Editorial | Paul Chan right to remind Hong Kong not to belittle itself against Singapore

- Hong Kong may have lost talent to the city state, but it still leads as an international financial hub and enjoys advantages its Asian rival can only dream of

A good story can generally tell itself. It does not need much help from a narrator.

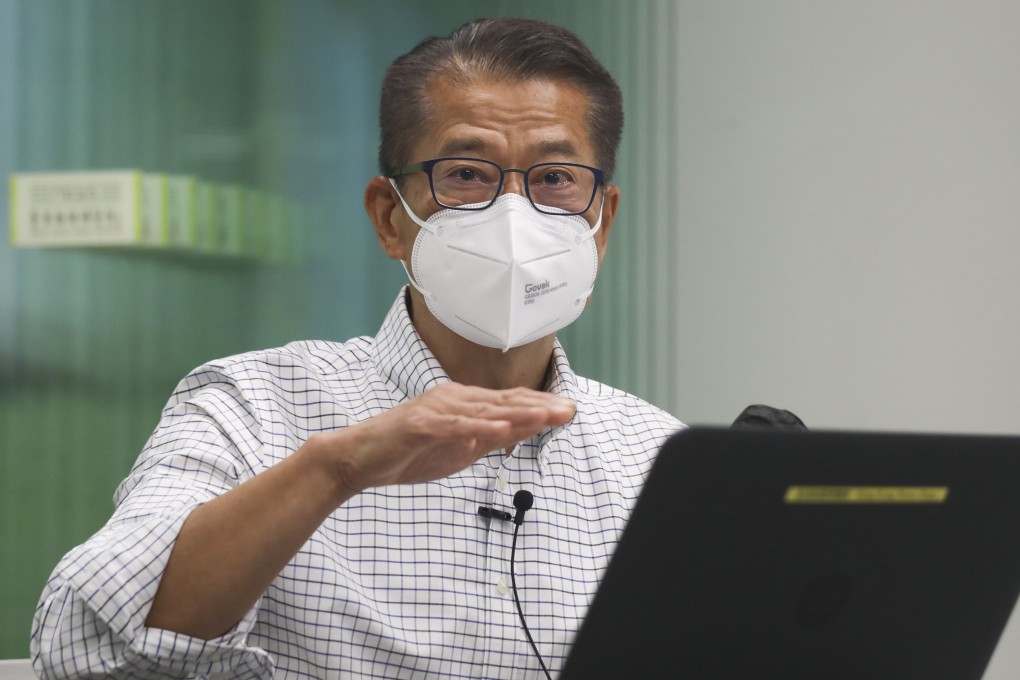

The financial secretary has felt compelled to make an exception of Hong Kong’s story, with a favourable, and unusually vocal comparison with Singapore. It is a departure from the diplomatically polite competition that has prevailed between the regional rivals.

That says something about sensitivity over the perception, shaped by Covid travel restrictions, that Hong Kong is no longer the place it once was in which to invest and do business, and that Singapore has benefited from it. Those concerns are not entirely unfounded.

The city needs to reverse the loss of talent – some of it to Singapore – and maintain competitiveness.

Paul Chan Mo-po concedes that in a blog post. But his main message is that Hong Kong still outperforms Singapore as an international financial hub in several ways, reflected in a decisive advantage in scale, and depth and breadth of its capital pool, which made it No 1 for IPOs in seven of the past 13 years.