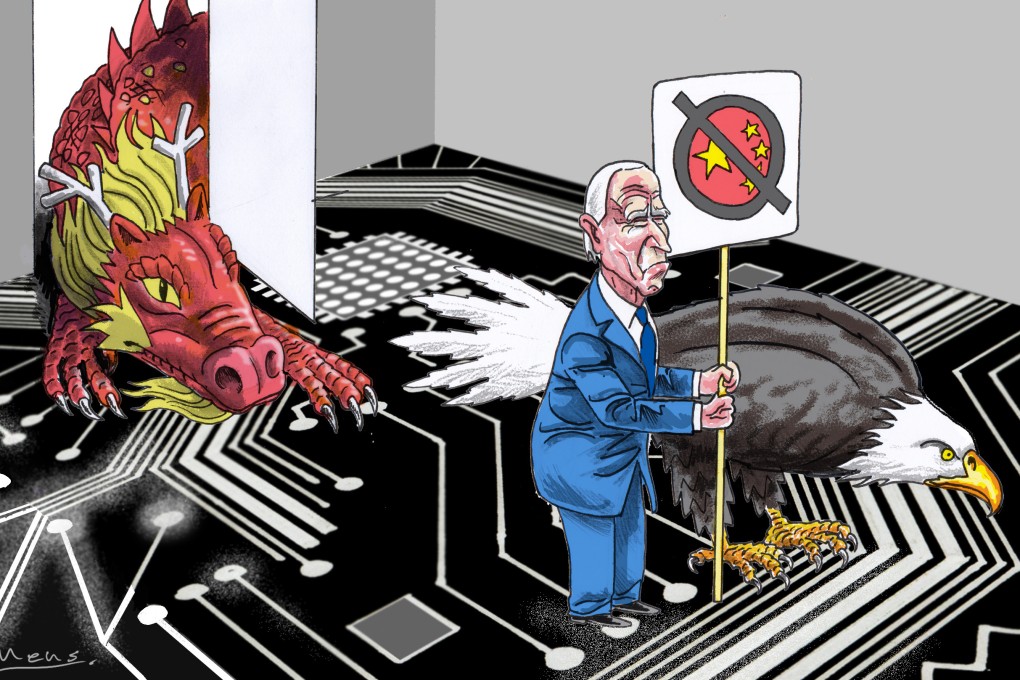

Opinion | How long can US allies support the semiconductor chip ban on China before caving in?

- The US may have overplayed it in coercing allies such as Japan and the Netherlands to join the sanctions, which will cost their companies and risk China’s economic wrath

This unprecedented move means even companies based outside the United States cannot sell to China if their products contain US-origin technologies. Such extreme sanctions upset the geopolitical status quo. Whether they work in the long run is an open question.

But a more immediate question is this: can we assume American allies will fully cooperate? My bet is, the Biden administration has overplayed its hand.

If recent US sanctions on Russia offer any clues, the chip sanctions are likely to fail. India, Spain, the Netherland and Japan – democratic nations all – have increased their imports from Russia since its invasion of Ukraine.

For the sanctions to succeed, however, the US must have buy-in from four others at the centre of semiconductor supply chains: Japan, South Korea, the Netherlands and Taiwan.