With US-China tensions rising over Taiwan, the global economy must brace for geopolitics trumping economics

- The Taiwan crisis has deepened the divergence between China and the US-led West

- While markets might believe that trade is the new mutually assured destruction, history tells another story

That raises the risk of geopolitics suddenly overwhelming economics. This is likely to be the biggest risk to the global economy in the coming years.

China’s exports of goods and services rose from US$2.26 trillion in 2017 to US$3.36 trillion in 2021, while the US’ exports inched up from US$2.33 trillion to US$2.53 trillion in the same period. In the first half of 2022, China’s exports of goods rose 13 per cent, despite the high base of comparison from last year.

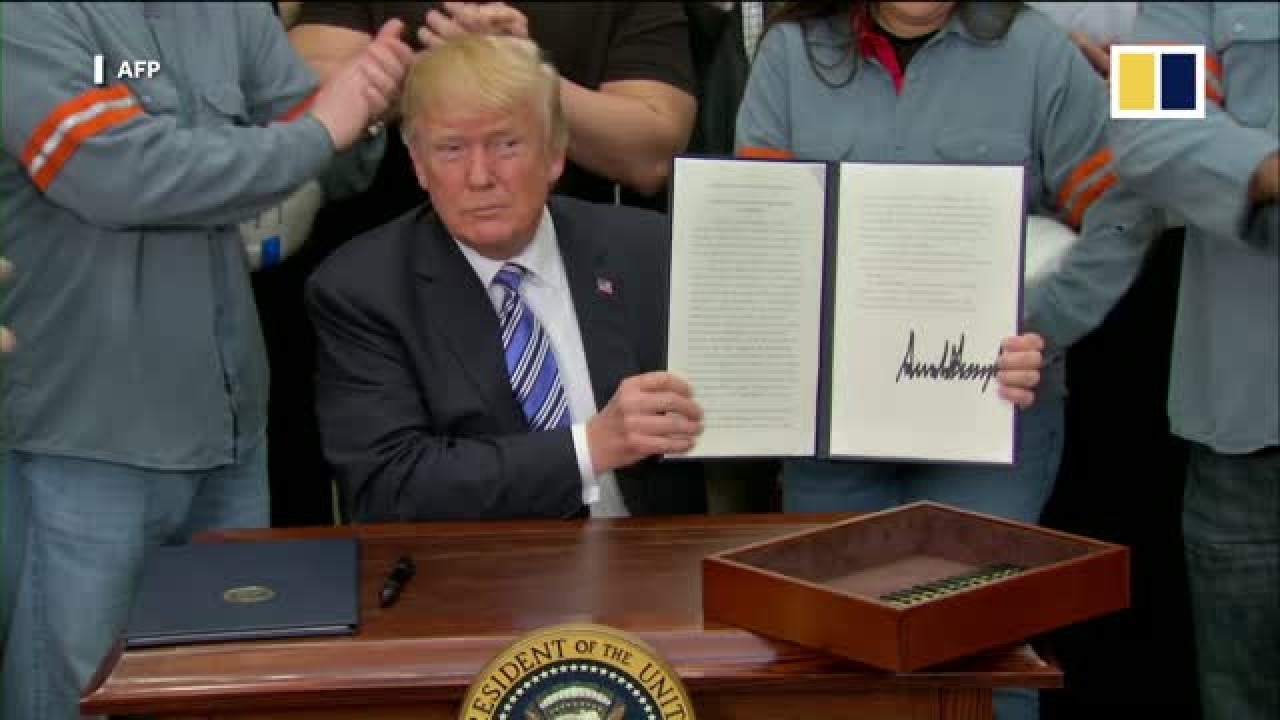

The hard truth is that most factories generate little profit, create jobs that are demanding but not well-paying, and require a capable and supportive government. After Trump said he would bring manufacturing jobs back to the US, American comedian Dave Chappelle joked, “For what …? So iPhones can be $9,000? … I wanna wear Nikes, I don’t wanna make them … Stop trying to give us Chinese jobs.”

Maybe politicians should consult comedians before they draft policies.

In addition, a manufacturing economy requires a lot of capital, which only countries with high savings rates can stomach. It means that people should have a strong preference for wealth accumulation rather than having a good time, that is, tolerance for a low discount rate, where present benefits are only slightly more valuable than future benefits.

Unless something drastic occurs, China’s exports could exceed US$6 trillion by 2027, more than the US, the European Union and Japan combined.

Globalisation has made the world economy more vulnerable to trade disruption, because economies of scale drive production concentration at every step of the supply chain. A major disruption would spell catastrophe for the global economy.

No danger of China losing its supply chain supremacy to India or Vietnam

Less well known is the importance of mark-up gross domestic product for developed economies. You may have heard of import-driven economies. These really hinge on massive mark-ups on Chinese imports.

From souvenirs at tourist spots to trainers promoted by sporting stars, mark-ups of over 10 times support a vast service economy. Without supplies from China, this mark-up economy wouldn’t exist.

As geopolitics and trade move further apart, it begs the question which side is mistaken. The market may think that politicians are bluffing, that the terrible consequences would deter politicians from pulling the plug on China trade, that trade is the new mutually assured destruction (MAD).

This view, however, goes against history. In past conflicts, geopolitics has tended to trump economics. That would imply that the market is mistaken, drifting to its own destruction.

Beijing has come too far to back down on Taiwan. A decisive moment is likely to occur within five years. When it does happen, the West will feel helpless at first and then lash out. Numerous sanctions would be imposed. Global trade would probably collapse. And the global economy could crash dramatically, accompanied by high inflation.

As societies are already so divided around the world, an economic depression would open many Pandora’s boxes. The market is in for a rude awakening.

Andy Xie in an independent economist