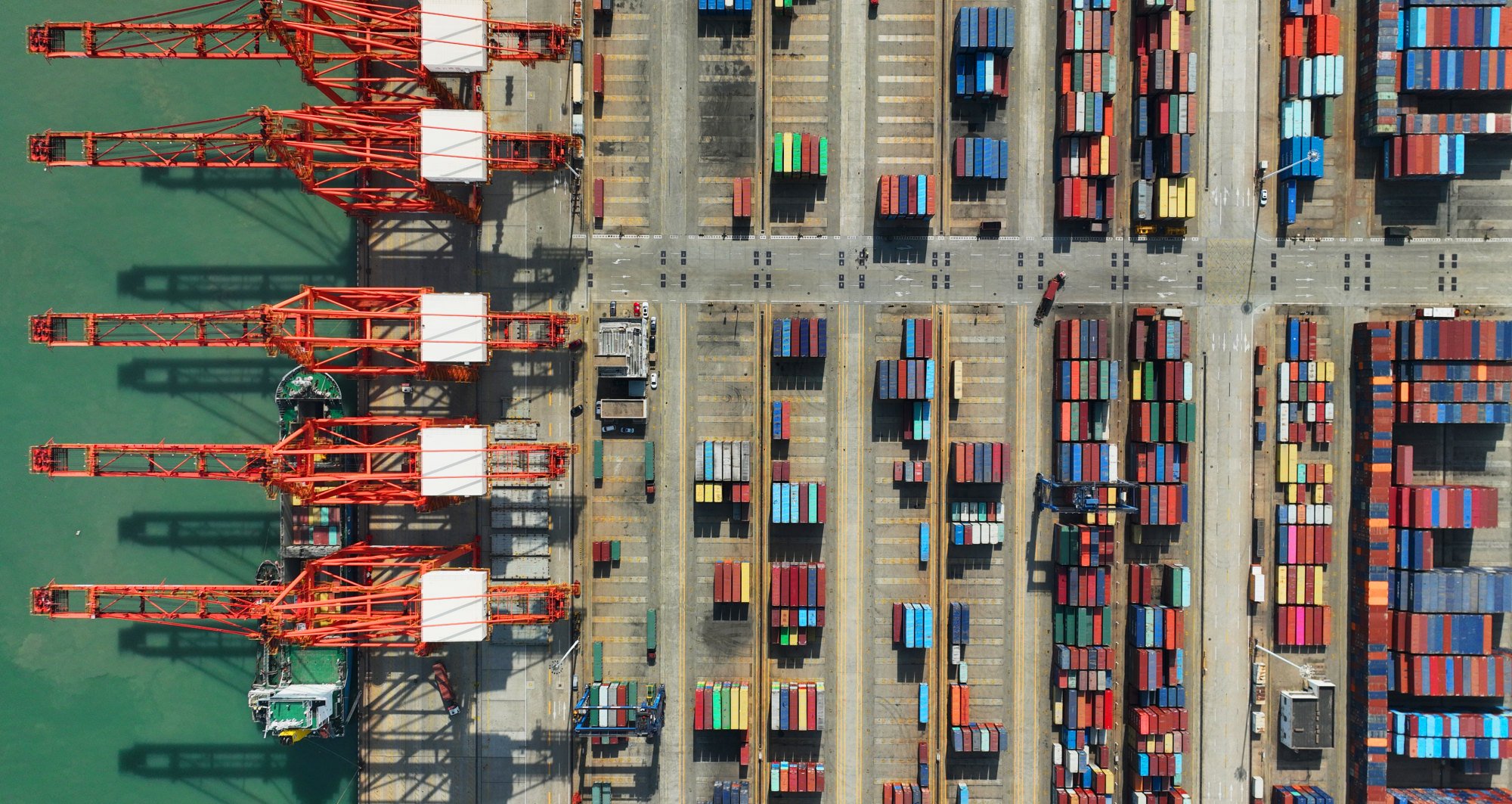

Amid US de-risking talk, as the world relies more on China’s exports, China is learning to rely more on itself

- Despite US-led curbs, China is exporting more to the world than before, growing its share of global manufacturing

- At the same time, its domestic economy is less dependent on foreign investment and exports

But there has been a dramatic decline in China’s importance to US trade. China accounted for 47 per cent of the US trade deficit in 2017, but just 32 per cent last year. US imports increased by about US$900 billion from 2017 to 2022, but China’s share declined from 22 per cent to 17 per cent.

China’s exports to Mexico also increased, by nearly 30 per cent last year, amid a surge in foreign investment by Chinese companies seeking tariff-free access to the US market. Hisense, for example, has poured US$260 million into a home appliance park in Mexico while Growatt, a solar equipment maker, has established a factory in Vietnam.

If the US goal was to curb China’s hi-tech exports, that has also failed. Hi-tech exports, which account for about 30 per cent of China’s exports, have continued to grow rapidly. Moreover, the share of hi-tech exports handled by foreign-invested enterprises fell from 70 per cent in 2011 to 25 per cent in 2020.

More generally, China has moved on from being largely an assembler of imported components to a manufacturer of sophisticated products. This has made China more self-sufficient, with imports as a share of its economy falling from a high of around 28 per cent, after joining the World Trade Organization, to about 15 per cent last year.

This explains why China’s share of global manufacturing continues to increase, from 26 per cent in 2017 to 31 per cent in 2021. In sum, despite the trade war, the world has become more dependent on China while China has become less dependent on the world.

Xi Jinping highlights tech self-sufficiency message in new book

A possible November meeting at the Asia-Pacific Economic Cooperation forum between Biden and President Xi Jinping offers an opportunity to move away from a zero-sum game in trade relations. The US is unlikely to take the initiative, given domestic political pressures, but Beijing could take the first step by dropping retaliatory tariffs.

In areas of mutual concern, such as climate change, Beijing could also offer to share its advances in green technologies. All this suggests the need for both sides to seek a more constructive approach in dealing with trade and technology issues.

Yukon Huang is a senior fellow at the Carnegie Endowment for International Peace