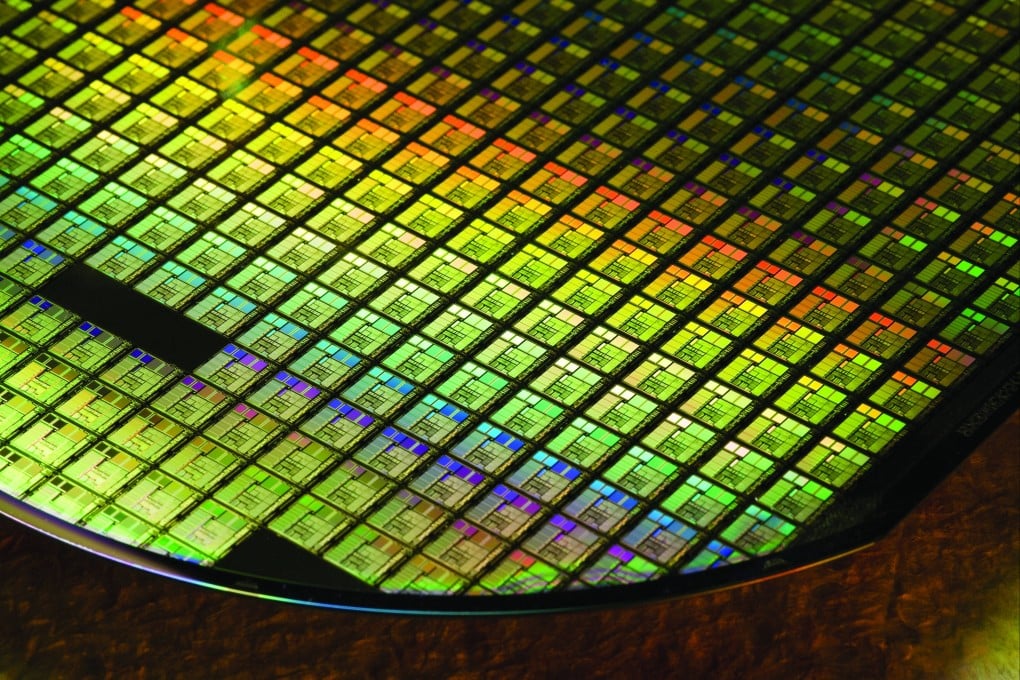

The new policy calls for diverting federal money into developing innovative technologies. Crucially, this will include US$52 billion in subsidies and tax credits for US semiconductor manufacturers.

During the pandemic, the global chip shortage severely disrupted the modern industrial sector, most areas of which depend on a steady supply of chips. The situation made more apparent than ever the US’ near-total reliance on Chinese-controlled supply chains and foreign-made semiconductor chips.

Advertisement

The shortage has also highlighted the risks of relying on a few large offshore foundries for global chip manufacturing. After all, semiconductors are used in most of today’s advanced technology, including military equipment ranging from radars to fighter jets. That means access to them is both an economic and national security concern. They are the key technological commodity of the 21st century.

Since the end of the Cold War, though, the imperative for government-led industrial policy in the US has waned, leading to underinvestment in domestic manufacturing and leaving other nations with lower labour costs room to build massive economies of scale. As such, while the semiconductor industry was born in the US, 80 per cent of foundries (or “fabs” in industry parlance) are now located in Asia.

Advertisement

Advertisement

Select Voice

Select Speed

1.00x