Semiconductors now at the heart of US-China power struggle

- The tiny chips have become a key asset in the US-China tech war, with Washington stepping up efforts to protect its supply

- The US fears the reunification of mainland China and Taiwan – the world’s leading chip maker – would leave it out in the cold in the semiconductor race

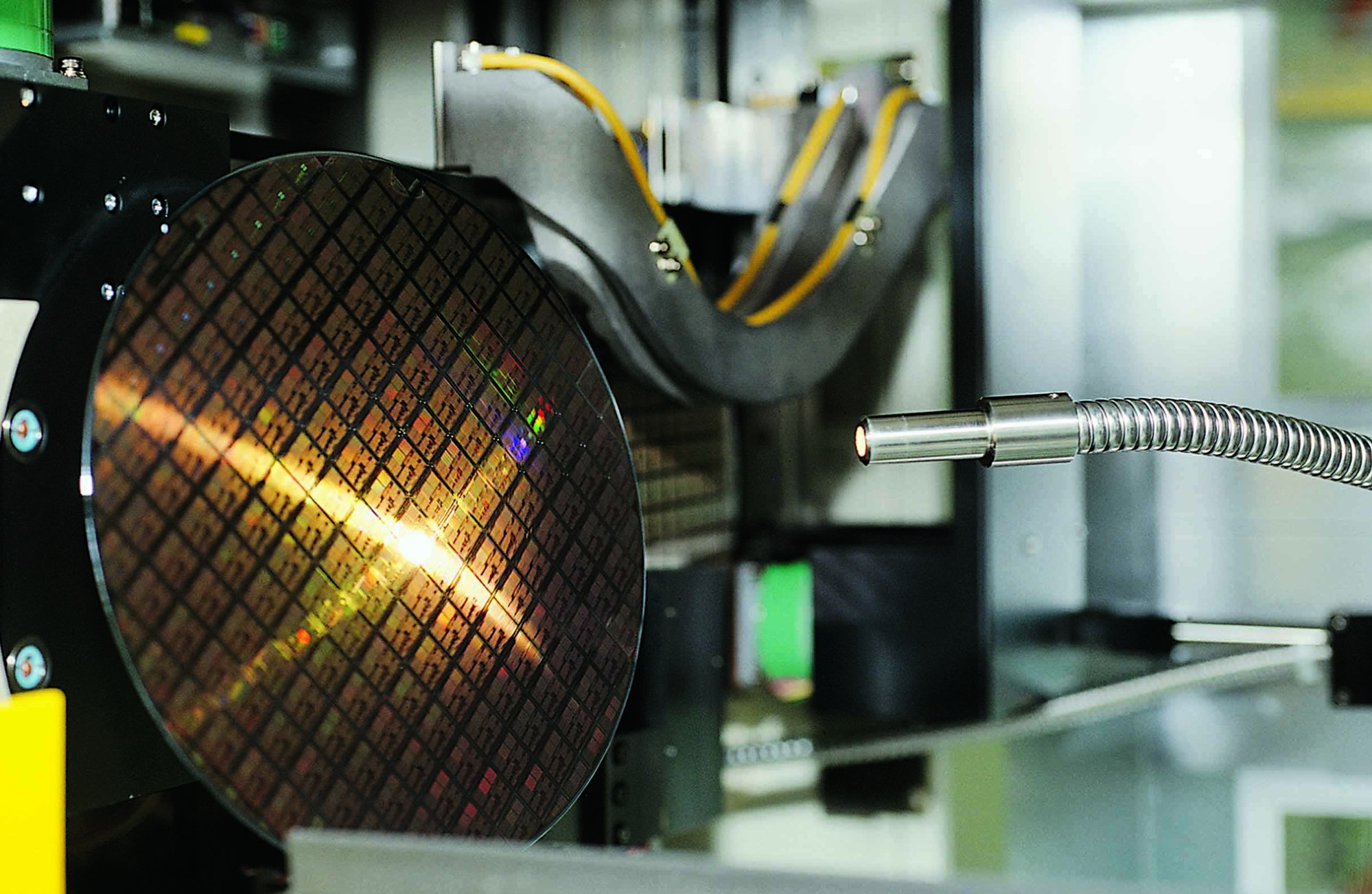

Are semiconductors set to replace oil and gas as the top strategic asset for global powers? The answer seems to be a resounding “yes”, given that they have become the centre of a global power struggle, especially amid growing Sino-US tensions over Taiwan.

In today’s 5G communication environment, semiconductors are a critical component in everything from smartphones and hi-tech military weapons to medical devices and space stations.

Taiwan currently accounts for some 64 per cent of the global semiconductor market, with TSMC – which also provides the world’s most advanced microchips to companies such as Apple, Qualcomm and Nvidia – alone accounting for 54 per cent of global demand.

TSMC and South Korea’s Samsung are the only two companies that have the capability to manufacture the most advanced 5-nanometre semiconductors.

Washington fears that Taiwan reunification would be the worst possible scenario in terms of US national security, as this would mean Beijing had control – whether directly or indirectly – of vital global semiconductor supply chains, which would potentially leave the US very vulnerable.

This suggests Beijing’s long-term reunification goal poses a direct threat to US interests. Interestingly, mainland China is equally dependent on Taiwan for the supply of semiconductors although it is making efforts to rapidly develop its own industry.

Though it is hard to predict how long Taiwan’s dominance in the sector will last, American policymakers have been working on a number of strategies to address the situation as well.

US return to state-led industrial policy heralds new tech race with China

Earlier this year, the US invited Taiwan, along with Japan and South Korea, to join a strategic alliance of four global chip powerhouses known as the Chip 4, or Fab 4, a platform seemingly aimed at countering China’s growing influence in global supply chains and isolating it in the semiconductor domain.

These pre-emptive moves by the US to shore up its own semiconductor supply are in anticipation of supply disruptions should Beijing ever launch military action to achieve reunification with Taiwan.

To secure its future leadership in semiconductor technology, the US has approached not only TSMC but South Korean companies Samsung Electronics and SK Hynix to invest in the proposed US foundry. However, these companies face a dilemma: if they choose to side with the US, they will lose the support of China.

Semiconductors are increasingly being seen by big powers as a core strategic asset in geopolitics, indicating a shift in the global political and economic order. It is clear that ongoing conflicts and conciliations over semiconductor hegemony could drastically alter the global equilibrium at any time in the coming months.

Dr Imran Khalid is a freelance contributor based in Karachi, Pakistan, who holds a master’s degree in international relations from Karachi University