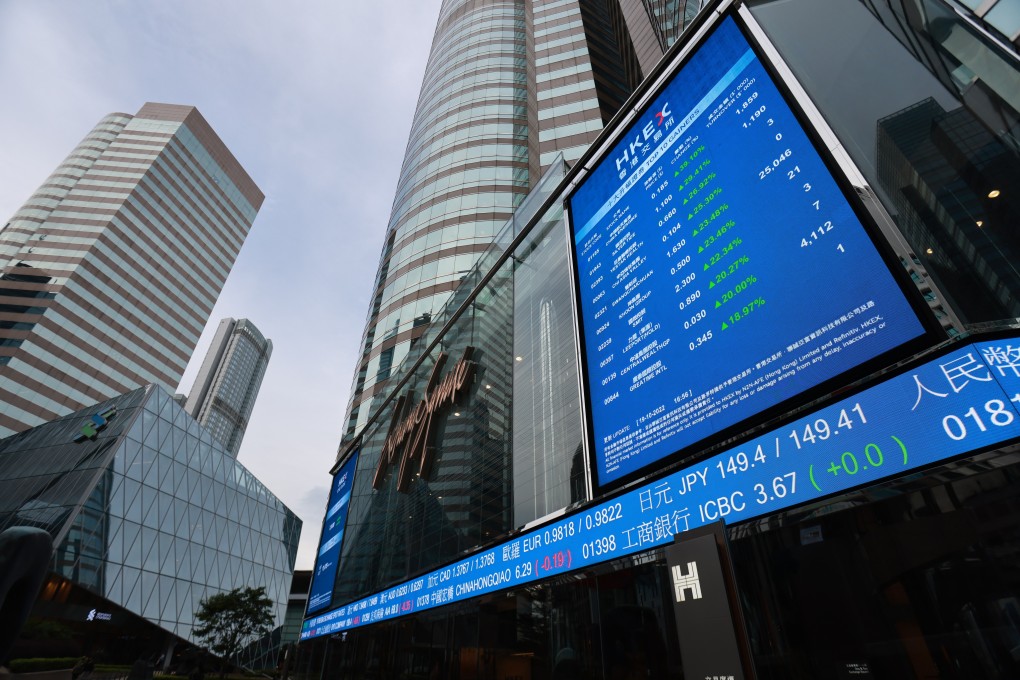

Editorial | Hong Kong exchange can get stronger by getting rid of the dead wood

- Bourse should follow the example of its Shanghai counterpart – which is set to expel a company that has been trading below par – if it is to maintain a healthy capital pool

Despite the rivalry between finance hubs for listings and capital raising, more does not mean better in the final outcome. It is the quality of listed companies and the candidates queuing up to raise funds which matter to a market’s standing with investors. This is especially so when Hong Kong is competing with much larger global hubs such as New York, even though it is a gateway to China with an edge over London in its depth of liquidity.

The principles that hold market participants to account and underpin investor protection – free flow of information, transparent rules and regulations, common law jurisdiction – are clearly established.

However, a healthy capital pool also depends on diligent housekeeping to get rid of the dead wood, such as penny stocks. Hong Kong has its fair share to clean up.

A timely reminder that should prod the city’s authorities into tackling the problem has come from Shanghai. That city’s exchange is expected to expel a company because its stock traded below par, or the minimum value of 1 yuan for 20 consecutive days, meeting the delisting threshold set by the Shanghai and Shenzhen exchanges.

It is not the first, as investors have been dumping penny stocks on the mainland’s exchanges, driving prices down far enough and long enough for some to face delisting. This is an important move against dead wood that can ensure funds from institutional and retail investors reach the companies that deserve them.