How Asia’s fintech revolution is helping small businesses build a better future

- The rapidly changing digital financial ecosystem can help people in low-income countries break free of poverty and take control of their financial lives

- Fintech collaborations now lie at the heart of Asian finance and have the potential to propel regional economies and their people into the future

Across Asia, fintech collaborations are gathering pace. The profound effects of these projects will be felt not just economically, in terms of enhanced trade and commerce, but also geopolitically.

That same month, Indian fintech company PhonePe launched its UPI international service, an app through which users can connect their Indian bank accounts and pay merchants in the United Arab Emirates, Singapore, Mauritius, Nepal and Bhutan.

According to a McKinsey survey, 75 per cent of people who used digital modes of payment for the first time during the pandemic indicated they would continue to use them even after things returned to normal, a reality seen in the growing number of cashless transactions across Asia. Fintech financing in the region has more than doubled from US$5.2 billion to US$11.2 billion in the past two years, contributing more than 40 per cent of the US$23.2 billion in global fintech investment.

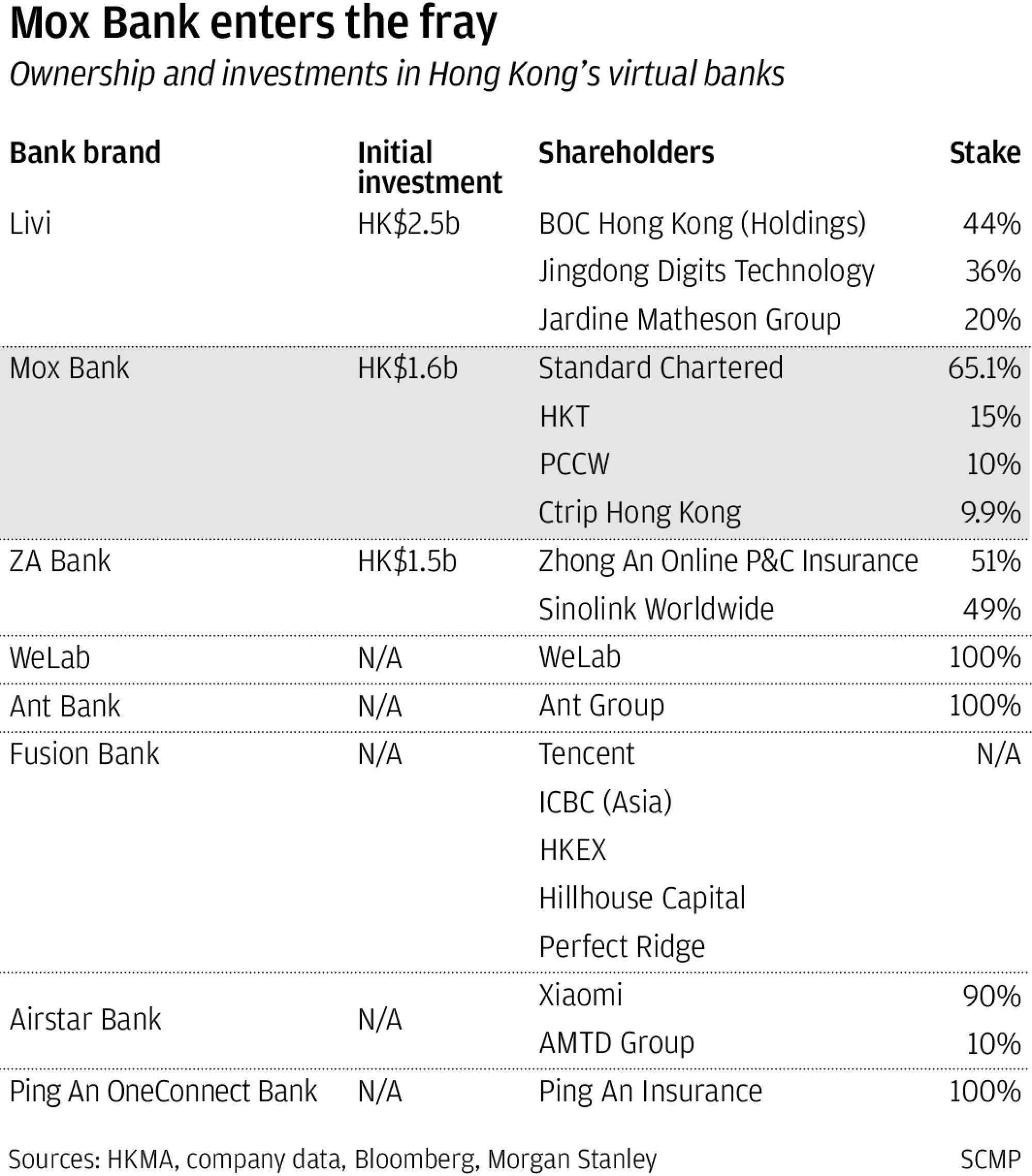

This isn’t limited to digital payments across borders. There were few stand-alone digital banks before the pandemic, but now this sector is primed for further growth as digital banking accelerates. In a rapid rise, China’s digital banks have amassed roughly 5 per cent of the country’s US$700 billion market share.

Virtual banking is making life easier for small businesses and transforming the way streetside vendors across Asia operate. Asia is already a hotspot for investment in start-ups and that is expected to continue, creating more support for fledgling businesses that had to struggle to secure loans from traditional bricks-and-mortar banks.

The rise of fintech and its support of small businesses in Asia goes hand in hand with the penetration of smartphones in low-income communities. According to a 2021 GSMA intelligence report, 1.2 billion people across Asia were connected to the mobile internet as of the end of 2020, equivalent to a 42 per cent penetration rate.

While there are many challenges, including defining data protection and privacy while digitalising societies, one of the upsides of this is the unique access it gives policymakers. According to a World Bank report, digital payments are enabling governments to reach out with effective support in the form of healthcare, education and social protection and welfare measures in low-income communities. This is likely to make preparing for future challenges, such as another pandemic, much easier.

The geopolitical impact of these transitions is significant. For years, China was the nerve centre around which all Asian trade flowed. Today, with growing fintech collaborations and increasing mobile phone penetration, India, Bangladesh, Vietnam and Indonesia are emerging as hotspots.

In response to these changing dynamics, traditional Asian banks must be wary about losing their market share as cross-border fintech collaborations make inroads at a rapid pace.

Silicon Valley turns to Vietnamese start-ups as Asia’s next growth engine

Many of these are embracing welfare measures as well. Take for instance the Mekong Business Initiative, a joint venture between the Asian Development Bank and the Australian government which supports small businesses in Southeast Asia. The initiative has launched Kiu, a new e-commerce platform to help small and medium-sized enterprises in the region gain access to finance and developed markets by connecting them with virtual loans and credit.

Fintech collaborations such as these now lie at the heart of Asian finance and have the potential to propel regional economies into the future. As Asia claims the global fintech spotlight, governments will continue to drive towards a cashless economy, which is more transparent, accessible and can change the way Asia does business.

Kamala Thiagarajan is a freelance journalist based in Madurai, southern India